by Nicolas Perez | Nov 5, 2021 | Tax Revenue

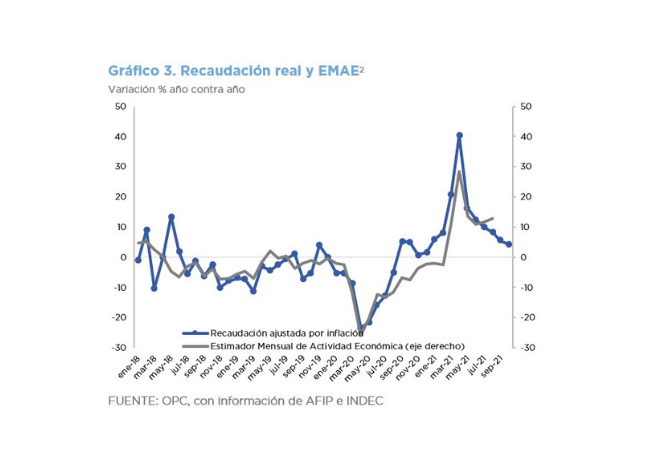

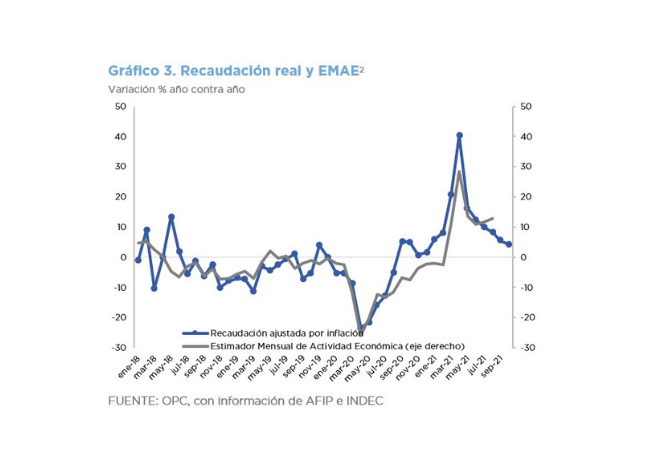

Tax revenues amounted to ARS1.018 trillion in October, which implied a 58.7% growth year-on-year (YoY). Adjusted for inflation, it expanded 4.3% YoY.

Among tax resources, the increase in VAT, Tax on Credits and Debits and Income Tax stands out. Export Duties and Social Security contributions continued to show a good performance.

The low comparison base attributable to the economic effects of the Mandatory Preventive Social Isolation (ASPO) that came into force on March 20, 2020, the increase in international raw material prices and the increase in the nominal exchange rate (30.7% YoY) contributed favorably to these results, although a deceleration continued to be observed.

by Nicolas Perez | Oct 27, 2021 | Budget Law

The National Budget Bill for 2022 estimates GDP growth of 4%. If this dynamic were to be verified, GDP would exceed the pre-pandemic level in 2022, although it would remain 3.5% below the peak recorded in 2017.

The nominal exchange rate (NER) would stand at ARS102.4 per USD in December 2021 and ARS131.1 per USD in December 2022. This implies an increase in the real bilateral exchange rate.

- The Consumer Price Index will close at 45.1% this year and 33% in 2022.

- The trade surplus in 2021 will be cut by 27.6% because of the increase in imports. Calculations assume that foreign sales in the second half of this fiscal year will increase 37%.

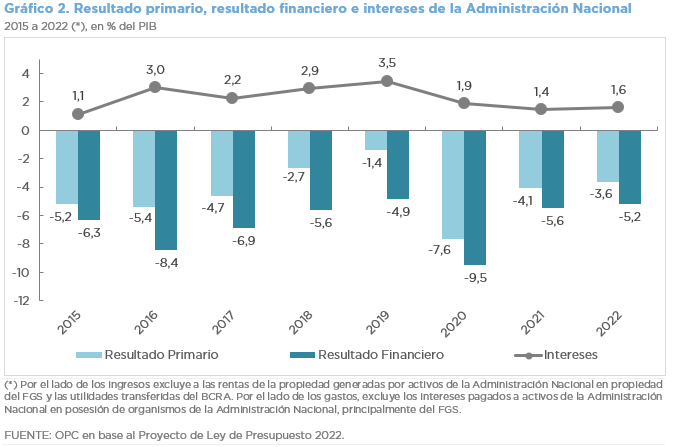

- In the 2022 Budget Bill, revenues are expected to account for 16.7% of GDP, which would imply 1.0 p.p. less than that projected for the 2021 closing.

