GENERAL DESCRIPTION OF THE CONTENTS OF THE 2021 NATIONAL BUDGET BILL

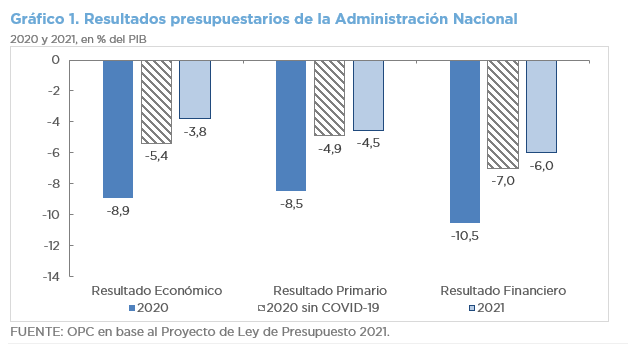

The National Budget Bill for 2021 foresees for next year a decrease in deficits due to the partial

recovery of the economy, with an increase in public investments and a reduction in the payment

of interest on the debt.

- According to the macroeconomic estimates of the Bill, the Gross Domestic Product

(GDP) will suffer a real fall of 12.1% this year, the nominal exchange rate will be AR$81.4

per dollar at the closing of the fiscal year, and the YoY inflation rate will be 32%. Next

year’s GDP is expected to rise 5.5% in real terms, with a nominal exchange rate of

AR$102.4 per dollar in December, and an inflation rate of 29% YoY. - Resources will increase by 9.7% YoY in real terms and total expenditure will fall by

10.4% YoY. - This dynamic between revenue and spending will lead to an improvement in the primary

balance in 2021, which would go from a deficit of 8.5% of GDP in 2020 to a deficit of

4.5% in 2021. The same applies to the financial balance, which would vary from a deficit

of 10.5% of GDP in 2020 to a deficit of 6.0% in 2021. - Capital expenditures will have the largest real increase and debt interest the sharpest

decline. - Gross financing needs in the next fiscal year will be AR$6.4 trillion (17.2% of GDP). The

Central Bank will contribute AR$800 billion to the Treasury, 62.2% less than this year. - Exports are expected to recover from a 14.2% YoY decline this year to a 10.4% YoY

increase next year. - The Budget Bill does not provide neither financial allocations for Emergency Family

Income – IFE (Ingreso Familiar de Emergencia) nor for assistance for the payment of

private salaries (ATP), but it does provide a 24.1% increase in resources for vaccines

(AR$45.4 billion), including the purchase of doses against COVID-19 (AR$13.69 billion).