ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – AUGUST 2022

For the first eight months of the year, the National Government recorded a real increase in its primary and financial deficits of 32.1% and 19.5%, respectively, compared to the same period of the previous year, given the dynamics between revenues and expenditures.

- Despite the 7.0% year-on-year increase in Social Security contributions and 2.1% in tax revenues, current revenues fell 0.8%, basically due to the decrease in the payment of the Solidarity and Extraordinary Contribution.

- Total expenditure amounted to ARS10,022.934 billion and grew at a rate of 3.4% YoY.

- Primary expenditures expanded 3.7% YoY, mainly because of the variations registered in pensions benefits (2.7% YoY), energy subsidies (6.2% YoY), personnel expenses (14.4% YoY) and social programs (13.7% YoY).

- From January to August, ARS14.463 billion were disbursed in “tourism promotion”, through the Pre-Viaje program (an increase of 835.3% year-on-year).

- The extended budget appropriation increased by ARS5,521.535 billion, with significant increases in pensions, energy subsidies, personnel expenses, interest on public debt and social programs.

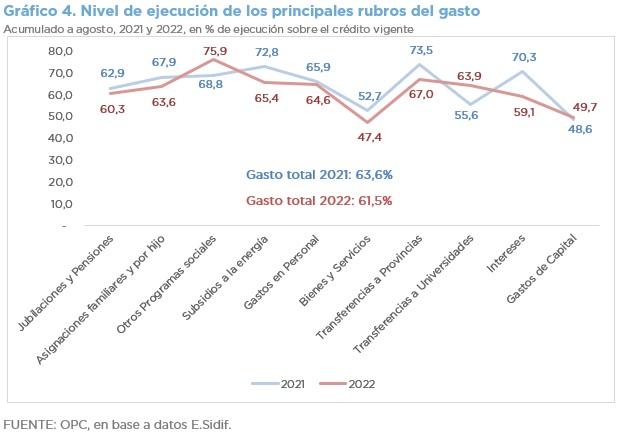

- As of August 30, total expenditure accrued ARS10,022.934 billion, equivalent to 61.5% of the current budget appropriation. Programs such as Potenciar Trabajo and Alimentar were above the average level. On the other hand, some economic subsidies, goods and services and real direct investment were below the average.