by Nicolas Perez | Apr 15, 2020 | Public Debt Operations

Government securities and loans for US$13 billion were placed in March, 22% of which were Central Bank Temporary Advances.

Six auctions were held, resulting in the placement of AR$550.44 billion in securities in pesos. Some of the auctions included swaps of different securities (BOGATO, DUAL, BOTAPO, LECAP, LELINK, Discount Bills).

The restructuring process of bonds issued under foreign law continues, although with delays with respect to the initial schedule.

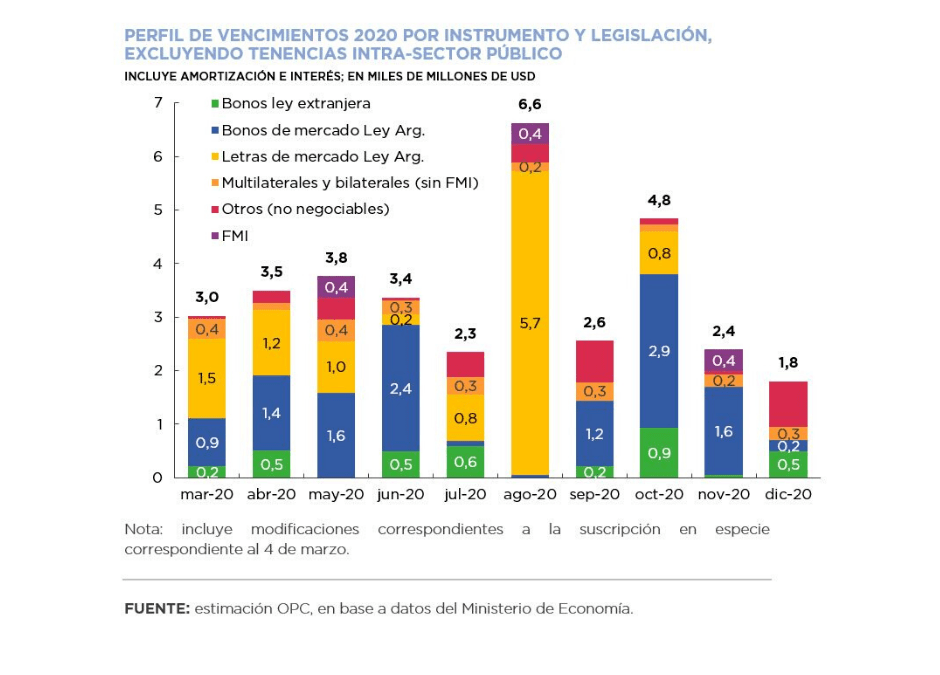

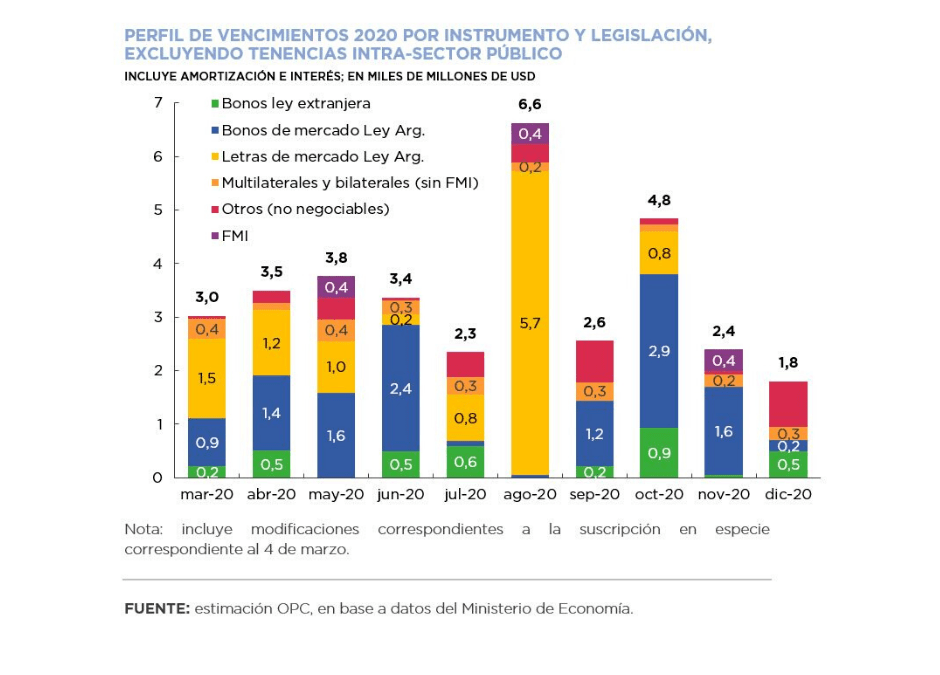

Debt payments for USD9.34 billion (USD8.1 billion in principal and USD1.24 billion in interest), which amounts to USD57.03 billion until the end of the year, are expected to be paid in April.

