ANALYSIS OF PUBLIC INVESTMENT BUDGET EXECUTION – 2023

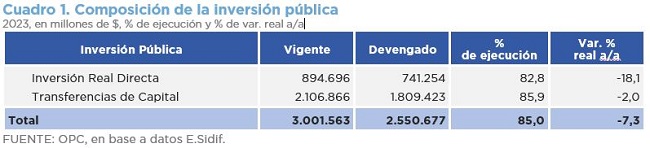

Due to a more pronounced drop in Real Direct Investment, Public Investment decreased 7.3% in real terms during 2023, with an execution of 85% of the current appropriation for the year.

- All functions decreased except for energy, because of the transfer of funds for the execution of the Néstor Kirchner Natural Gas Pipeline: transfers to ENARSA grew by 146.3% in real terms and are equivalent to more than half of transfers made to state-owned enterprises.

- Transfers to trust funds fell by 41.8% year-on-year, and those to provinces and municipalities fell by 13.9% year-on-year.

- Half of public investment (50.7%) was financed with resources from the National Treasury, which showed a real growth of 9.1% with respect to 2022.

- A total of 20.8% of investment was financed with external credit.

- The main investment project was the construction of the CAREM Phase II reactor.

- The Ministry of Education accounted for 43.8% of total capital procurement, mainly for the purchase of computers under the Conectar Igualdad Program.