ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – JUNE 2022

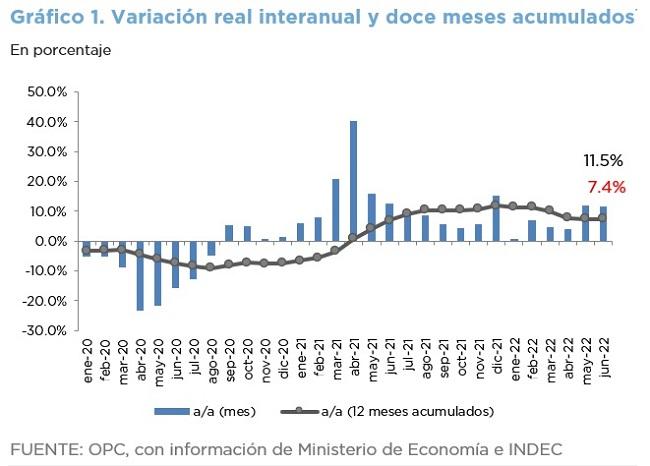

In the first half of the year, the National Government recorded a primary deficit of ARS1.395,180 trillion and a financial deficit of ARS1.922,347 trillion, with both results decreasing by 92.1% year-on-year (YoY) and 51.8% YoY, respectively. This was the result of a real drop in total revenues versus an expansion of total expenditures of 9.6% YoY.

- The economic deficit was ARS1.413,575 trillion, an increase of 82.7% YoY.

- Given the lower collection of the Solidarity and Extraordinary Contribution, total revenues fell 0.4% YoY in real terms. Excluding this exceptional revenue, total revenues would have grown 4.0% YoY.

- In the year-on-year comparison, tax revenues grew by 2.8% and Social Security revenues by 8.9%.

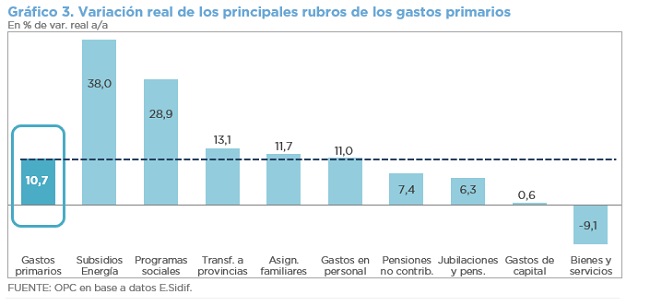

- Primary expenditures increased 10.7% YoY.

- Social programs increased 28.9% YoY and continue to lead the growth of social benefits.

- As of June 30, total expenditures amounted to ARS7.244,098 trillion, equivalent to 44.1% of the current budget appropriation. Social programs and energy subsidies exceeded this level of execution.