The Necessity and Urgency Decree (DNU) 346/2020 deferred until the end of the year the interest payments and amortizations of foreign currency securities under Argentine legislation.

Therefore, maturities for USD18.38 billion were postponed, of which USD9.01 billion belong to securities held by the private sector.

by Nicolas Perez | Apr 8, 2020 | Tax Revenue

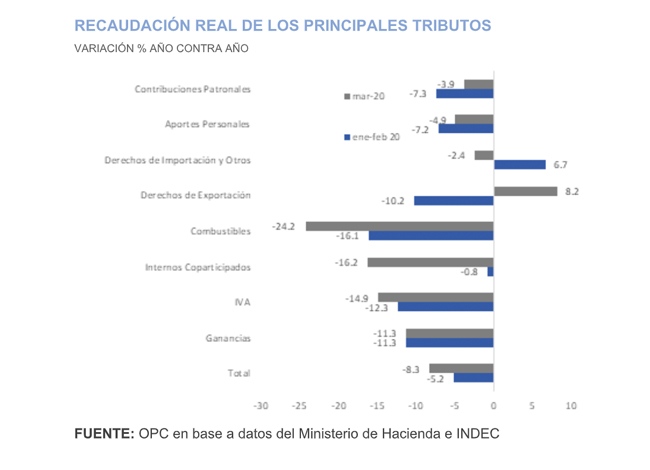

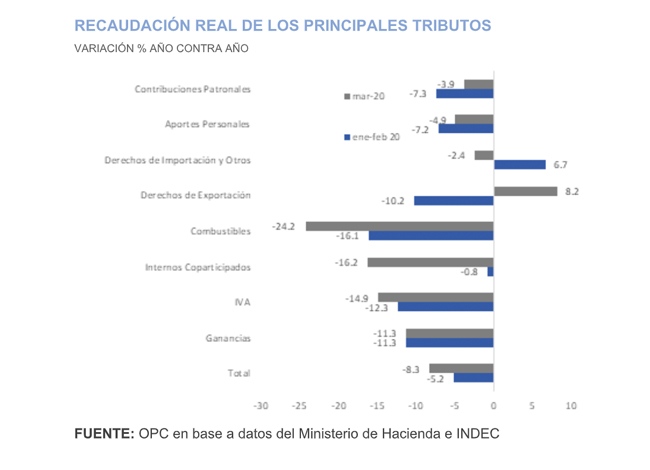

Tax revenue reached AR$443.63 billion in March, which implied a 35.3% year-on-year (YoY) growth. On the other hand, inflation-adjusted tax revenue fell by 8.3% YoY, a poorer performance than that observed in the first two months of this year.

These figures reflect the fiscal impact of the measures applied to contain the effects of the COVID-19 pandemic, although the full effects on tax revenue will be seen in the coming months.

The contraction of three tax resources strongly linked to the level of activity stands out in March: VAT DGI, Internal Taxes and Taxes on Fuels.

On the contrary, the collection of Wealth Tax (the first advance payment for assets abroad for fiscal year 2019 was received in March), of Export Duties (due to the changes in the scheme approved in December) and of the Statistics Tax (increases were introduced in May and December of last year) had better performance than the rest.

