by Nicolas Perez | May 22, 2020 | Public Debt

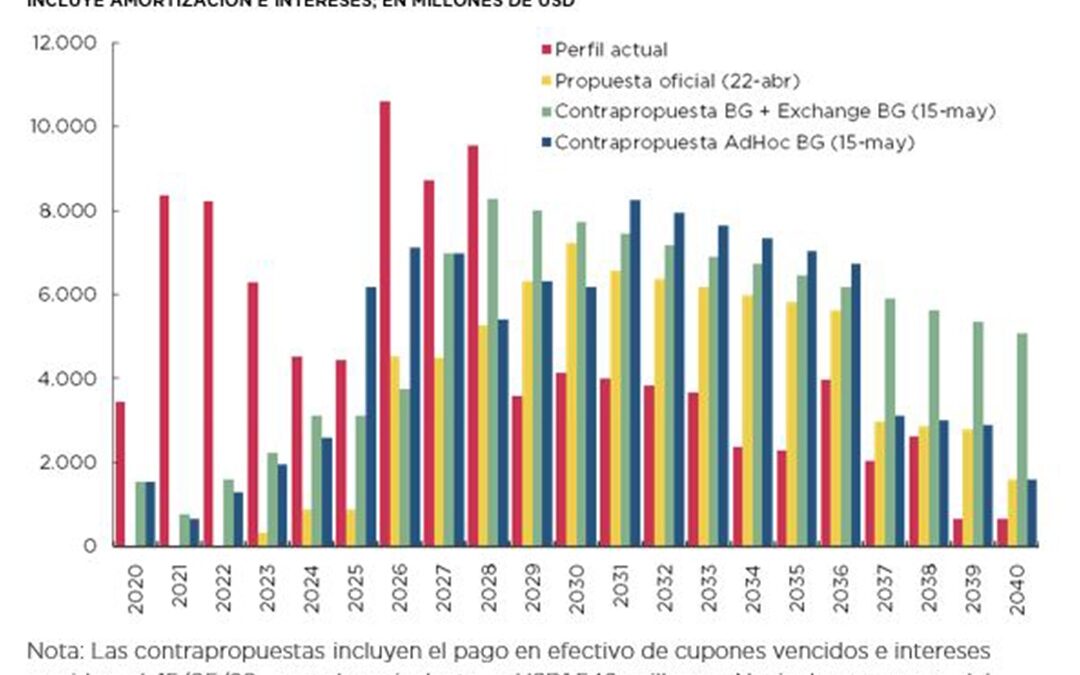

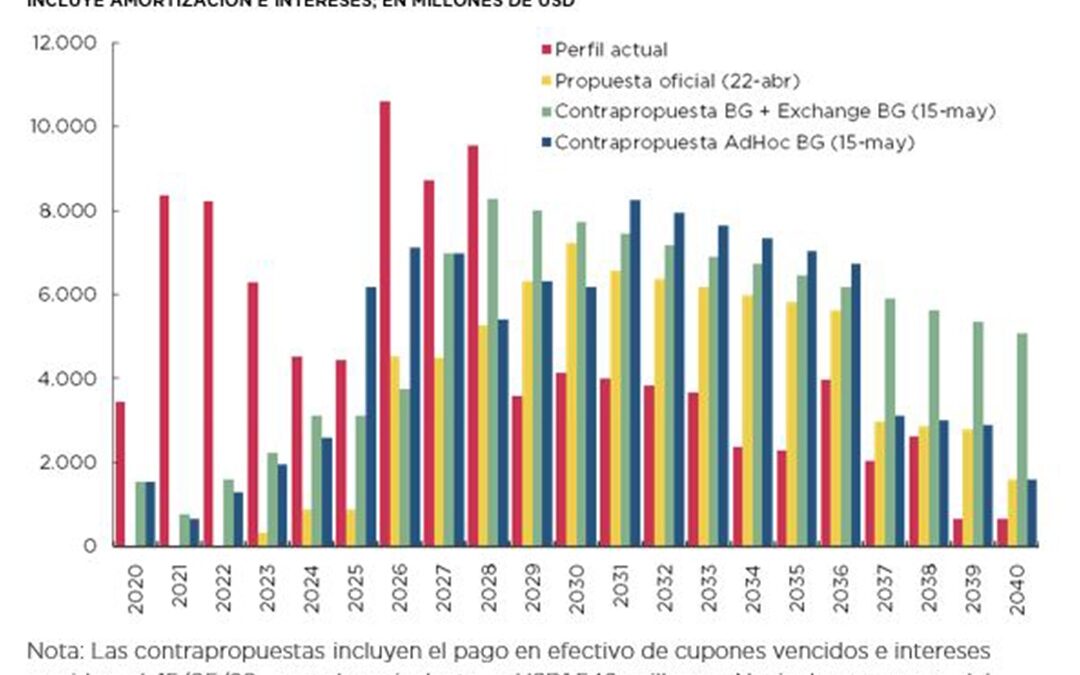

Following the proposal submitted on April 22 to restructure the bonds issued under foreign legislation, the government received counterproposals from three groups of creditors. With respect to the government proposal, the counteroffers have lower reduction of principal, higher coupons, shorter grace period and include the payment in cash of matured and accrued coupons at the time of the settlement of the transaction, in addition to other legal provisions that grant more benefits to the creditors.

The counterproposals have an estimated average value of between USD61 and USD63 for bonds in dollars. This implies a substantial increase with respect to the approximately USD40 of the government proposal. The counterproposals imply total maturities (principal + interest) of USD8.0-USD9.2 billion for the term 2020-2024 and USD46.7-USD47 billion for 2020-2030.

by Nicolas Perez | May 14, 2020 | Public Debt Operations

