by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

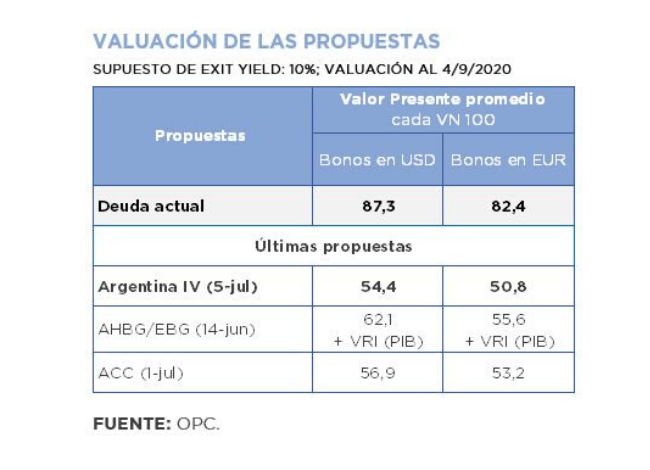

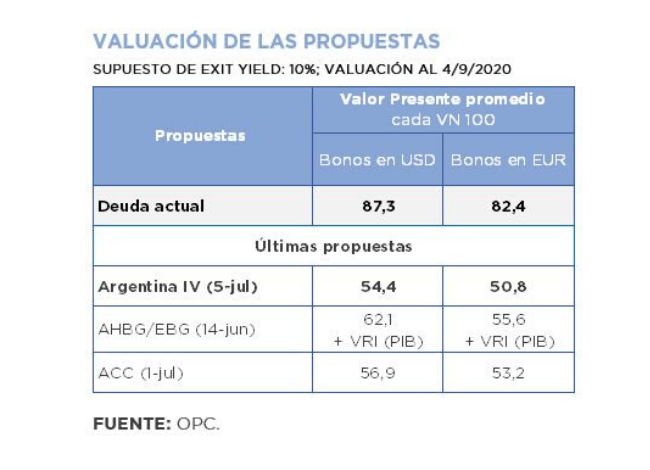

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

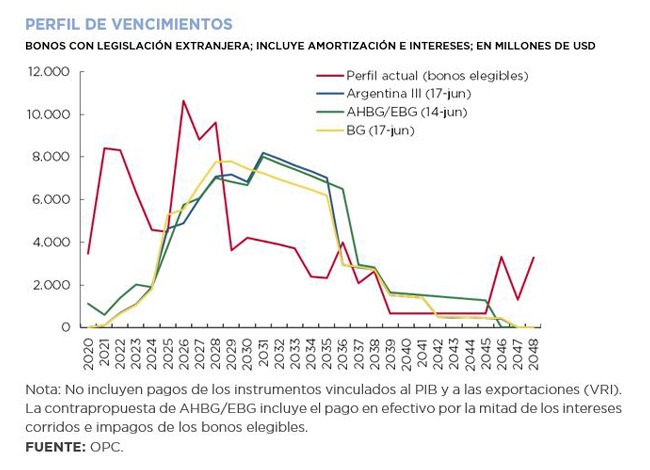

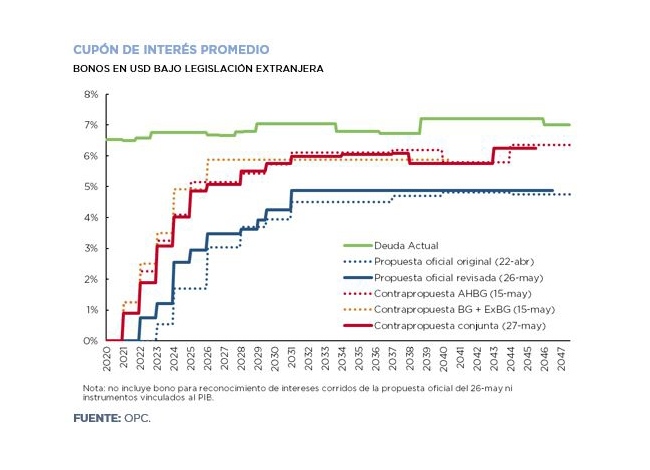

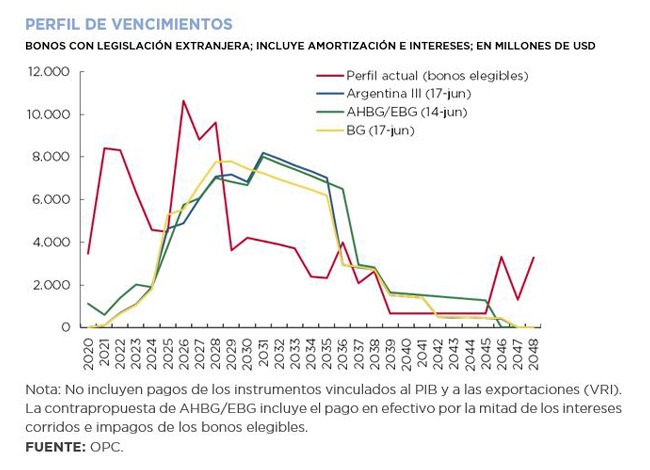

