by Nicolas Perez | Dec 16, 2021 | Budget Execution

Primary expenditure had the highest jump so far this year (41.2% YoY), partly driven by transfers to government-owned companies and trust funds, which increased 10 times.

In the 11th month of the year, total revenues expanded 7.4% YoY in real terms, driven by the good performance of most of its items.

- Export duties grew 18.5% YoY because of the increase in international prices and the exchange rate.

- Social Security contributions increased by 13.3% YoY, because of the higher number of contributors and the low base of comparison for 2020.

- Energy subsidies increased 26.0% YoY because of increased transfers to CAMMESA (Argentine Wholesale Electricity Market Clearing Company).

- The discontinuation of the IFE (Emergency Family Income) and the ATP (Emergency Assistance for Work and Production) were partially offset by the “Potenciar Trabajo” (ARS22.812 billion) and Food Policies (ARS18.007 billion) programs, whose resources increased by 85.9% YoY and 48.2% YoY, respectively.

- Funds allocated to the Previaje program amounted to ARS13.581 billion.

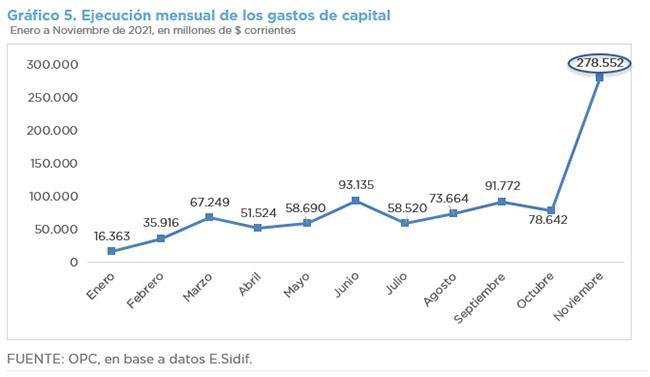

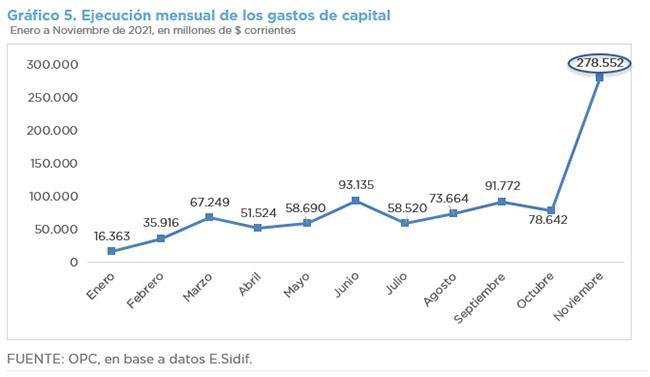

- Real direct investment (ARS32.786 billion) recorded a real increase of 107.3% YoY, focused on road and railroad works.

- The primary deficit increased 188.1% YoY and the financial deficit increased 100.5% YoY.

- The initial budget for the fiscal year increased by 30.9%, which is equivalent to ARS2.597 trillion, prioritizing social programs, capital transfers and energy subsidies.

- Expenditures related to the COVID-19 pandemic accounted for 84.8% of the current appropriation (ARS414.813 billion), and items funded by the Solidarity and Extraordinary Contribution accounted for 71.2% (ARS145.718 billion).

by Nicolas Perez | Dec 14, 2021 | Public Debt Operations

- Three auctions were held in November, resulting in the placement of different instruments for a total of ARS479.41 billion. Government securities in local currency were subscribed for ARS391.07 billion and dollar-denominated bonds payable in pesos (USD linked) for ARS37.87 billion.

- On November 4, the T2V1 bond (maturing on November 30) was offered for conversion into two baskets of instruments consisting of USD linked and LEDES bonds. As a result, 52% of the outstanding amount of the T2V1 bond was accepted.

- Net placements of Temporary Advances (TA) for ARS130 billion were recorded, increasing the stock to ARS1.49 trillion. At the end of October, the maximum legal limit on the stock of TA stood at $2.24 trillion.

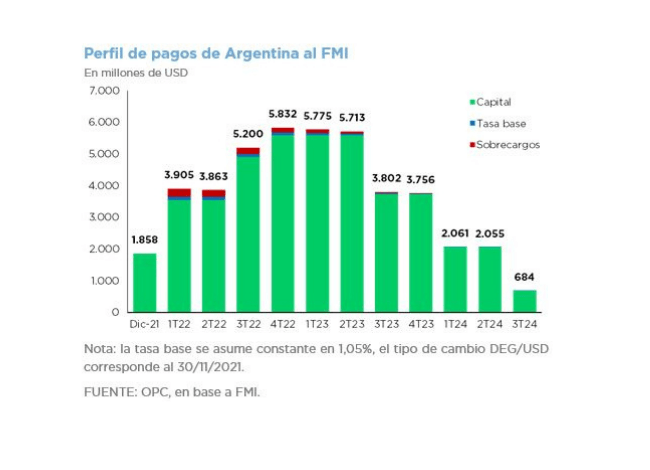

- During the month, interest payments were made for the equivalent of USD963 million. The payment of interest to the IMF for USD387 million stands out. As of November, the surcharge rate paid by Argentina to the IMF increased by 100 b.p. after 36 months since the debt balance exceeded 187.5% of the quota.