The government submitted its proposal for the restructuring of bonds issued under foreign legislation in April. The proposal covers twenty-one series of bonds totaling US$65.62 billion, eligible for swap into ten new securities (five denominated in dollars and five in euros), with annual payments, maturing in 2030, 2036, 2039, 2043, and 2047. The deadline for creditors to submit their consent, which was due on Friday, May 8, was extended to May 22.

Within the course of the negotiation, the payment of the interest coupons of the BIRAD 2021, 2026 and 2046 bonds (which are part of the bonds eligible for the swap) for a total amount of USD503 million, due on April 22, was not made. The grace period to make the payment runs until May 22, after which a default will occur.

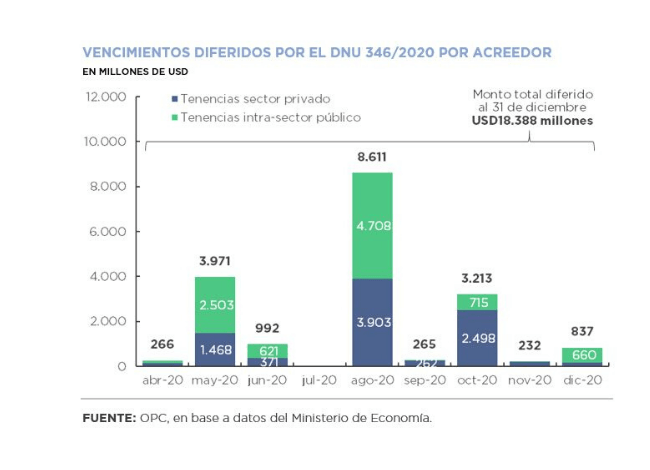

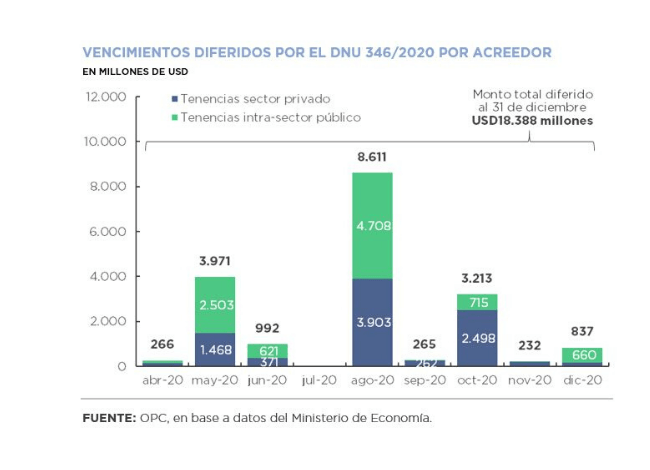

Necessity and Urgency Decree (DNU) 346/2020 postponed to December 31 the payments of interest and amortization of public debt securities in dollars issued under domestic legislation. As a result, payments of USD18.38 billion were deferred until the end of the year, USD9.01 billion of which were held by private investors.