- It also provides for primary expenditures to represent 20.3% of GDP in 2022, which would imply a decrease of 1.5 p.p. with respect to the current fiscal year, driven by the contraction of energy subsidies (0.9 p.p.) and social programs (0.5 p.p.). On the other hand, capital expenditures would grow by 0.3 p.p. Including debt interest payments, total expenditures would account for 21.9% of GDP, implying a drop of 1.3 points compared to 2021.

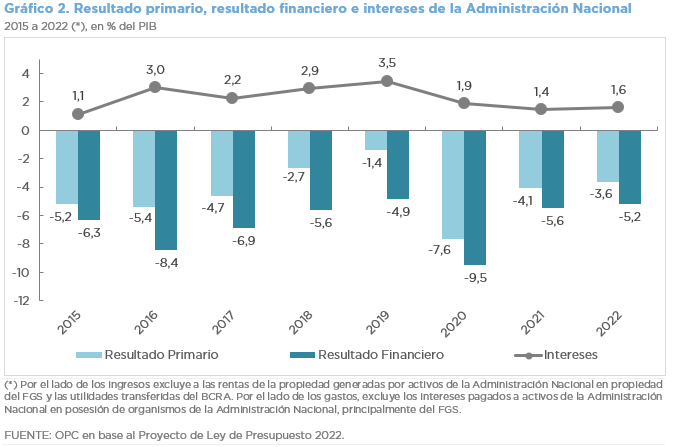

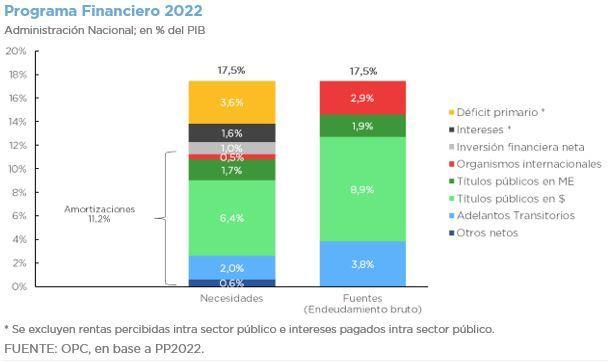

- The dynamics between revenues and expenditures would result in an improvement in the primary, fiscal, and financial balances, which, despite this, would still be negative. The projected fiscal deficit for next year is 2.9% of GDP, the primary deficit is 3.6% and the financial deficit is 5.2%.

- Real direct investment will grow, including the construction of the Néstor Kirchner natural gas pipeline and the renovation of the tracks and corridor of the General Belgrano Cargas Railroad. Within the procurements of goods, the purchase of computer equipment, within the framework of the Juana Manso – Conectar Igualdad Federal Plan, stands out.

- It is projected to allocate ARS122.265 billion for the procurement of vaccines against COVID-19: 80 million doses to inoculate 40,975,941 people.

- In the Executive Branch, 5,873 new staff members are projected, including 2,245 positions in the Ministry of Security (38.2%).

- Of the 95 sections of the Bill, about 34 do not relate to specific budgetary matters and, therefore, should be the subject of other regulations.

- According to the Argentine Congressional Budget Office’s own projections, the current fiscal year would close with an additional expenditure of ARS375.809 billion, equivalent to 0.87% of GDP: 47.2% for higher estimated funds for Social Benefits and 23.9% for energy subsidies.

by Nicolas Perez | Oct 27, 2021 | Budget Law

- For next year, the 2022 Budget Bill (BB2022) includes interest payments for ARS1.097 trillion, including interest within the public sector. The proportion of interest in the total expenditure of the National Government would increase from 7.1% in 2021 to 8.2% in 2022.

- Considering government-owned companies, trust funds and other entities, the estimated interest expenditure of the National Non-Financial Public Sector (NFPS) would increase from 1.7% of GDP in 2021 to 1.9% of GDP in 2022. Part of the projected increase reflects the higher interest rates that will accrue in 2022 on securities issued under the restructuring of public debt in foreign currency completed in September 2020, which have an increasing coupon (“step up”).

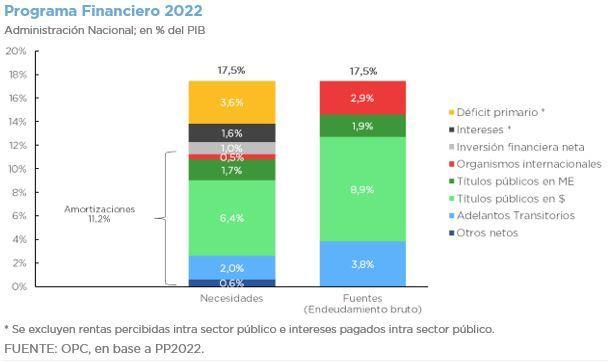

- Projected financing needs for 2022 total 17.5% of GDP. They are expected to be covered by gross placements of government securities (including intra public sector) for 10.7% of GDP, gross granting of Central Bank (BCRA) Temporary Advances for 3.8% of GDP and gross disbursements from international organizations for 2.9% of GDP.

