by Nicolas Perez | Mar 4, 2020 | Cost Estimates

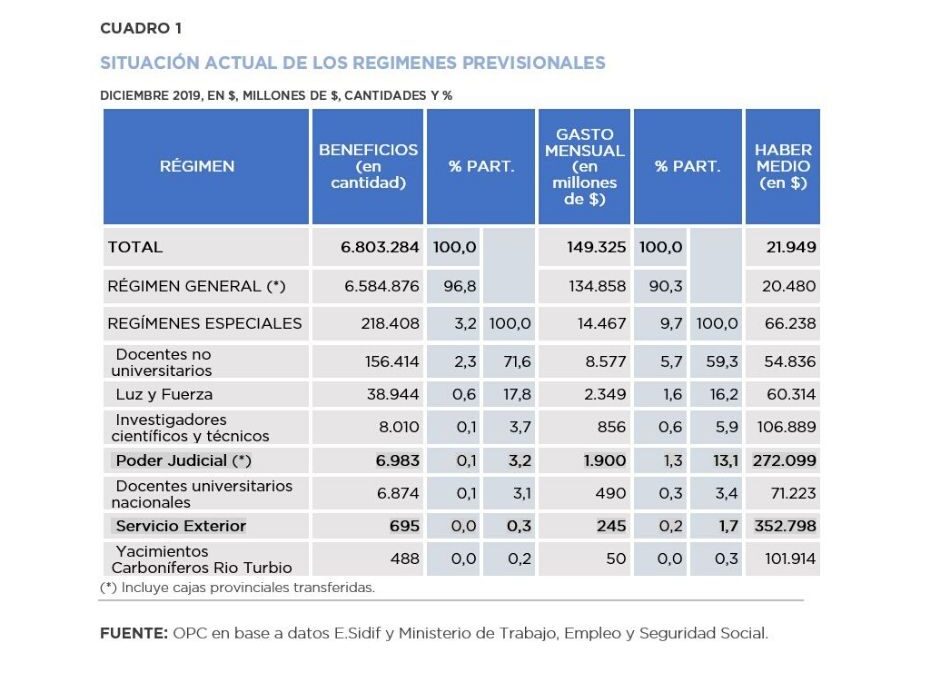

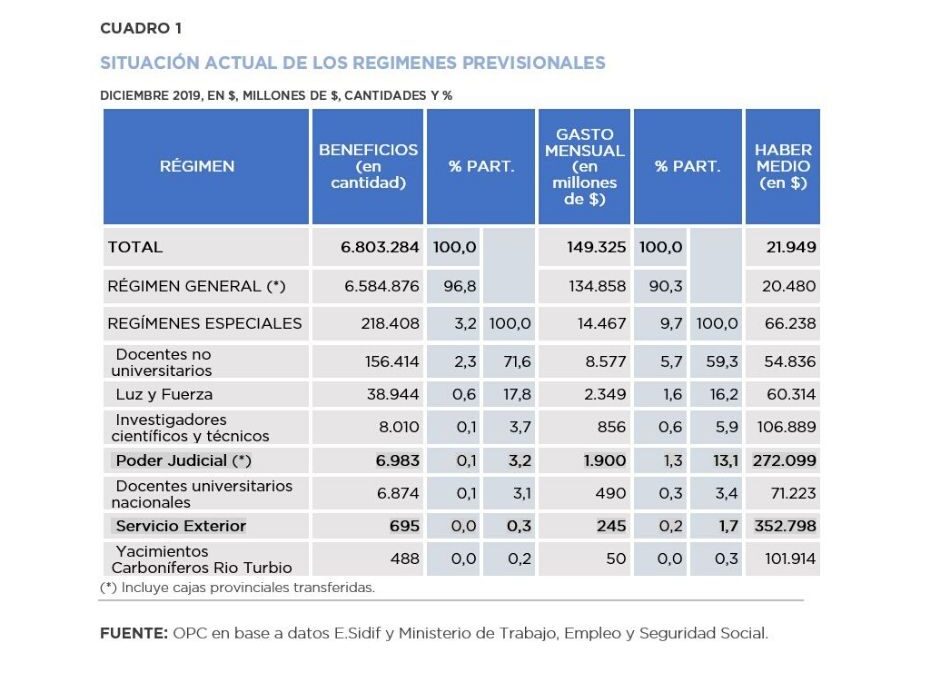

On February 14, the National Executive Branch introduced a bill on the special pension regimes for officers of the Judiciary and the Foreign Service of the Nation, which was approved by the Chamber of Deputies and is now being reviewed by the Senate.

Under current regulations, a deficit of AR$10.88 billion for the Judiciary’s pension regime and AR$2.34 billion for that of the Foreign Service is estimated for 2020.