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.

by Nicolas Perez | Jun 24, 2020 | Health

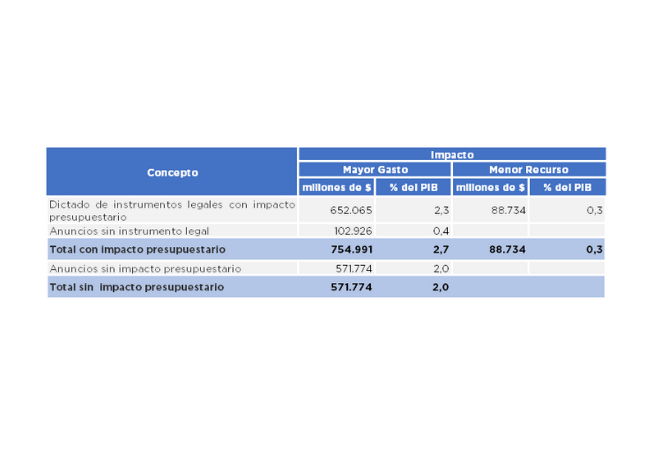

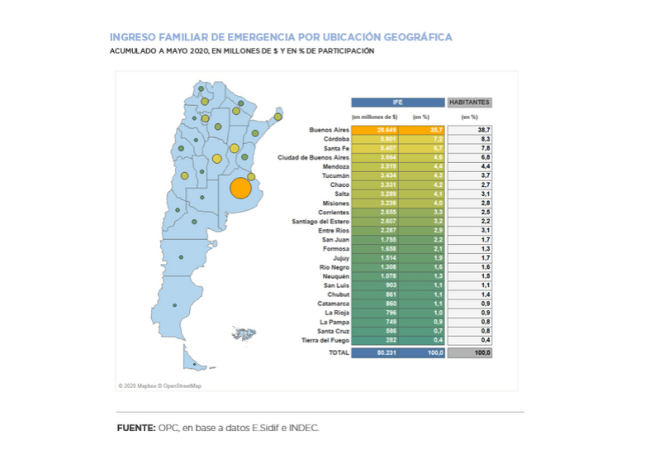

The national government has taken a series of economic measures within the framework of the health emergency and the current epidemiological situation caused by COVID-19.