Six auctions were held during the month, resulting in the placement of AR$435.97 billion in securities in pesos, including AR$314.07 billion as part of a swap transaction of the BONCER TC20. In addition, financing was obtained from the Central Bank through the placement of USD171 million in Bills and Temporary Advances (TA) for AR$80 billion.

by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

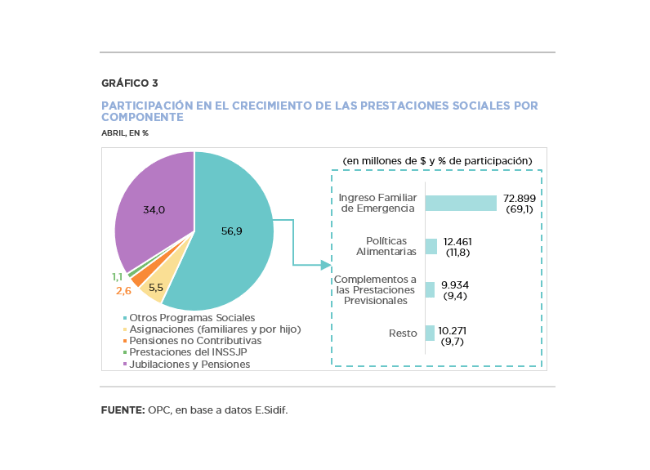

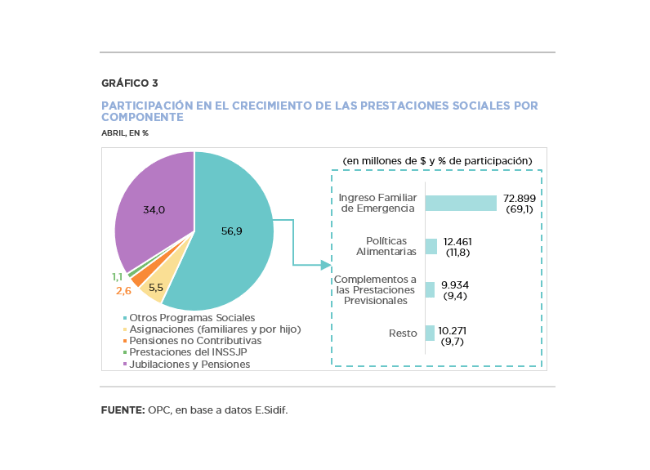

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).

by Nicolas Perez | May 11, 2020 | Tax Revenue

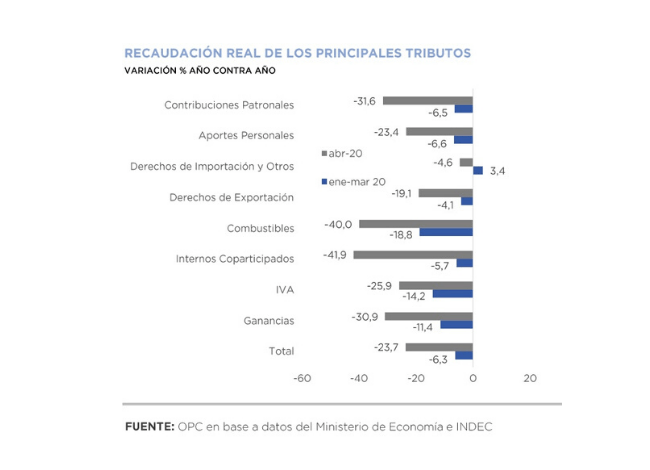

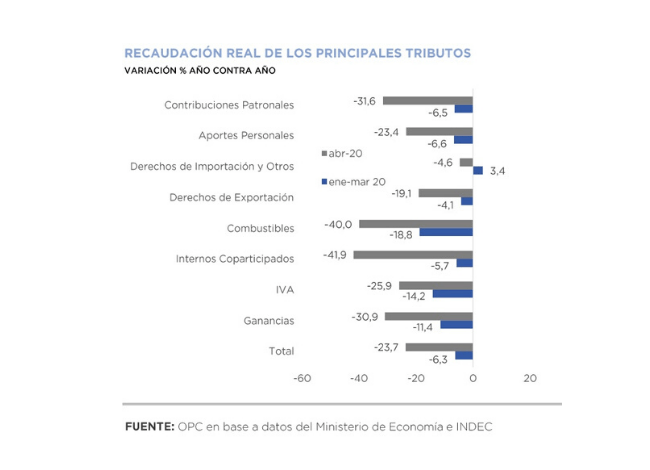

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.

by Nicolas Perez | Apr 25, 2020 | Public Debt

The Government submitted its proposal for the restructuring of bonds issued under foreign legislation. The swap proposal covers 21 series of bonds, issued under New York and UK legislation, and denominated in dollars, euros, and Swiss francs, totaling USD65.62 billion.