Meanwhile, the fiscal savings derived from the amendments proposed (increase in the rates of personal contributions) are estimated at AR$3.89 billion for the Judicial Branch and AR$424 million for the Foreign Service.

by Nicolas Perez | Feb 28, 2020 | Budget Law

DNU (Necessary and Urgent Decree) 193/2020 was published on February 28 in the Official Gazette, by means of which supplementary provisions are included to the extension of the Budget in force for the fiscal year 2020, as provided by Executive Order 4/2020.

There are no changes in the level of appropriations or resources allocated by Administrative Decision 1/2020.

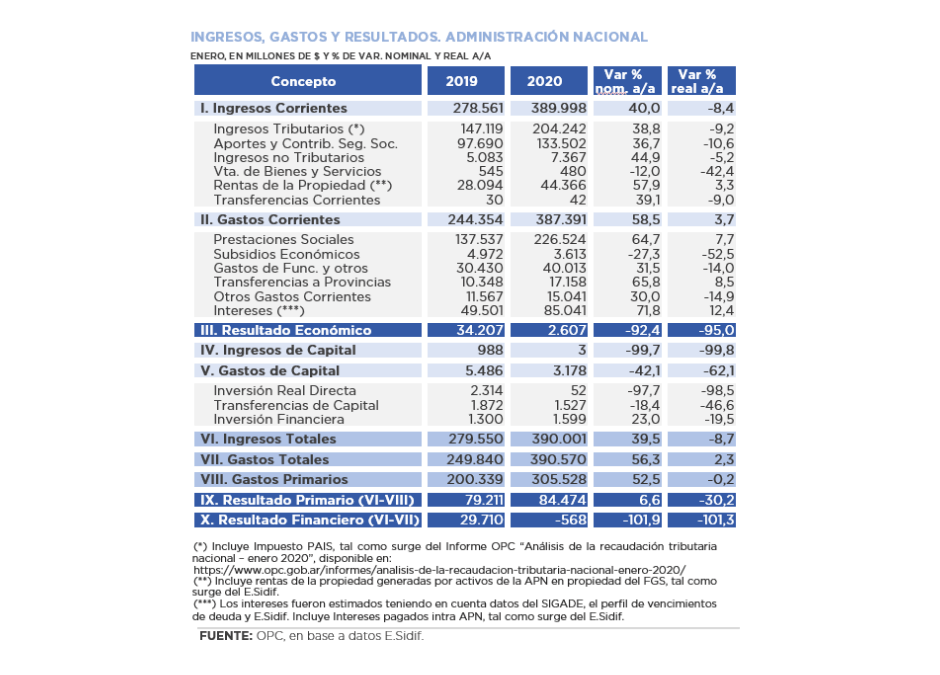

by Nicolas Perez | Feb 19, 2020 | Budget Execution

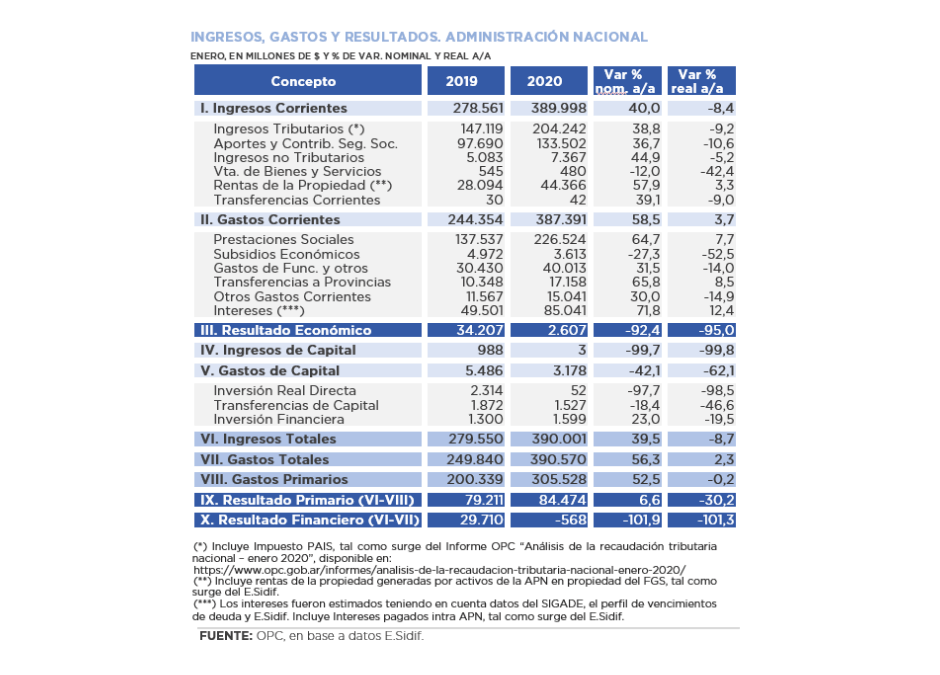

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.