- The BCRA’s net assistance to the Treasury would reach 1.8% of GDP in 2022 and would be made effective exclusively through the net granting of Temporary Advances.

- Sections 39, 45 and 47 of BB2022 establish limits on the gross amounts for securities issuance and loans maturing after the end of fiscal year 2022, with a total authorized amount equivalent to $6.59 trillion, USD32.993 billion and EUR287 million. On the other hand, Sections 40 and 41 authorize the use of short-term credit (maturing within the same fiscal year), establishing limits on the outstanding amounts of such instruments for a total of $2.78 trillion.

by Nicolas Perez | Oct 22, 2021 | Activities

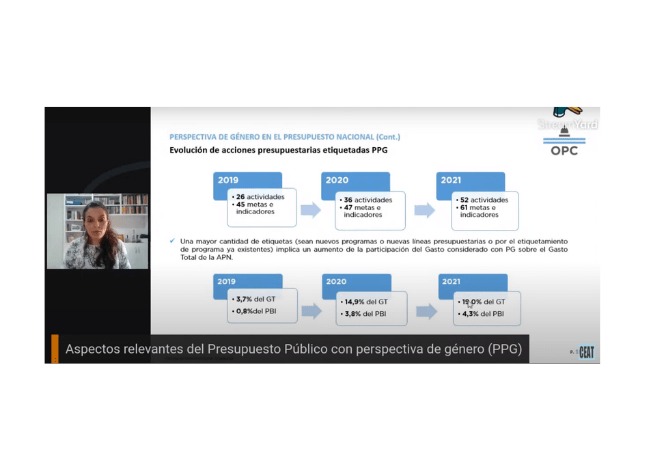

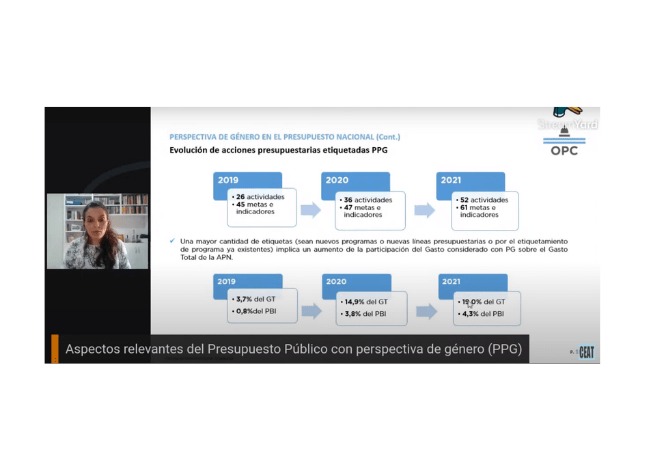

On October 20, the OPC participated in the event Gender-Responsive Budgeting organized by the Center for Studies on Tax Administration (CEAT) of the School of Economic Sciences of the University of Buenos Aires (UBA).

The Director of Studies, Analysis and Evaluation, María Eugenia David Du Mutel de Pierrepont, spoke on conceptual aspects for including gender perspective in public budgets and presented Argentina’s progress in this area.

The meeting included the participation of Dr. Agustina O’Donnell, Judge of the Tax Court of the Nation, who spoke on the relevance of approaching tax regulations from a gender perspective and was moderated by Elvira Balbo, tax specialist and member of CEAT, who also presented the work of Dr. Daniella Fuentealba Soto, lawyer of the Federal Administration of Public Revenue, on Social Responsibility of Tax Administrations.

The event is part of a series of presentations promoted by CEAT’s Social Responsibility Committee, which brings together leading specialists in the field of taxation in the country and the region.

by Nicolas Perez | Oct 15, 2021 | Budget Execution

Between January and September, the National Government reduced its primary (68.8%), fiscal (57.3%) and revenue (74.7%) deficits in real terms as compared to the same term of the previous year.

During the first nine months of the year, the revenues of the National Government grew 25.4% in real terms, basically because of a better VAT collection and the ARS427.401 billion coming from the allocation of Special Drawing Rights (SDR) that Argentina received in accordance with its quota of participation in the IMF.