The proposal includes the swap of the eligible bonds for ten new bonds (five in dollars and five in euros), repayable in annual payments, maturing in 2030, 2036, 2039, 2043, and 2047.

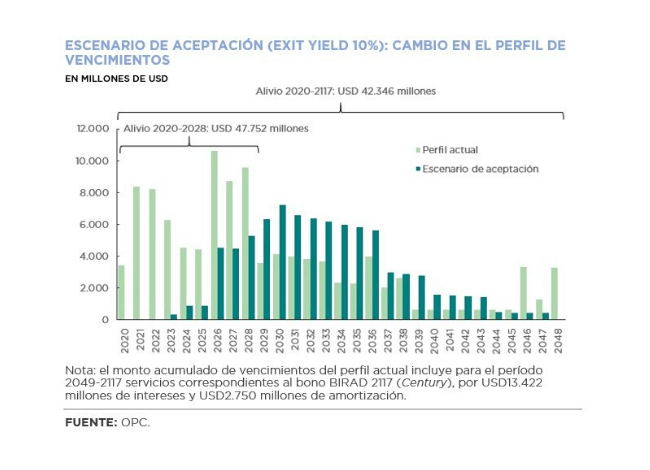

Acceptance of the offer would imply a reduction of principal of 5.4%. The stock of bonds issued under foreign legislation would be reduced by USD3.67 billion (from USD65.62 billion to USD61.95 billion).

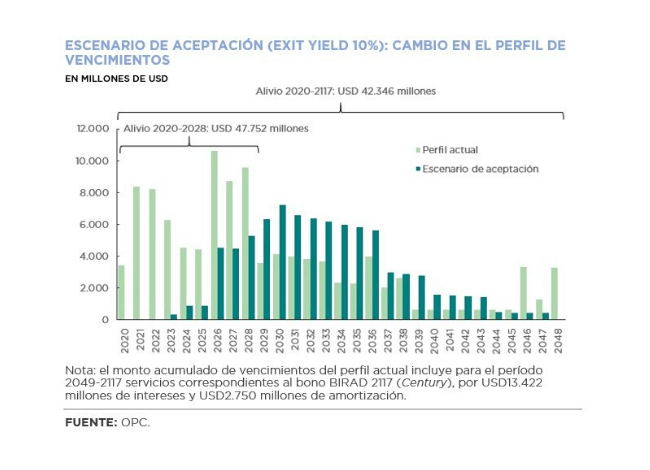

The maturity schedule would be significantly modified, due to a combination of interest coupon reduction, grace period and maturity extension. The average maturity would increase from 5.9 to 11 years.

Throughout the bonds’ life, the interest burden would be reduced by USD38.67 billion (from USD59.67 billion to USD20.99 billion). By adding the reduction of principal, a net reduction of US$42.34 billion in total servicing would be obtained. The relief would be concentrated in the first years, accumulating USD47.75 billion in the term 2020-2028.

by Nicolas Perez | Apr 15, 2020 | Budget Execution

National government accounts recorded a primary deficit of AR$84.02 billion and a financial deficit of AR$135.71 billion in March, both figures being worse than those of the same month of the previous year due to the combined effect of a drop in revenues and a rise in expenditures.

