by Nicolas Perez | Jul 23, 2020 | Cost Estimates

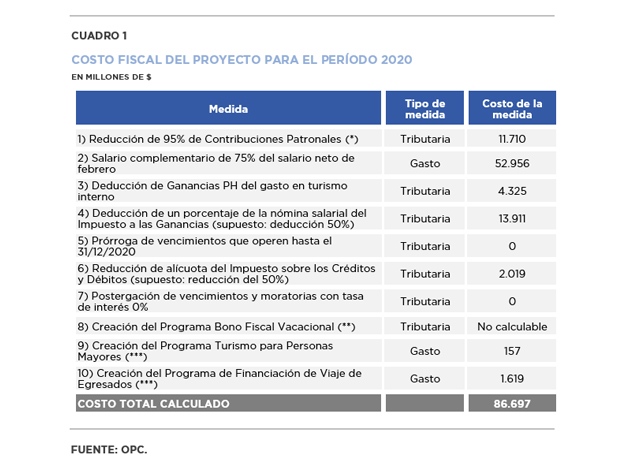

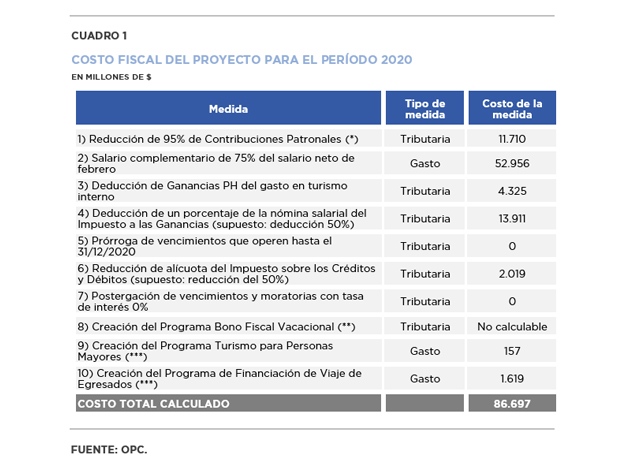

The Bill for the promotion of tourism activity, which originated in the Senate of the Nation, will have an estimated fiscal cost of AR86.7 billion, both for the higher expenditure that the national government will face and for the revenues expected to be lost between July 1 and December 31.

The estimate does not include the cost of tax deadlines extension, a measure with a financial but not economic cost.

The fiscal cost is estimated based on the 50% of the salary mass deductible from Income Tax and the reduction in the rate of the Tax on Bank Debits and Credits, a percentage that is not explicitly stated in the text.

The parliamentary initiative proposes a 180-day assistance plan for certain companies located in areas of the country that depend mainly on this activity, consisting of tax incentives and stimulus programs based on he transfer of public funds or lower taxes.

by Nicolas Perez | Jul 21, 2020 | Public Debt

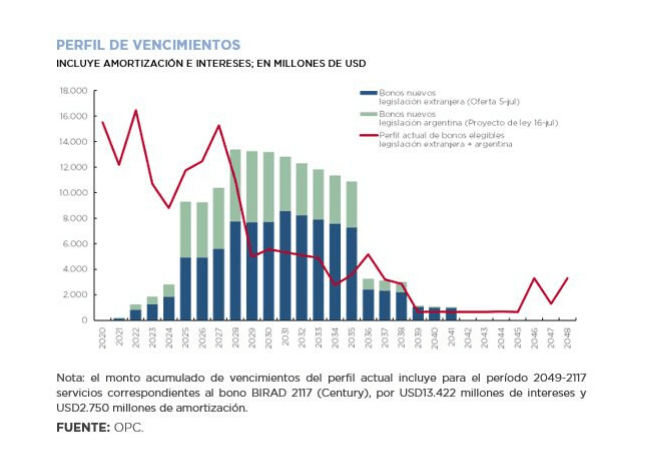

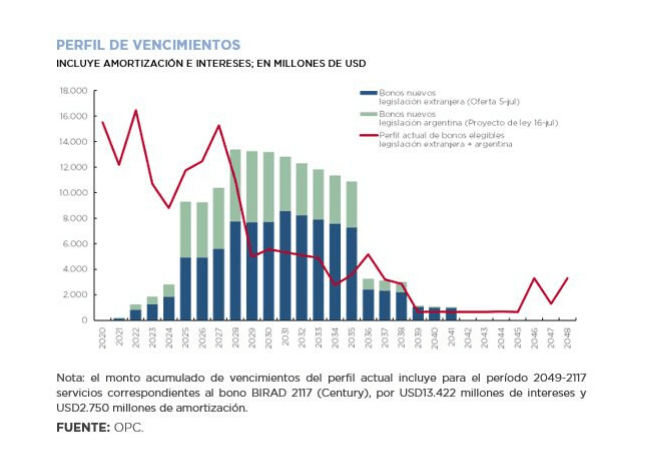

On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.

