FISCAL IMPACT OF BILL S-1860/22 TO REDUCE INDIGENCE THROUGH THE IMPLEMENTATION OF THE INCOME SUPPORT PROGRAM

Bill S-1860/2022 aims at reducing indigence, guaranteeing access to adequate food for people who are in a situation of extreme vulnerability. To this end, it proposes the implementation of an Income Supplement, consisting of a monthly monetary benefit for the value of a Basic Food Basket.

To estimate the fiscal impact associated with the granting of the Income Supplement, it is necessary to quantify the universe of potential beneficiaries, a figure that will be decisive for the calculation.

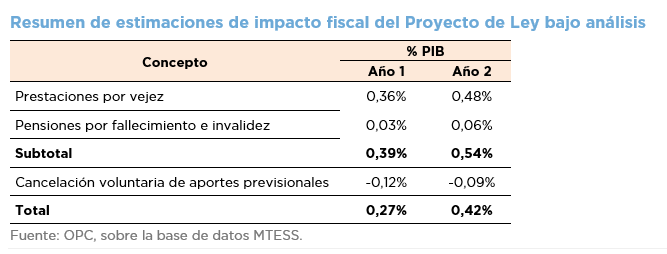

Based on the number of potential beneficiaries estimated by the EPH (Permanent Household Survey) and taking the average value of the Basic Food Basket and this year’s GDP, the fiscal impact of the measure would amount to 0.31% of GDP. By 2023, this figure would imply an expenditure of approximately ARS460 billion.

If this policy were implemented, the percentage of individuals living in indigent households would be reduced by 65%, but only if the current assistance programs are maintained.