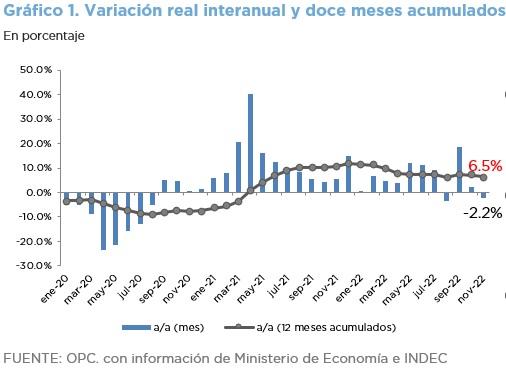

ANALYSIS OF NATIONAL TAX REVENUE – NOVEMBER 2022

Tax revenues amounted to ARS1,953.860 billion in November 2022, which implied a growth of 88.8% year-on-year (YoY). Adjusted for inflation, it decreased 2.2% YoY.

Among tax revenues, the increase in real terms in Income Tax, driven by the second advance for the extraordinary payment applicable to corporations. A higher level of economic activity compared to 2021 contributed to the good performance of VAT, also benefited by lower refunds.

Wealth Tax decreased because of a high base of comparison attributable to the difference in maturities that operated between fiscal periods.

Export Duties decreased because of the termination of the benefits established by the Export Increase Program (DNU 576/2022) and returned to the previous trend.

On the other hand, Social Security contributions showed a slight growth.