by Nicolas Perez | Mar 17, 2020 | Other Publications

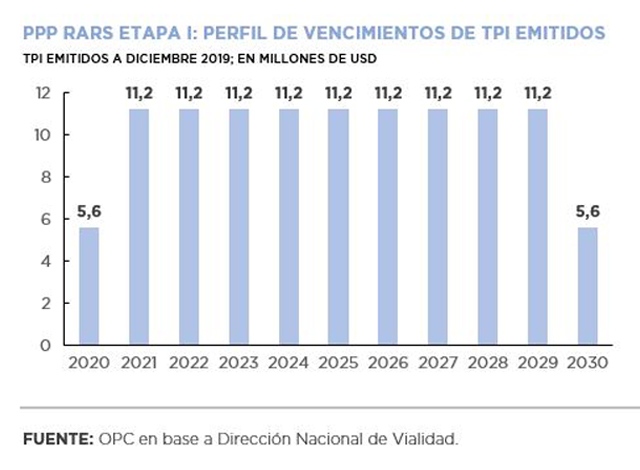

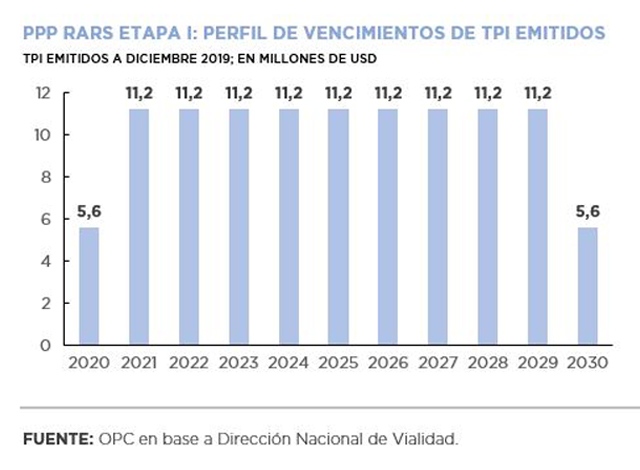

Several projects were authorized in the 2018 and 2019 Budgets under the Public Private Participation (PPP) modality for sectors such as transportation, energy, water and sewage, housing, and health.

However, in a context of high economic and financial volatility, added to the uncertainty derived from the judicial investigations of corruption in the public works sector, there has been a significant delay in the PPP program.

To date, only six road projects have been awarded for Phase I of the Network of Safe Highways and Routes (RARS). In addition, a call for tender was announced for an electricity transmission project. The rest of tenders showed no progress.

In July 2019, the contractors of the six awarded road corridors and the National Road Authority (Dirección Nacional de Vialidad) signed an addendum to the contracts that postponed schedule for the development of the main works and extended the deadline for financial closure. As of October 31, 2019, the works showed an average progress of 1.18%, generating payment obligations to the public sector in the form of Investment Securities (TPI) for USD112 million.

by Nicolas Perez | Mar 12, 2020 | Public Debt Operations

Government securities and loans for USD3.48 billion were placed in February and interest payments were made for the equivalent of USD704 million, of which USD376 million were paid to the International Monetary Fund.

After several attempts to swap and refinance the payment of the BONAR DUAL 2020 for an estimated amount of AR$109.3 billion (USD1.75 billion), the government postponed to September the payment of USD1.18 billion.

The process of debt restructuring under foreign law advanced in February, with the enactment of the Law for the Restoration of the Sustainability of the Public Debt under Foreign Law, the meetings of the Ministry of Economy with representatives of the International Monetary Fund (IMF), and a statement on the subject made by the Minister to the Chamber of Deputies.

Debt service payments of USD7.5 billion (USD6.47 billion on principal and USD1.03 billion on interest) are expected for March, which amounts to USD67.13 billion if maturities that will occur between March and December are included.

Excluding maturities within the public sector, estimated services for the term are reduced to US$34.40 billion, 49% in domestic currency.

by Nicolas Perez | Mar 11, 2020 | Budget Execution

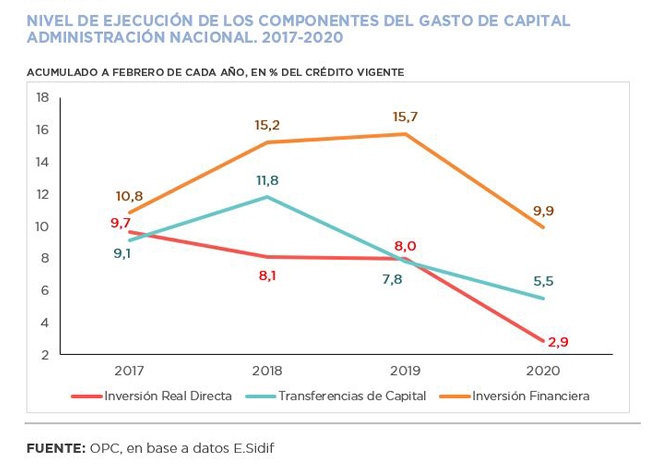

Revenues recorded a real fall of 14.7% year on year (YoY) in February, while expenditures grew by 1.3% YoY. This dynamic resulted in a financial deficit of AR$65.5 billion, increasing the unbalance of the same month of 2019, when the deficit was AR$7.04 billion.

All revenue components showed year-on-year declines below inflation, although the most pronounced was that of property income and non-tax revenues. The most significant proportional increase in expenditures was the payment of interest on debt, a situation similar to that recorded in recent months. Although to a lesser extent, social benefits were above inflation.

- The resources from the Sustainability Guarantee Fund (FGS) totaled AR$4.49 billion and showed a real contraction of 69.3% year-on-year.

- Economic subsidies had a real contraction of 55.8% year-on-year, basically due to a decrease in those allocated to the energy sector, which fell 87.5% year-on-year.

- Debt interest payments implied an outlay of AR$42.36 billion in February, registering a real increase of 137.4% YoY. Thus, this item became the expenditure component with the highest positive real variation.

