by Nicolas Perez | Dec 6, 2021 | Health

In Argentina, the great differences in the provision of health care between jurisdictions, labor informality and a mixed system, conditioned by regulations that are not always effective for their purpose, hinder the existence of equitable and egalitarian access to health care.

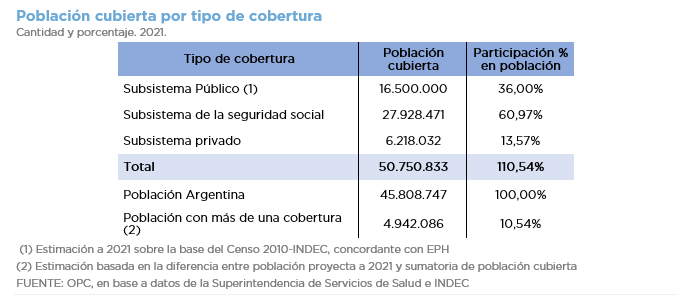

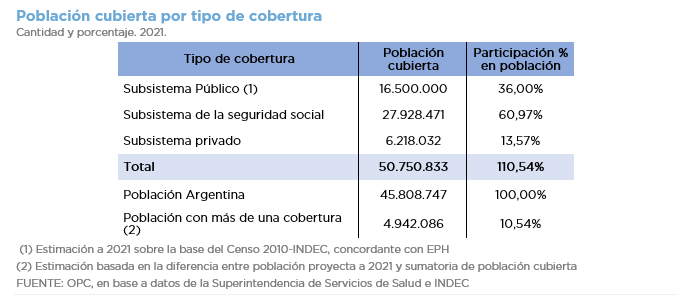

- Public health care is used by 36% of the population, about 16 million people, who have no other type of coverage and with large differences in the benefits they receive in each province. Sixty-one percent of the population is covered by the Social Security/Union-run system and 13.6% is covered by the private system (10.4% of the population has more than one type of coverage).

- Sixty-three percent of registered health facilities are private and 97% of them are business establishments. The National Government plays a subsidiary role in health care, which is evidenced, among other things, by the fact that 95.7% of public hospitals are provincial or municipal.

- There are large differences between jurisdictions in the number and types of facilities. In the province that has the most, the number of health care centers is four times higher than in the province that has the fewest.

- The concentration of beneficiaries among the different Social Security/Union-run health insurances is remarkably uneven: the one belonging to the trade union of employees of commerce has 1,692,600 members, whereas others have less than 500.

- The budget of PAMI (Comprehensive Medical Attention Program, managed by the National Government) represents 1.1% of the Gross Domestic Product.

- The difference in coverage of the private subsystem is the most significant: between the province with the highest coverage and the one with the lowest coverage (with respect to their total population) there is a difference of 21.2 times.

- In the private subsystem there is also a strong concentration: OSDE (as a prepaid health insurance company), Swiss Medical, Galeno, Omint, Medicus and Paramedic account for 80% of the total.

- The complementary policies of free choice of Social Security/Union-run health insurance and transfer of contributions to the private subsector increase the differences between services provided by the different Social Security/Union-run health insurances and affect their funding.

- In most Social Security/Union-run health insurances and prepaid private health insurances the number of male members is greater than the number of female members, mirroring the reality of the labor market.

- In general terms, infant mortality is higher in the provinces of northern Argentina than in the rest of the country.

by Nicolas Perez | Nov 15, 2021 | Budget Execution

In October, the primary deficit amounted to ARS229.512 billion and the financial deficit amounted to ARS277.88 billion, which implies 35.9% and 24.4% higher than those recorded in the same month of the previous year, respectively.

Total revenues for the month expanded by 4.8% year-on-year (YoY) in real terms, driven by the good performance of tax revenues and Social Security contributions, with increases of 6.1% YoY and 7.3% YoY, respectively.

- Non-tax revenues grew 61.0% YoY, boosted by the collection of ARS 2.751 billion from the Solidarity and Extraordinary Contribution in the month of October.

- The amounts received from Export Duties, which grew 43.4% YoY, both because of the increase in prices and in the quantities of soybean products sold, stand out. On the other hand, Wealth Tax revenue contracted by 35.8% YoY.