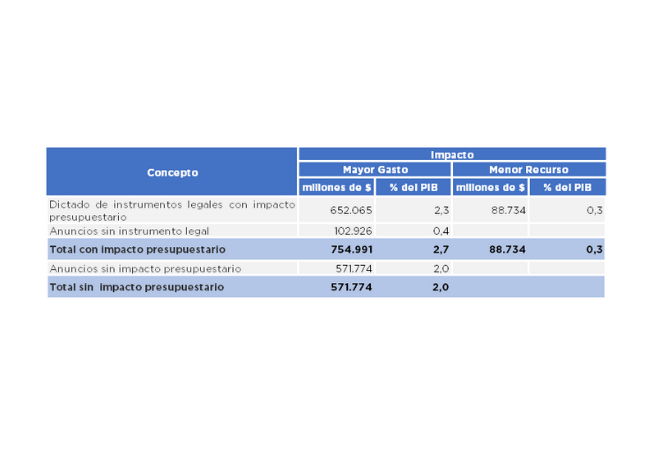

As of June 23, the measures announced to face the crisis imply an expenditure of AR$754.99 billion, equivalent to 2.7% of the Gross Domestic Product (GDP) and a decrease in resources of AR$88.73 billion (0.3% of GDP). Meanwhile, financial facilities totaled AR$ 571.77 billion (2.0% of GDP).

This is a dynamic report that will be permanently updated, as new regulations are issued by the national government or budget amendments that update appropriations are introduced to cover expenses derived from the health emergency.

by Nicolas Perez | Jun 22, 2020 | Public Debt

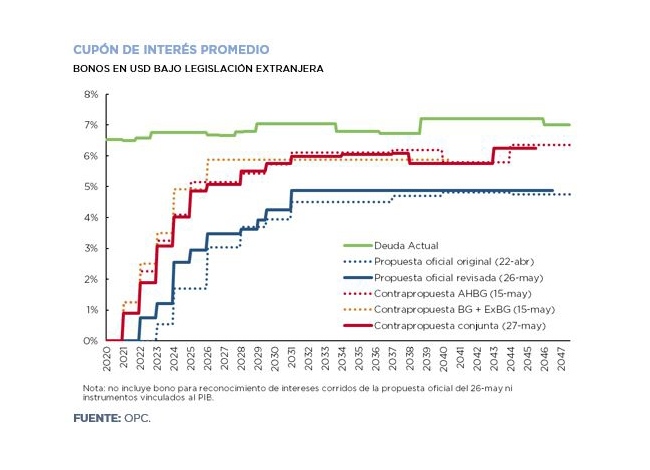

In a new round of talks, Argentina and the main bondholder groups exchanged new proposals to restructure securities under foreign law.

The new argentine proposal has an estimated average value of USD52.1 for bonds in dollars, about USD12 higher than the original offer, assuming an exit yield of 10%. Meanwhile, the creditors’ proposals are between USD55 and USD61. These figures do not include the different contingent instruments included in the offers (linked to GDP and exports, depending on the proposal). Beyond the differences in the estimated values based on the financial structure, there are also discrepancies in some legal terms of the new bonds to be issued and of the transaction itself.

Argentina stressed that some of the adjustments proposed by the creditors “are largely inconsistent with the debt sustainability framework that the Republic needs to restore macroeconomic stability and to move forward with an IMF program”. For its part, the main group of creditors said that “the negotiations failed”. In addition, both parties mentioned that they are evaluating all available options, which for creditors includes the possibility of claiming the acceleration of the foreign law bonds. However, on June 19 the government announced a new extension of the restructuring offer until July 24, with the intention of continuing talks with creditors.

by Nicolas Perez | Jun 10, 2020 | Budget Execution

The transfer of profits from the Central Bank to the National Treasury for AR$430 billion during May improved total revenues to face the higher expenses demanded by the health emergency and reduced the deficit in public accounts.

- Primary expenditures increased by 45.1% year-on-year (YoY) in real terms, basically to cover expenditures made in the context of the pandemic, which amounted to approximately AR$160.86 billion during the month.

- The increase in total expenditures slowed down to 21.3% YoY, mainly due to a 52.4% YoY decrease in debt interest payments.

- Without the Central Bank’s help, the primary deficit would have totaled AR$265.34 billion and total revenues would have fallen by 35.8% YoY compared to the previous year.

