by Nicolas Perez | Aug 12, 2020 | Public Debt Operations

Placements of securities and loan disbursements were recorded for the equivalent of USD9.8 billion, of which AR$528.15 billion (USD7.7 billion) consisted of auctions of marketable securities in pesos.

In addition, the equivalent of USD7.37 billion of principal payment was made, mainly due to a voluntary swap of securities in dollars for new instruments in pesos carried out on July 17.

During the month, interest coupons were not paid on several foreign-legislation BIRAD bonds totaling USD584 million. As of July 31, outstanding interest coupons on bonds issued under foreign legislation totaling USD1.67 billion remain unpaid, which are expected to be recognized as part of the restructuring process of such securities currently underway.

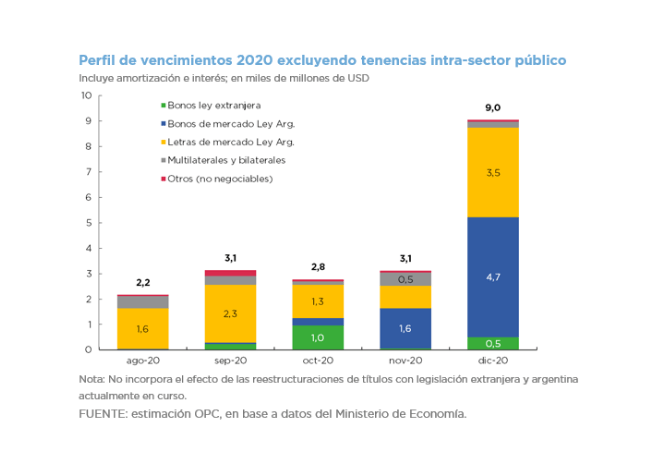

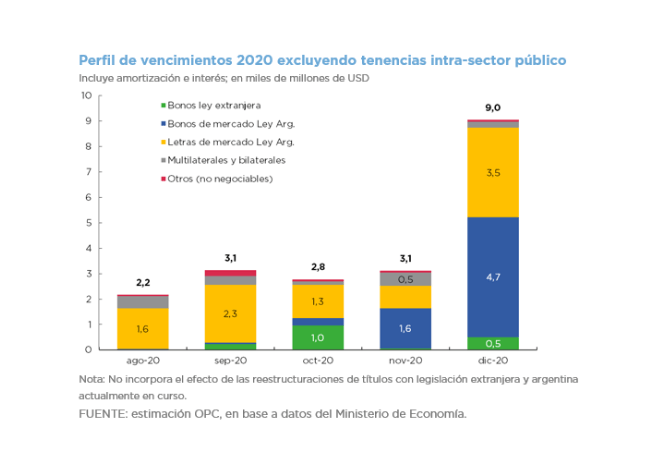

We estimate debt service maturities for the equivalent of USD3.13 billion for August, amounting to USD35.53 billion by the end of the year (approximately USD20.29 billion excluding holdings within the public sector).

On August 4, the government announced an agreement with the main groups of creditors for the restructuring of bonds issued under foreign legislation. The deadline for creditors to accept the revised proposal was extended until August 24, while the settlement date of the transaction is September 4. At the same time, Law 27,556 on the restructuring of government bonds in dollars issued under Argentine legislation with the same conditions as the bonds under foreign legislation was enacted.