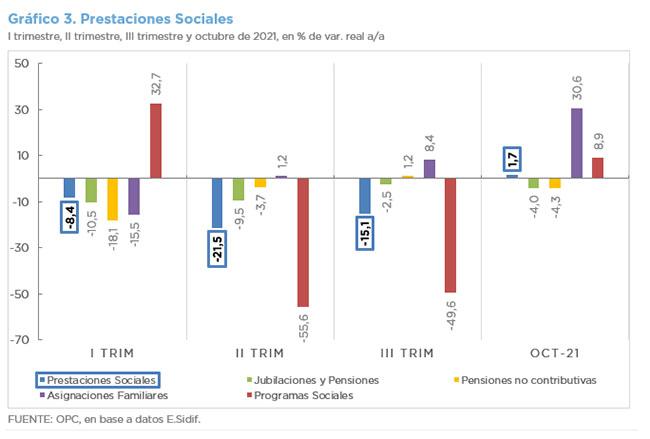

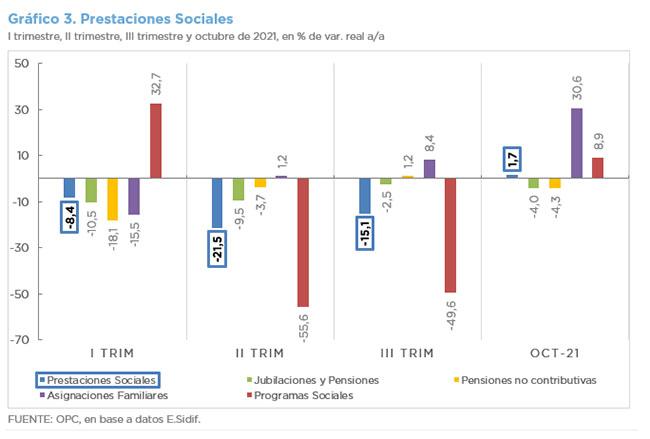

Primary expenditures rose for the third consecutive month with an increase of 11.4% YoY in real terms.

- One of the most expansive components of expenditure was energy subsidies, which increased 124.5% year-on-year in real terms. They also recorded the highest level of execution so far this year: 96.4%.

- Social programs had a real increase of 8.9% YoY in October, mainly because of the increase in the value of benefits and the number of beneficiaries that has been verified throughout this year in the Socio-Productive Inclusion and Local Development (Potenciar Trabajo), Food Policies, PROGRESAR education grants and REPRO II programs, among others.

- Retirement and pensions recorded a 4.0% year-on-year decrease once again, and non-contributory pensions fell by 4.4% year-on-year.

- During the first ten months of the year, the initial budget approved increased by ARS1.341 trillion, through different measures.

by Nicolas Perez | Nov 11, 2021 | Public Debt Operations

- In October, three market auctions were held, resulting in the placement of government securities for a total of ARS466.281 billion, of which ARS90.897 billion were for bonds denominated in dollars and payable in pesos (USD linked).

- In the auction of October 6, the swap of the T2V1 bond (maturing on November 30) for a basket of USD linked bonds was offered and 45% of the outstanding amount was accepted.

- Net placements of Temporary Advances (TA) of ARS335 billion were recorded during the month, increasing the stock to ARS1.36 trillion. At the end of September, the legal ceiling on the stock of TA stood at $2.17 trillion.