- The initial budget appropriation increased by AR$788.17 billion (16.2%), 93.4% of the increase being concentrated in social benefits (AR$541.23 billion), in transfers to the provinces (AR$124.92 billion) and in other current expenditures (AR$69.83 billion).

by Nicolas Perez | Jun 9, 2020 | Public Debt Operations

Negotiations between the government and creditors for the restructuring of securities issued under foreign law continued during the month of May. Three groups of creditors submitted their counterproposals to the government offer introduced at the end of April. In the last week of May, the government announced a revised proposal, while two creditor groups jointly submitted a new counterproposal. The positions of the government and the creditors became closer in terms of present value and financial relief for the next years.

The interest coupons of bonds BIRAD 2021, 2026 and 2046 for a total of USD503 million remain unpaid, which constitutes a default event according to the issuance terms of the bonds.

Six auctions were carried out during the month, resulting in the placement of AR$286.53 billion in securities in pesos, including AR$151.22 billion as part of two swap transactions of LETES in dollars and Bono DUAL 2020. In addition, financing was obtained from the Central Bank (BCRA) through the placement of bills for USD485 million.

Debt service payments for the equivalent of US$5.5 billion (US$3.15 billion excluding holdings withing the public sector) are expected for June, totaling US$45.47 billion through the end of the year.

by Nicolas Perez | Jun 5, 2020 | Tax Revenue

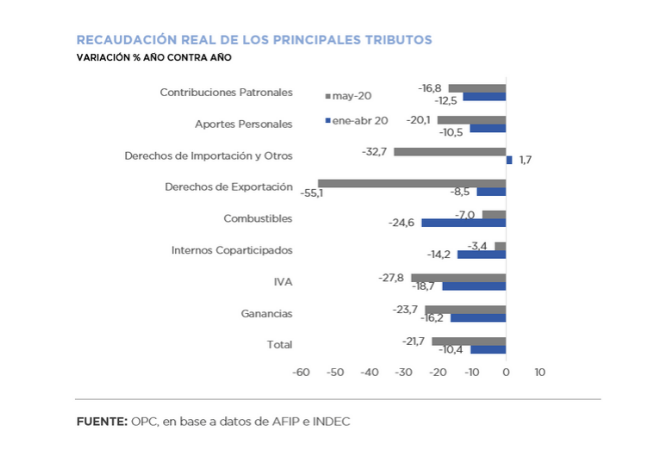

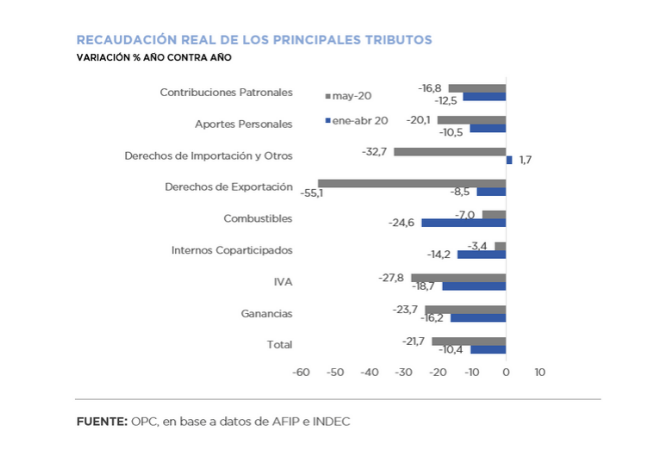

- National tax revenue reached AR$499.53 billion in May, which implied a nominal growth of 12.4% year on year (YoY), but a drop of 21.7% YoY, when adjusted for inflation.

- All taxes shrank in real terms, but the sharpest declines were in taxes related to foreign trade and VAT, with decreases of 49.1% and 27.8%, respectively. Both contractions are the sharpest since the beginning of 2002.

- The decline in tax revenue during May was explained by the adverse macroeconomic context caused by the COVID-19 pandemic and by the fiscal relief measures implemented by the national government.

- There was a record collection of the PAIS Tax (AR$11.9 billion) due to higher purchases of foreign currency.

- Resources for the first five months of the year were 16.3% below OPC’s November estimate, basically because of changes in the economic and regulatory situation.

- Tax relief measures in the framework of the pandemic in the first five months reduced the estimated revenue by AR$75.93 billion.