SELF-EMPLOYED WORKERS AND THEIR RELATIONSHIP WITH THE SOCIAL SECURITY SYSTEM – JANUARY 2023

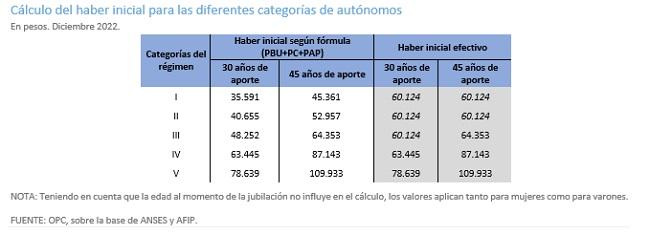

The self-employed and simplified-regime taxpayers (monotributistas) represent 26.2% of the contributors to the Social Security system, but their current contribution is not sufficient to cover even a minimum retirement pension, a benefit that applies to most of the categories of self-employed workers.

- If the self-employed retirement pension were self-financed, their contribution to the system’s total would increase from 3.4% to 15.7%. In absolute terms, last December’s collection would increase fivefold: from ARS9.556 billion to ARS50.533 billion.

- The self-employed have a high tax burden, which can represent up to 50% of their income. For simplified-regime taxpayers it represents an average of 4%.

- The system of Social Security contributions involves a certain degree of regressivity since its weight is relatively higher for the lowest categories.