by Nicolas Perez | Jul 15, 2020 | Budget Execution

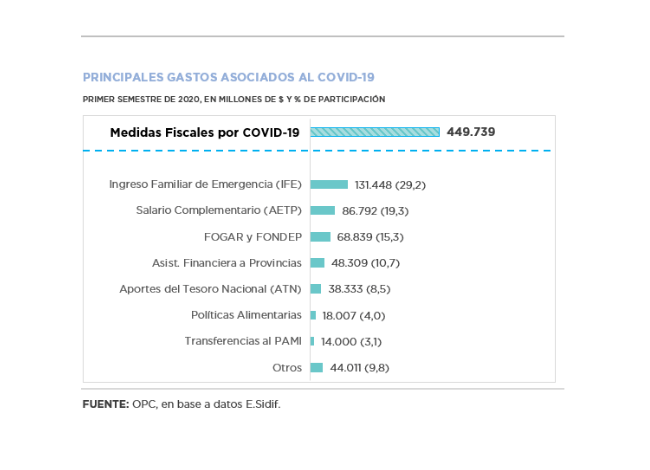

- During the first half of the year, the national government recorded a primary deficit of AR$911.12 billion due to the increase in expenditures and the decrease in revenues, both conditioned by the health crisis. his deficit was financed with profits from the Central Bank of Argentina.

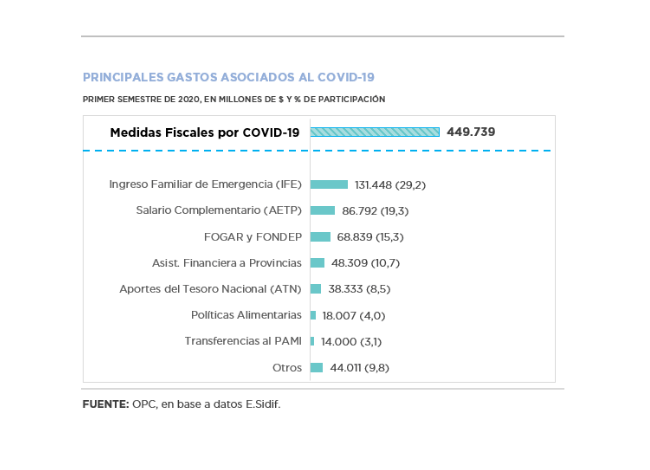

- In the first half of the year, primary expenditures increased 22.3% YoY in real terms. This variation is almost entirely explained by the fiscal measures adopted by the national government within the framework of the COVID-19 emergency and the social isolation measures. Meanwhile, given the year-on-year drop in debt interest (-38.7% YoY), the increase in total expenditures had a more moderate expansion of 0.9% YoY.

- The programs implemented to face the health challenge implied an expenditure of around AR$449.73 billion, without which primary expenditure would have grown by 3.2% in real terms compared to the first half of the previous year.

- Through twelve amendments, the initial Budget for the fiscal year increased by AR$845.41 billion, 67.6% of which was allocated to reinforce social benefits.

- In June, pensions and retirement benefits fell in real terms for the first time in the semester (1.4%), but supplementary bonuses caused lower pensions to increase 11.7% above inflation.