by Nicolas Perez | Aug 10, 2020 | Tax Revenue

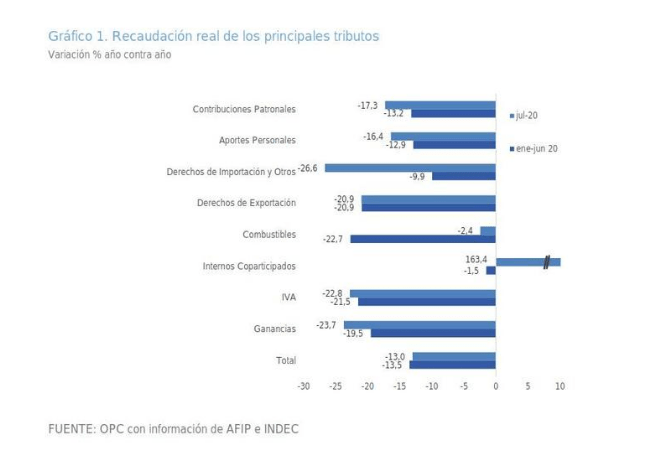

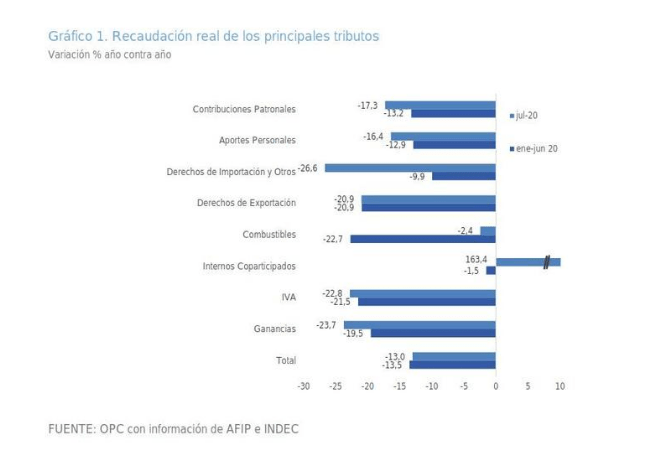

Total tax revenue amounted to AR$559.09 billion in July, which implied a nominal growth of 24% YoY, however, it contracted for the seventh consecutive month when adjusted for inflation, showing a decrease of 13% YoY.

In the first seven months of the year, total collection amounted to AR$3.44 trillion, 26.2% higher than in the same period of last year.

The main factor behind the drop in inflation-adjusted tax revenues was the economic impact of COVID-19. The national tax revenue is strongly linked to the level of activity, so the recessionary context, deepened by the pandemic, is the main factor explaining why tax revenue has decreased in 22 of the last 25 months in real terms.

by Nicolas Perez | Aug 7, 2020 | Budget Law

On August 5, the Bill in revision that amends the General Budget of the Nation for the year 2020 (CD 25-20) was introduced in the Senate. The Bill was approved with amendments by the Chamber of Deputies on August 4. With respect to the Bill introduced by the Executive Branch, new expenditure authorizations were added to be allocated by the Chief of Cabinet of Ministers, who must, at the time of including them in the budget, reduce other spending items, increase the calculation of resources, or modify financial sources and investments. New quantified authorizations total AR$15.8 billion. Other new expenditures have been approved, the amounts of which have not been specified in the Bill.