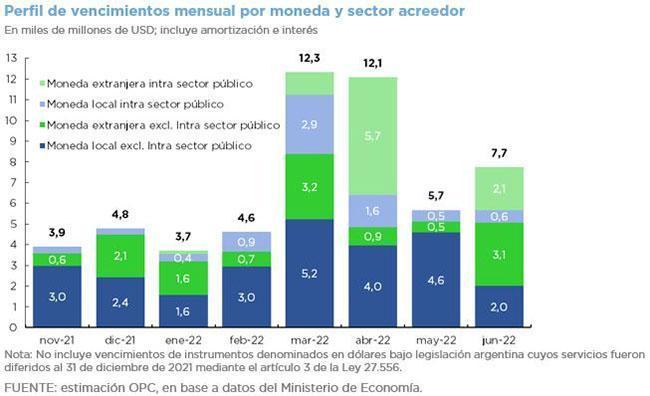

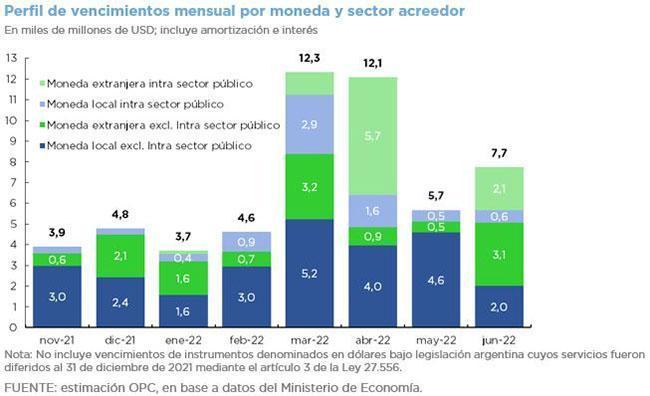

- Maturities for November are estimated to total the equivalent of USD3.899 billion. Excluding holdings within the public sector, maturities are reduced to USD3,583 million, of which 83% is payable in domestic currency.

- For the last two months of the year, maturities are estimated for the equivalent of USD8.672 billion (USD8.075 billion excluding maturities within the public sector).

by Nicolas Perez | Nov 10, 2021 | Budget Law

The Public Investment (PI) forecast for fiscal year 2022 will amount to ARS 1.314 trillion, which represents a real increase of 22.6% in relation to the execution estimated for this year.

Based on the projections of 2022 Budget Bill, PI will reach 2.2% of the Gross Domestic Product (GDP), basically because of the increase in Direct Real Investment.

- The investment project with the greatest budgetary significance is the Construction – Stage I of the Néstor Kirchner Gas Pipeline (Tratayén and Salliqueló) (ARS 57.088 billion), and the procurement of computer equipment for distribution in schools (ARS 70.404 billion) leads the acquisition of capital goods.

- Budget Bill 2022 includes 794 multiannual works with the largest disbursements expected for 2024. The most important is the construction of the Chihuido I multipurpose facility, in the province of Neuquén (ARS 228.9 billion).

- Capital transfers to government-owned companies and trust funds that are part of the National Public Sector will increase by 21% in real terms compared to this year.

- Within the framework of the Juana Manso – Conectar Igualdad Federal Program, the distribution of 1,550,000 technological equipment for access to educational contents and the provision of connectivity to 40,000 schools is expected for next year.

- The Inter-American Development Bank (IDB) and the China Development Bank (CDB) are the main external credit sources for infrastructure development.

by Nicolas Perez | Nov 9, 2021 | Budget Law

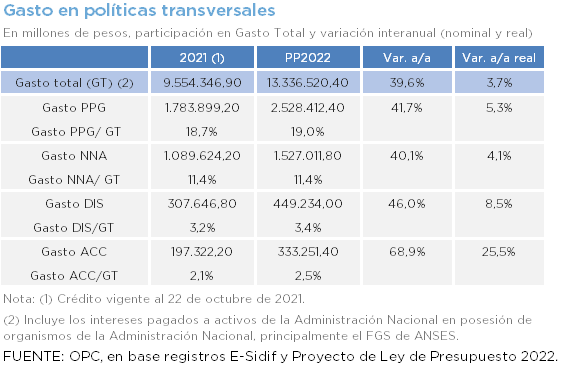

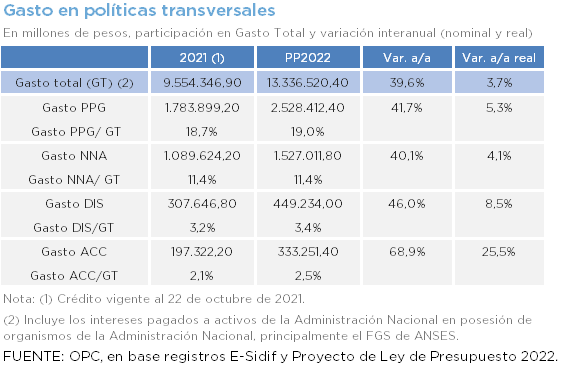

In the 2022 Budget Bill, the budgetary allocations of each cross-cutting policy show increases in real terms with respect to the appropriations for 2021, mainly direct monetary transfers, channeled through social programs.