In an adverse economic context of declining production, consumption and employment, tax resources fell by 14.7% YoY in real terms and Social Security resources by 4.2% YoY

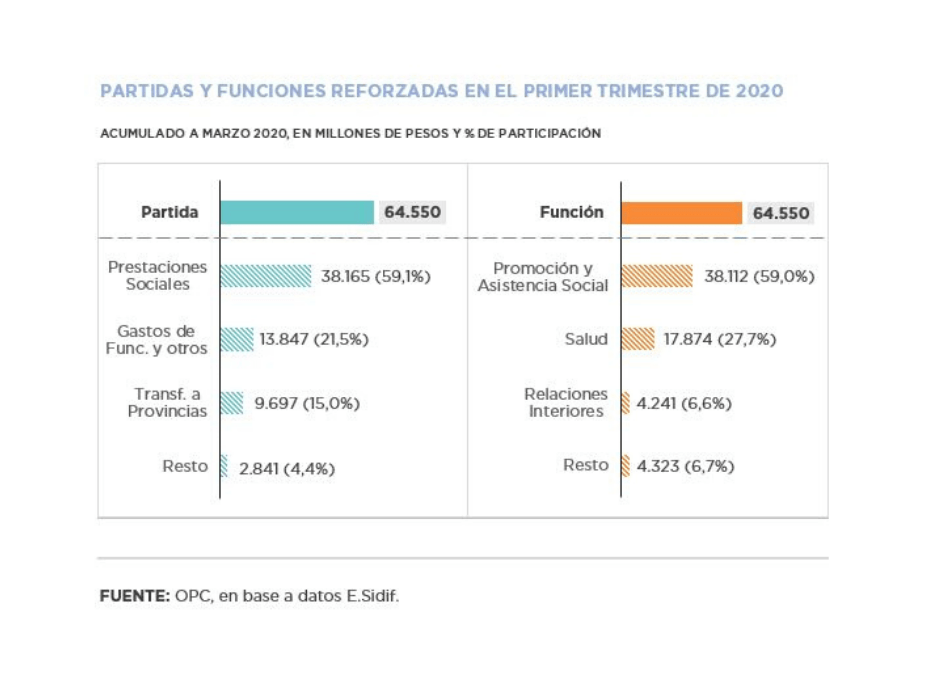

Expenditure growth was basically driven by the financial assistance to social plan beneficiaries, transfers to provinces and hospitals, in the pandemic context.

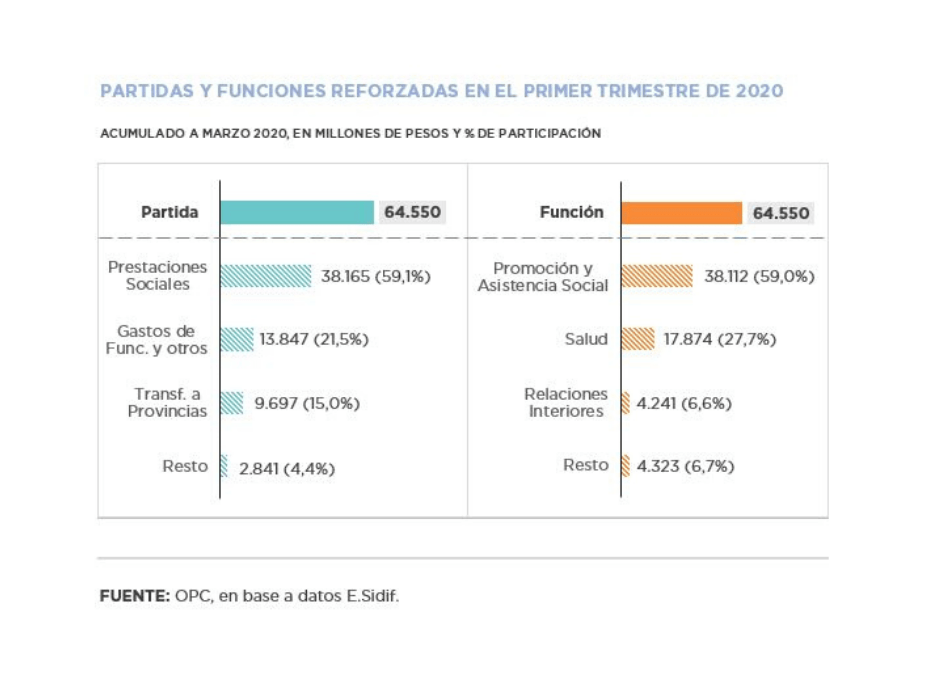

In the first quarter of the year, 26.1% of the current budget was accrued, which was increased by AR$64.55 billion. Of this increase, 51.9% was allocated to social benefits (AR$38.16 billion) through different palliatives for the health emergency.

Some social benefits, such as Food Policies, Supplement to Social Security Benefits and Employment Support, also gained relevance with execution levels above 45%.