ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – FEBRUARY 2022

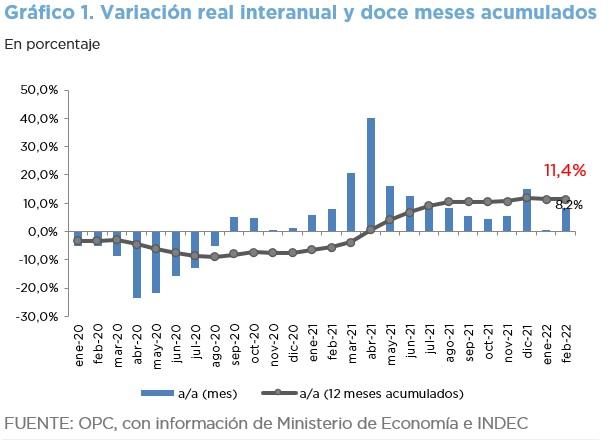

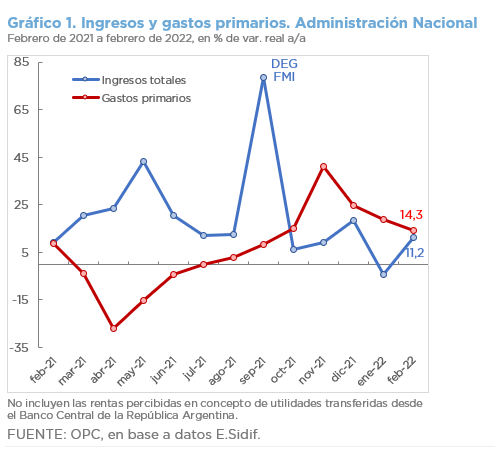

Despite a year-on-year increase in revenue of 11.2% in real terms, the primary and financial deficits of the National Government increased in February with respect to the same month of the previous year.

- Tax revenue increased by 13.0% year-on-year (YoY) and Social Security contributions by 9.0% YoY.

- Revenue from the PAIS tax increased by 119.6% YoY and that from the Tax on Bank Debits and Credits by 48.2% YoY.

- Primary expenditures grew 14.3% YoY, basically driven by energy subsidies, which increased 109.6% YoY.

- The primary deficit increased by 31.6% YoY in real terms and the financial deficit increased by 13.1% YoY reaching ARS217.498 billion.

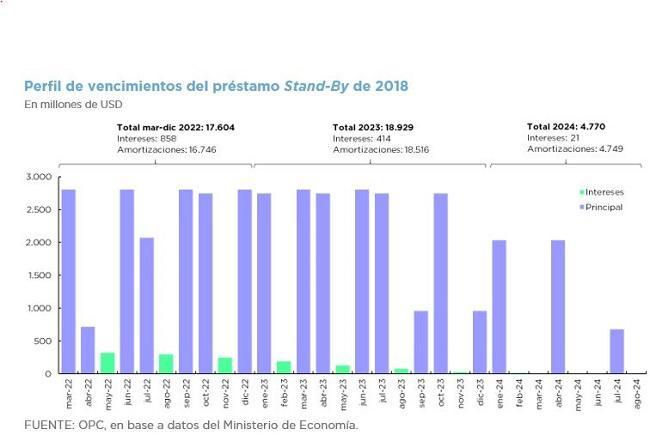

- Debt interest fell by 15.9% YoY because of the decrease in payments of peso-denominated obligations.

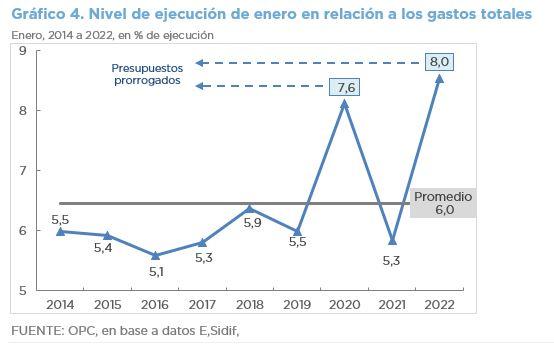

- As of February 28, total expenditure accrued ARS1.846,988 trillion, equivalent to 17.1% of the current budget appropriation.

- Expenditure on debt interest was 26.2% of the current appropriation. In contrast, real direct investment was 8.1%, comparable to pre-pandemic records.