Social programs had significant increases during the current fiscal year, both in their monetary values and in the universe of beneficiaries, but no changes in the values of these benefits over those recently granted are expected for next year.

Policies aimed at promoting a sustainable environment and combating climate change are the ones that show the greatest real growth between the current and projected budgets (25%), basically because of the allocation of resources to AySA S.A. (Argentine Water and Sanitation Company), with half of the funds allocated to this policy.

The real increase for gender equality policy is 5.3%, for children and adolescents 4.1%, and for assistance for persons with disabilities 8.5%.

- The allocation for Food Cards, part of these three cross-cutting policies, registered a significant increase in coverage during 2021, from approximately 1.5 million beneficiaries at the beginning of this year to 2.8 million today.

- For the first time next year, funds (ARS13.761 billion) will be allocated to childcare facilities, which were not included this year.

- The allocation for the Acompañar Program falls 14.7% below inflation given the number of beneficiaries included in the 2022 Budget Bill and the current value of the minimum wage (SMVM).

- For 2022, allocations for the Potenciar Trabajo program do not consider increases in the value of the SMVM over the one recently granted, given the expected level of coverage.

- Budget Bill 2022 does not include the duplication of the amount of child allowances por active population, provided by Executive Order 719/2021, since the measure was implemented after the submission of the Budget Bill.

- Although the financial analysis for the Universal Child Allowance (AUH) shows that the current appropriation would not be covering all outstanding payments until the end of 2021, the policy would still show increases over inflation in 2022.

- The Juana Manso – Conectar Igualdad program, educational infrastructure works, and the National Teacher Incentive Fund have significant budget increases.

- The real increase in disability programs is basically explained by the rise in disability pensions.

- The items aimed at the insertion of workers with disabilities are also reinforced.

- There are other policies aimed at persons with disabilities that are not addressed by labelling or mentioned in the Budget Message Annex as part of this cross-cutting policy.

- Within the Ministry of Environment and Sustainable Development, there are real increases in actions for the direction and conduct of environmental policy and falls in actions for the conservation and protection of biodiversity and the management of climate change.

- Significant increases in budget allocations are expected for the Ministry of Public Works and the National Agency for Water and Sanitation Works (ENOHSA) for water and sanitation infrastructure works.

- There are cases in which physical targets do not strictly relate to budget allocations and would require amendments.

by Nicolas Perez | Nov 8, 2021 | Budget Law

For 2022, tax resources projected by the Argentine Congressional Budget Office (OPC) reach ARS15.325 trillion, ARS248.443 billion (1.6%) lower than the amount estimated in the 2022 Budget Bill.

This assumption implies a real revenue growth of 9%, with different behaviors among taxes.

The main differences between the OPC projections and those of the 2022 Budget Bill for the end of the current year arise in Income Tax (-$63.504 billion), Bank Credits and Debits (-$28.307 billion) and Social Security Contributions (-$21.595 billion). On the other hand, the OPC estimates a higher collection than the 2022 Budget Bill for VAT net of refunds (+$39.674 billion) and for Other Taxes (+$8.389 billion).

In some cases, the differences are related to different estimates on the activity dynamics (e.g., recovery of wages and jobs); in others, because of the implementation of changes in tax regulations, which make the calculations more difficult.

The Budget Message does not contain precise parameters on how the resources will be allocated, nor is there consistency in the categorization of when a revenue is “tax” or “non-tax”, which makes the parliamentary analysis difficult.

This evaluation considers as an assumption that next year’s allocation of resources will be the same as this year. Projections made by OPC are based on the same macroeconomic assumptions and the same regulatory standards.