by Nicolas Perez | Aug 6, 2020 | Public Debt

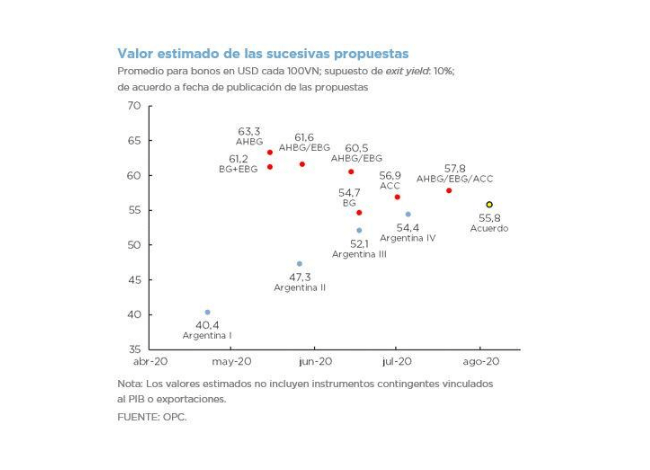

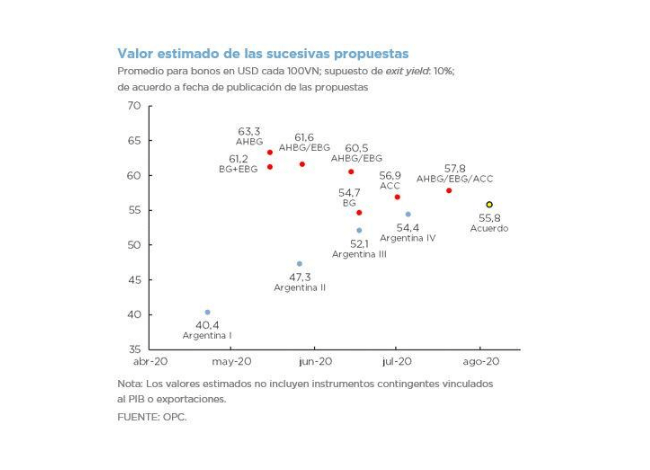

On August 4, the government announced an agreement with the main groups of creditors to restructure bonds under foreign legislation. Based on the agreement, the terms of the last offer made by Argentina on July 6 are modified.

The modifications include the advancement of some maturities of the new bonds to be delivered, new conditions for the swap for bonds in different currencies and the commitment to introduce some adjustments to the collective action clauses of the new securities that are supported by the international community.

Assuming an exit yield of 10%, the settlement has an estimated average value of USD55.8 per USD100 of eligible face value. The agreement involves an improvement of USD1.4 over the previous official proposal.

Under the assumption that the full eligible amount is swapped, the new bonds would generate amortization and interest payments of approximately USD4.6 billion in the term 2020-2024 and USD42.7 billion in the term 2020-2030.

The creditor groups that negotiated the agreement, together with other bondholders that would provide support, claimed to hold 60% of the eligible bonds issued under the 2005 indenture and 51% of the 2016 indenture bonds.

According to the current schedule, the creditors have a deadline to accept the proposal until August 24 and, in case of acceptance, the swap transaction would be settled on September 4.

by Nicolas Perez | Jul 30, 2020 | Budget Law

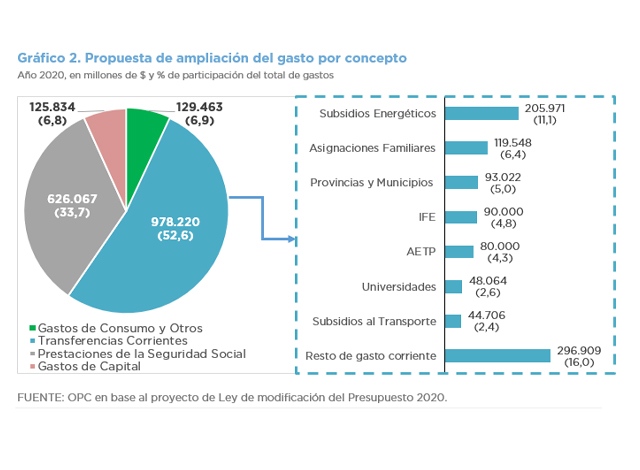

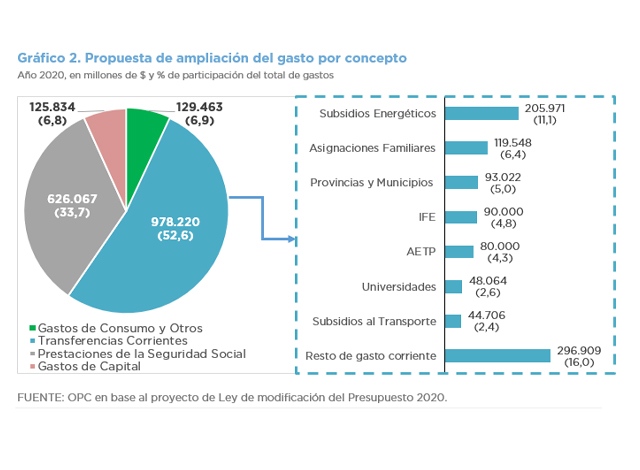

The National Budget Amendment Bill for Fiscal Year 2020 foresees an increase in expenditures of AR$1.86 trillion and an increase in resources of AR$642.84 billion, mainly due to the extension of the 2019 Budget and the higher disbursements caused by the health crisis and the deterioration of the macroeconomic situation.

