ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – JULY 2022

With an increasing expenditure in energy subsidies and some social programs, during the first seven months of the year the National Government recorded a primary deficit of ARS1,538.364 billion, 71.0% higher than that of the same period of the previous year.

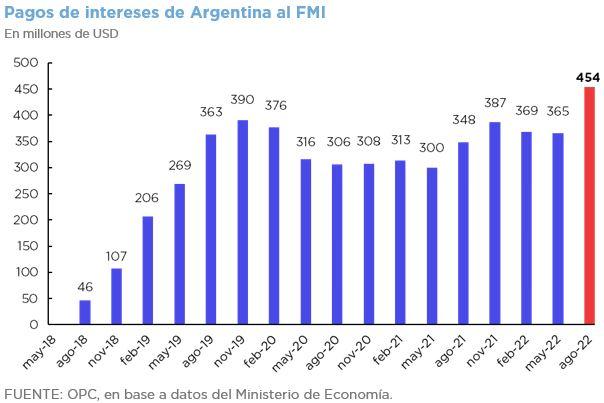

- Including debt interest payments, the financial deficit was 41.1% higher at ARS2,202.759 billion.

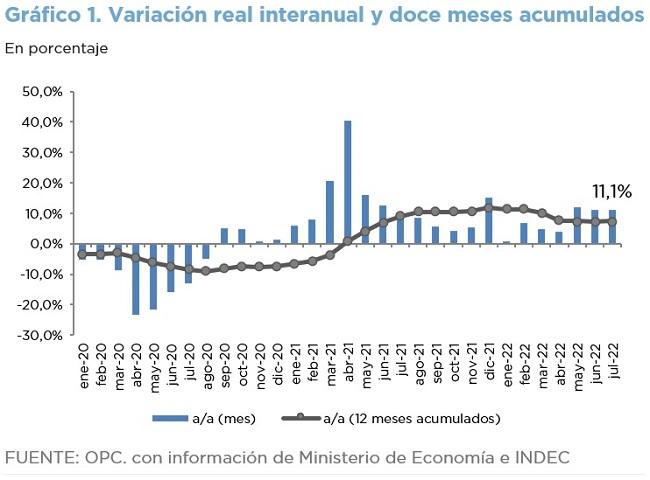

- Total revenues fell by 0.4% in real terms, whereas expenditure increased by 7.7%.

- The deterioration in revenues was mainly due to non-tax resources such as the Solidarity Contribution and capital transfers.

- Primary expenditure rose 8.3%, primarily because of energy subsidies and social programs.

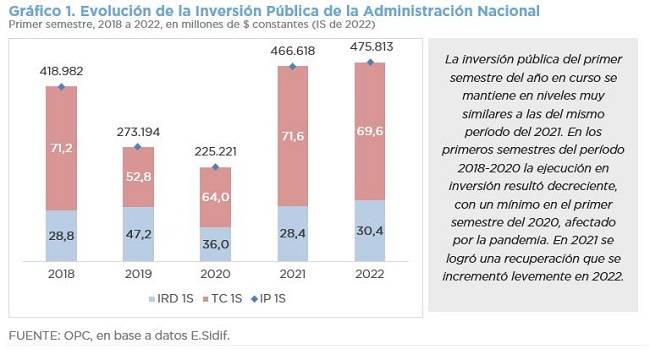

- As of July 31, total expenditures amounted to ARS8,661.651 billion, equivalent to 52.7% of the current budget appropriation.

- Social programs exceeded that proportion (66.6%). On the other hand, other economic subsidies had a much lower execution than the average expenditure (28.6%).

- The execution of the Potenciar Trabajo program (83.6%) and Food Policy (67.2%) stands out.

- During the first seven months of the year, the extended budget appropriation grew by ARS5,649.535 billion, with the largest increase concentrated in pension benefits.