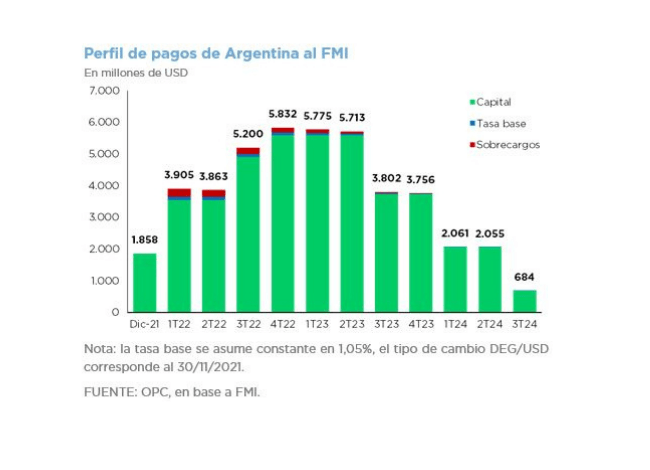

- Maturities for December are estimated to total the equivalent of USD5.156 billion (amortizations for USD4.856 billion and interest for USD300 million). Excluding holdings within the public sector, maturities are reduced to USD4.58 billion, including the principal payment to the IMF of USD1.858 billion.

by Nicolas Perez | Dec 14, 2021 | Activities

On Monday, December 6, we shared a virtual meeting with representatives of the Information, Analysis and Budgetary Advisory Office of the Senate of Chile (OPS) to exchange experiences and generate collaborative work links between both institutions.

Although the OPS was created as such during the year 2021 by Resolution of the General Secretariat of the Senate, its origin is found at the beginning of 2019 when the Budget Office of the National Congress was created, continuing the work developed by the Budgetary Advisory Unit (2003 – 2018). Like the OPC, the OPS provides independent analysis on the state of the fiscal situation to the Parliament and the public.

Participating in the meeting on behalf of OPS were Alejandra Vega Carvallo, Rodrigo Ruiz, Eduardo Diaz, and Rubén Catalan. On behalf of the OPC, Marcos Makón (OPC Director); Carlos Guberman (Director of Tax Analysis) and Natalia Laría (Coordinator of Institutional and Parliamentary Relations) were present.

by Nicolas Perez | Dec 13, 2021 | Activities

María Pía Brugiafreddo, an analyst from the OPC’s Directorate of Studies, Analysis and Evaluation, participated in the “G20 Global Leadership Program”, organized by the Korea Development Institute School of Public Policy and Management, which took place in Seoul between November 16 and December 9, 2021.

The program is part of the Korean government’s commitment established at the Seoul Summit in 2010 to promote debate and exchange on development strategies aimed at achieving the G20 Agenda and the Sustainable Development Goals.

The meeting was attended by more than 40 representatives of public organizations from different countries, who exchanged strategies implemented by their countries to promote sustainable development.

by Nicolas Perez | Dec 9, 2021 | Cost Estimates

The purpose of Bill S-1123-2020 is to promote and enhance the use of unpaid work time carried out in households. The Bill proposes the creation of a special category called “Category AA” in the Simplified Regime for Small Taxpayers, exclusively for individuals who perform household chores and only covers the contribution to Social Security and Health Insurance Plan.

The registration of individuals in the regime may generate budgetary impacts in several aspects:

For every 100,000 individuals registered in the new category, the monthly revenue for social security purposes would be ARS101 million, and ARS141 million in contributions for health insurance plan. The latter would be paid to the Social Security/Union-run health insurance chosen by the registered persons, and therefore would not increase the public coffers.

If there are individuals who are currently eligible and contributing to category A of the Simplified Regime for Small Taxpayers and wish to change to the new AA provided for in the Bill, ARS23 million would be lost per month for every 100,000 individuals.

Finally, if the provisions of the Bill are analyzed as a closed pay-as-you-go pension system, 29 active category AA contributors would be needed for each one who retires to guarantee the internal sustainability of the proposed regime.

by Nicolas Perez | Dec 7, 2021 | Tax Revenue

Tax revenue amounted to ARS1,037,964 million in November, which implied a growth of 59.5% year-on-year (YoY). Adjusted for inflation, it expanded 4.7% YoY.

Among the most significant tax revenues were the increase in VAT and the Tax on Credits and Debits. Export Duties and Social Security resources continued to show a good performance.

The low comparison base attributable to the economic effects of the Mandatory Preventive Social Isolation (ASPO), which came into effect on March 20, 2020, continues to favor the year-on-year comparison, in addition to the increase in the international prices of raw materials and the increase in the nominal exchange rate (30.7% YoY).