Such dynamics deepens the financial deficit by AR$1.21 trillion, which will be basically financed with transfers of profits from the Central Bank and domestic and multilateral debt.

The initiative implies a negative financial balance of AR$3.02 trillion and a primary deficit of AR$2.23 trillion for the year 2020.

- It is proposed to increase by 33.5% the budget appropriation in force as of July 18, mainly to address the social economic emergency, guarantee the functioning of the government and mitigate the pandemic.

- Social Security and energy subsidies are the priority.

- Appropriations related to the pandemic would increase to AR$869.5 billion.

- National government resources would increase by 24.5% with respect to the initial appropriation: Wealth tax revenue would increase by 410.2%.

- The Bill authorizes the subscription of securities in dollars to replace other instruments without guaranteeing an improvement.

by Nicolas Perez | Jul 27, 2020 | Employment and Social Security

- After the age of 40, the number of contributors begins to decline, particularly in the private sector, suggesting that there is an ” ejection from the labor market” after that age.

- This situation, together with the high level of informality, makes it impossible to access long-term pension benefits.

- The fact that 40.6% of contributors are women and 59.4% are men is a sign that a large part of the female labor force is outside the formal market.

- More than 50% of the active beneficiaries of the general regime receive amounts 2.5 times below the minimum wage; and 15.4% of men and 19.7% of women receive an amount equal to or less than the minimum wage.

- A pension benefit is equivalent to 38.1% of an active person’s income.

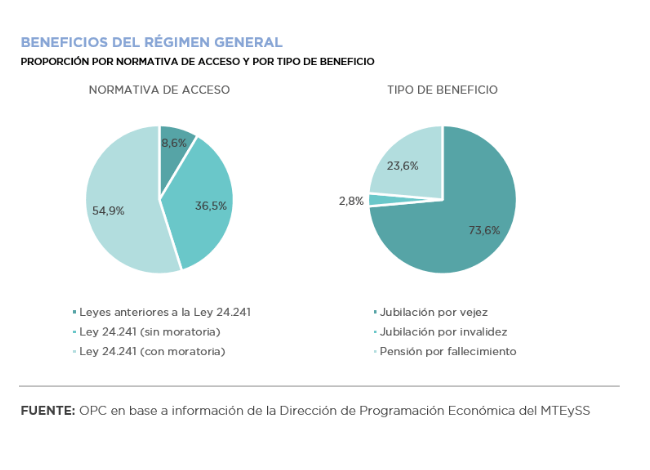

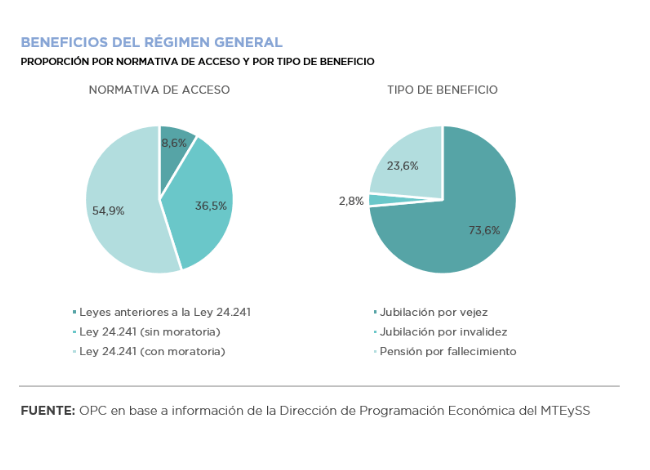

- Of the general regime benefits, 54.9% required a moratorium.

- Women, who were included to a large extent through a moratorium, account for 67.6% of the benefits.

- Excluding the special regimes, 86.1% of the benefits are equal to or less than two minimum pensions.

- The pension amount accounts for 38.1% of the average salary received by workers in the ten years prior to retirement.