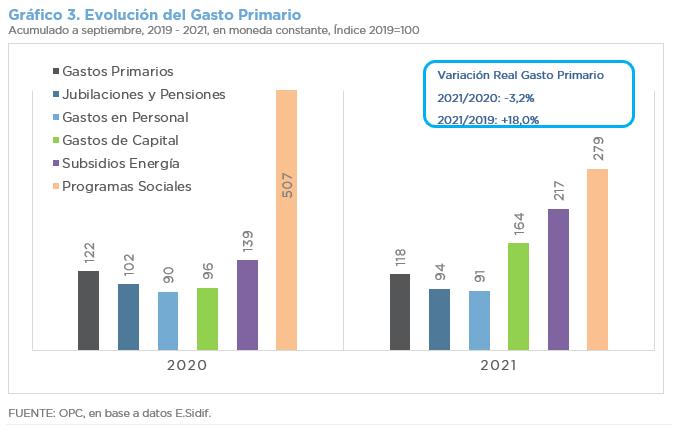

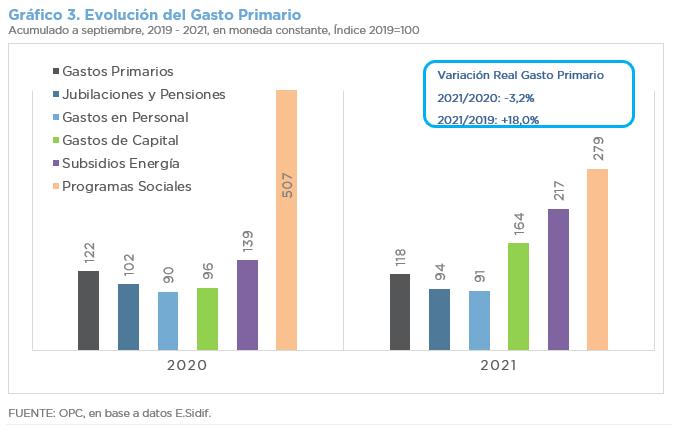

Primary expenditure fell 3.2% but with an uneven behavior per item.

- Pensions decreased in real terms by 7.4% because of the application of the mobility formula to which the ANSES schemes are subject.

- Social programs showed a decrease in real terms of 45% because of the discontinuation of IFE (Emergency Family Income) and ATP (Employment and Production Assistance Program), which was partially offset by the budgetary reinforcement in other initiatives such as Potenciar Trabajo, Food Policies, PROGRESAR grants and REPRO.

- Energy subsidies and capital expenditures lead the expansion of expenditures, with increases of 56.9% and 71.9%, respectively.

- The increase in tax and Social Security revenues is partly determined by the low annual comparison base since the previous year’s economic activity was depressed by the Mandatory Preventive Social Isolation.

- Interest payments on debt fell 25%, resulting from the restructuring of obligations in foreign currency, partially offset by an increase in payments to multilateral organizations.

- Public investment in Housing and Urban Development increased 280% on average, boosted by the Pro.Cre.Ar program and the Social Housing Trust Fund.

- There was a drop of 24.9% YoY in property income, basically caused by lower interest from the Sustainability Guarantee Fund (FGS).

- The initial budget for this fiscal year increased by ARS1.152 trillion, with social programs (ARS342.160 billion), energy subsidies (ARS209.061 billion) and public investment (ARS104.847 billion) as priorities.

- As of September 30, total expenditures accrued ARS6.991 trillion, equivalent to 73.2% of the current budget appropriation, a higher level than that recorded in 2020, when it reached 66.0%.

- The execution of energy subsidies reached 88.4% and the items financed with the Solidarity and Extraordinary Contribution, 70.9%.

by Nicolas Perez | Oct 15, 2021 | Activities

On Wednesday, October 13, we participated in the virtual meeting organized by NDI (National Democratic Institute). The purpose of the activity was to contribute to capacity building and share best practices between the Parliamentary Budget Officer of Canada and the Argentine Congressional Budget Office (OPC).

The Office of the Parliamentary Budget Officer (PBO) was created in 2006 and, like the OPC, provides independent analysis of the state of the fiscal situation to the Parliament and the community. In addition, upon request, it provides cost estimates for proposed legislation under discussion.

The meeting was moderated by Dayana Chaparro, NDI Program Officer, and was attended by the following PBO representatives: Yves Giroux (Head of the Office), Jason Jacques (Director General – Costing and Budgetary Analysis), Chris Matier (Director General – Economic and Fiscal Analysis); Melissa Fraser-Arnott (Director of Parliamentary Relations and Planning) and Kaitlyn Vanderwees (Analysts Team). Present from the OPC were Marcos Makón (OPC Director); Mariano Ortiz Villafañe (Director of Sustainability and Public Debt Analysis); María Eugenia Pierrepont (Director of Studies, Analysis and Evaluation); Carlos Guberman (Director of Fiscal and Tax Analysis), Natalia Laría (Coordinator of Institutional and Parliamentary Relations) and Sofía Banegas (Private Secretary of the Directorate General).

The exchange was carried out to continue and deepen the contents shared during the “Discussion: The Role of Congress in Budget Transparency” held last July, where topics such as work standards and resources to strengthen budget evaluation processes were discussed.