- The 71.8% drop in expenditure on housing and urban development was partly offset by the increase in expenditures on Potable Water and Sewerage, which rose 142.0% YoY, and on Financial Assistance for the Construction of Emergency Modular Hospitals, within the framework of COVID-19 ($4.38 billion).

by Nicolas Perez | Jul 14, 2020 | Public Debt Operations

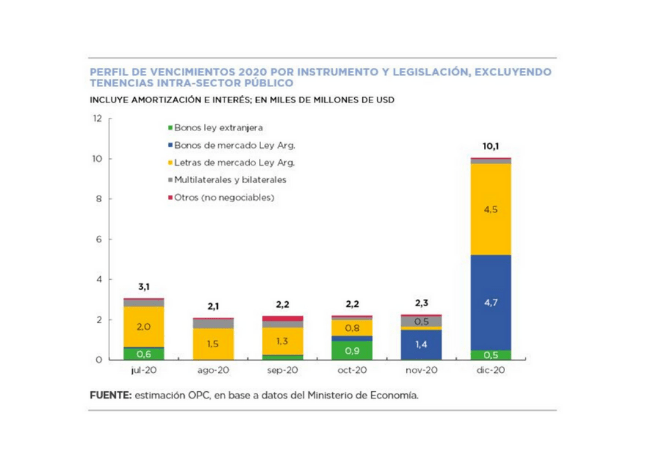

An amendment to the proposal to restructure the bonds issued under foreign legislation was formally submitted on July 7. With respect to the original offer submitted on April 22, principal reductions are lowered, interest accruals are brought forward, coupon rates are increased, the delivery of a bonus in recognition of accrued interest on eligible bonds is added, and the average life of the new bonds is reduced.

In addition, the new bonds maturing in 2038 and 2041 are issued under Indenture 2005, and a minimum participation threshold is introduced as a condition for the effectiveness of the swap. The proposal has an stimated average value of USD54.4 for the dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest creditor proposals are between USD57 and USD62.

In June, there were placements of securities and loan disbursements for the equivalent of USD5.1 billion, of which AR$221.95 billion (USD3.2 billion) were obtained through marketable securities auctions.

During the month, the payment of interest coupons on the BIRAD 2117 (6/28) and DISCOUNT bonds in dollars under foreign legislation (6/30), for a total of USD328 million, was defaulted.

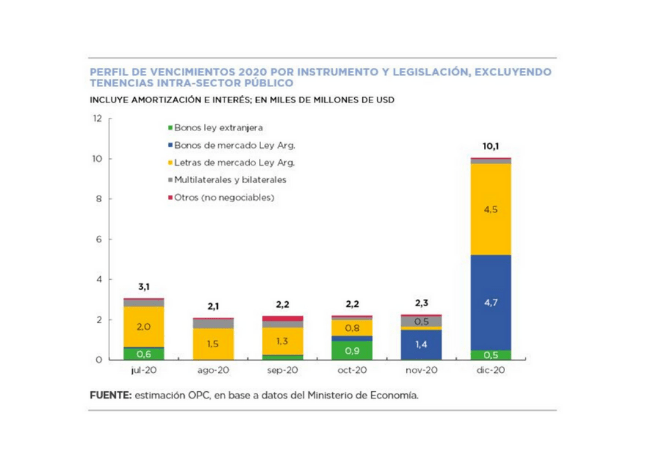

Debt service payments for the equivalent of US$3.86 billion (US$3.07 billion excluding holdings within the public sector) are expected for July, amounting to US$40.2 billion by the end of the year.

