- At the end of May, the scheduled maturities with the Paris Club totaling approximately USD2.43 billion, the final payment of the 2014 restructuring agreement, were not paid. If the failure to pay persists after 60 days, the country would be declared in default with the member countries of the group.

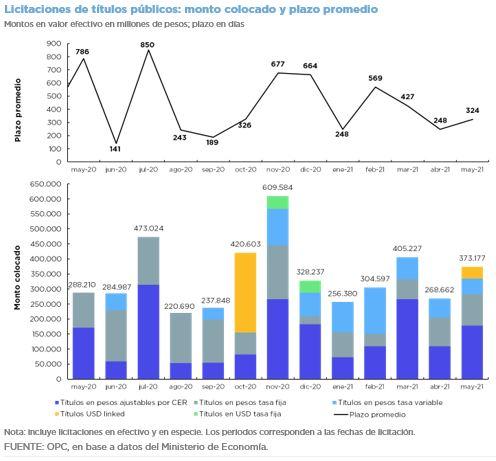

- Three auctions were held resulting in the placement of different instruments for a total of AR$373.17 billion: securities in domestic currency for AR$334.27 billion and bonds in dollars payable in pesos (USD linked) for AR$38.9 billion.

- The BCRA (Central Bank of the Argentine Republic) decided that as from June, financial entities may allocate part of their reserve requirements to government securities in pesos with a term of between 180 and 450 days acquired in the primary market. The securities used for reserve requirements will be excluded from the regulatory limits of exposure to the public sector.

Maturities for June are estimated to total the equivalent of USD5.71 billion. Excluding holdings within the public sector, maturities are reduced to USD2.59 billion, of which 92% is payable in domestic currency.