- In July, marketable government securities for the equivalent of USD4.96 billion were cancelled, including the voluntary swap of BONCER TX21 – maturing in August – for ARS215.17 billion (approximately USD2.23 billion).

- The last two swap re-openings for the remaining creditors of the restructuring of foreign currency securities issued under Argentine legislation in September 2020 were carried out. In total, securities were swapped for USD41.57 billion, 99.66% of the original eligible amount.

- At the end of July, the first partial payment agreed in June with the member countries of the Paris Club was made for approximately USD227 million.

Maturities for August are estimated to total the equivalent of USD4.7 billion. - Excluding holdings within the public sector, maturities are reduced to USD3.14 billion.

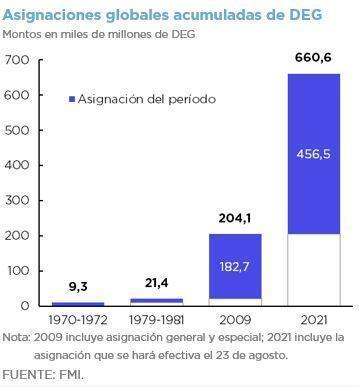

- On August 2, the IMF approved a new general allocation of Special Drawing Rights (SDRs) for the equivalent of USD650 billion, which will become effective on August 23. Given Argentina’s quota in the IMF (0.67%), the country will receive the equivalent of USD4.35 billion.

PUBLIC DEBT OPERATIONS – JULY 2021

12 August, 2021