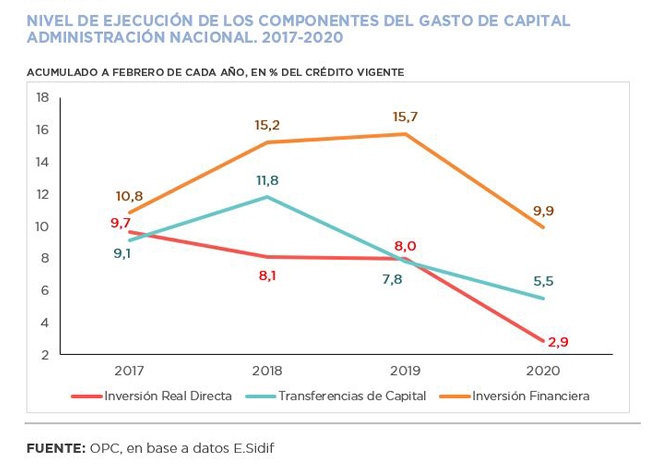

- Transfers to provinces accounted for 20.5% of the allocated budget in the first two months of the year, leading the execution level reached in the first two months of the year.

by Nicolas Perez | Mar 6, 2020 | Tax Revenue

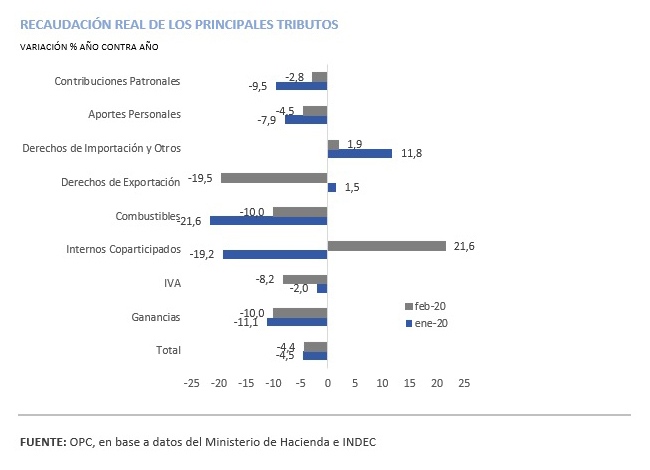

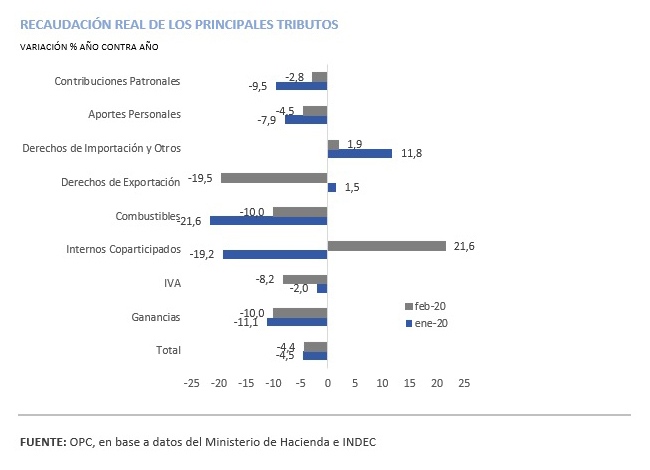

Tax revenue reached AR$471.69 billion in February, which implied a growth of 42.6% year on year (YoY). However, when adjusted for inflation, it fell by 4.4%, a performance similar to that of the previous month.

Despite last year’s exchange rate jump and the changes in the scheme of tariffs implemented in December, Export Duties grew only 19.9% year on year, the lowest increase since August 2018. This behavior is explained because exporters of the agro-industrial sector brought forward the recording of transactions to the last months of 2019, anticipating an eventual increase in the rates of this tax or eventual export quotas.

The fall in Employer Contributions slowed down due to the freezing of the amount of non-taxable income, among other regulatory changes provided for by the Social Solidarity Law, but its real fall continues to be the main contraction factor in tax revenue.

The increase in the Internal Tax rate on automobiles, provided for by the same law, boosted the collection of this tax by 21.6% in real terms.

Revenue from Fuel Taxes fell 10% in the second month of 2020 because of the partial freezing of fixed rates decided by the Executive Power, and the VAT DGI recorded its thirteenth consecutive month of decline, in line with the fall in consumption.

The PAÍS tax generated resources for AR$7.53 billion in February and reached a total of AR$10.71 billion during the year. This amount accounts for 1.1% of total revenue of the first two months of the year and 3.5% of the year-on-year growth in revenue for the same term.