by Nicolas Perez | Jul 13, 2020 | Budget Law

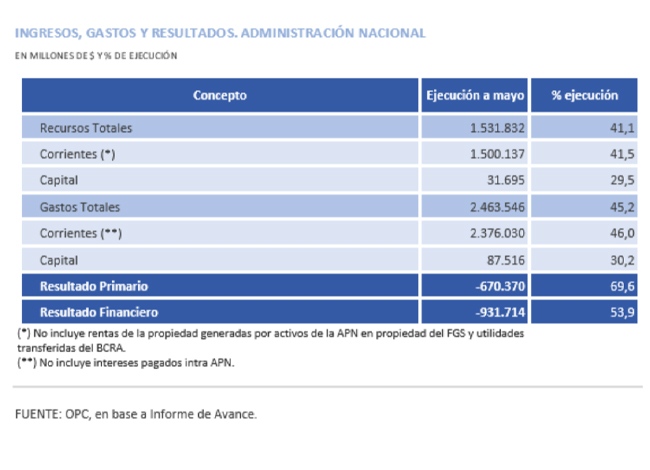

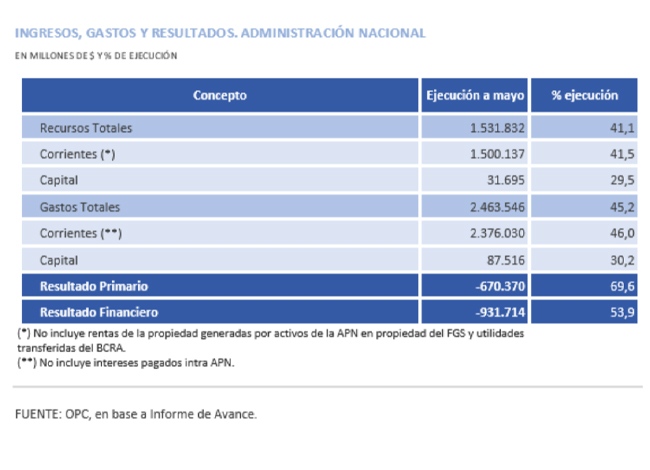

According to the Progress Report on the Draft Budget for 2021 sent by the Executive Branch to the Congress, as of May 31, the national government recorded a primary deficit of AR$670.37 billion and a financial deficit of AR$931.71 billion.

The official analysis does not include macroeconomic projections for 2021. The uncertainty caused by the pandemic, which drastically distorted budgetary expectations and whose consequences cannot yet be measured, as well as the pending closing of the debt renegotiation makes forecasting for coming years difficult.

New categories of current expenditures are included in 2020, such as the Emergency Family Income (AR$80.23 billion) and the Assistance to Labor, Employment and Production (AR$44.75 billion), both within the framework of the health emergency.

There is also a detail of the budgetary reinforcements to mitigate the effects of the health crisis which amounted to AR$537.31 billion at the end of May. OPC’s estimates, updated as of June 23, bring this amount to AR$652.06 billion.

by Nicolas Perez | Jul 9, 2020 | Tax Revenue

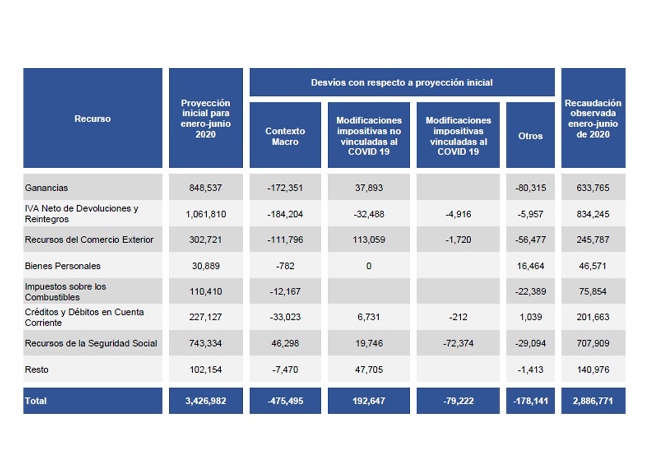

During June, the national tax revenue totaled AR$545.96 billion, which implied a growth of 20.1% year on year (YoY) but a retraction of 15.6%, when adjusted for inflation.

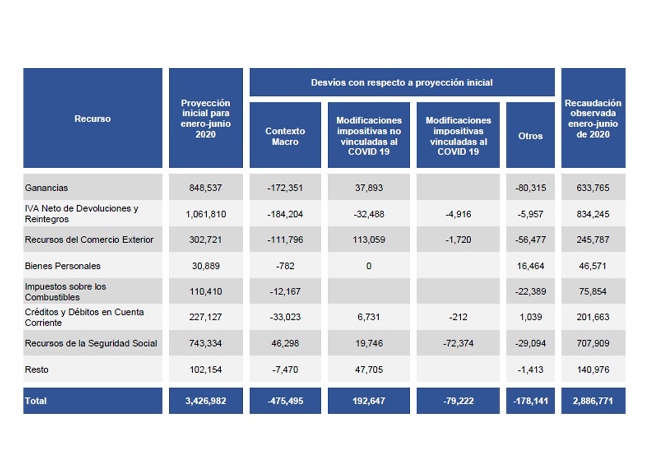

Revenues from the main taxes decreased in real terms, largely due to the adverse macroeconomic context caused by the COVID-19 pandemic and by the fiscal relief measures applied by the national government, in addition to an increase in tax arrears.

This context, added to certain regulatory changes, led to the fact that in the first half of the year the revenues of the national government were 15.8% below what the OPC projected at the end of November when the 2020 Budget Bill was being analyzed.

The new rules for taxpayer relief alone implied a drop of AR$79.22 billion in revenues for the first five months.

PAÍS Tax reached a record collection from the purchase of dollars.