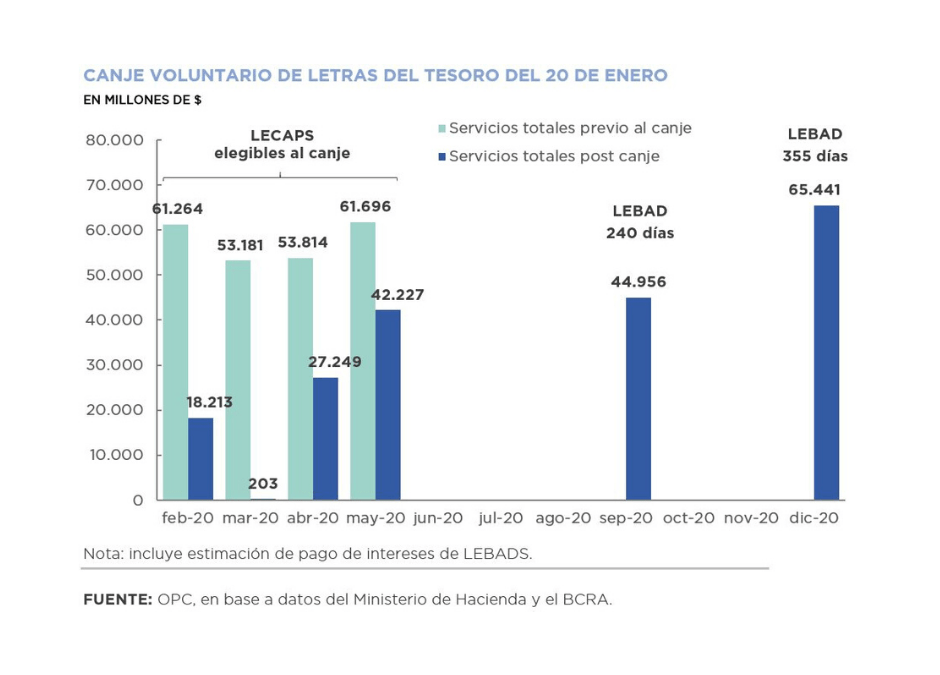

by Nicolas Perez | Feb 14, 2020 | Public Debt Operations

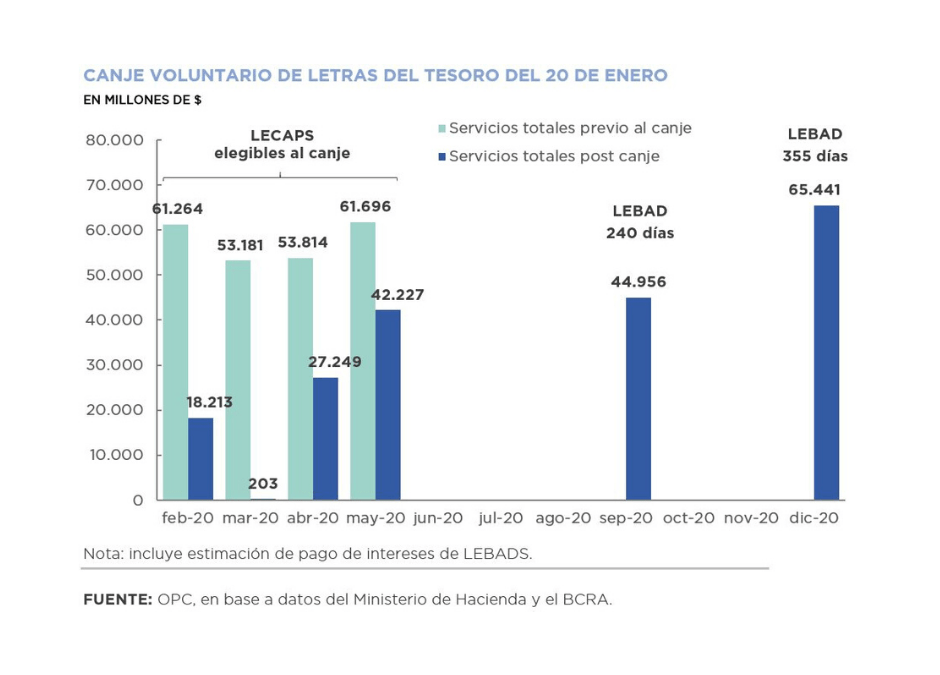

The equivalent of USD3.5 billion in securities placements and loan disbursements were recorded in January, of which USD1.26 billion were Treasury bills in dollars placed with the Central Bank.

There were also payments of Treasury bills in dollars for USD52 million and in pesos for AR$123.55 billion, as well as amortization of bonds and loans for USD715 million.

The National Executive Branch submitted to Congress a Bill to restore the sustainability of public debt issued under foreign law, which was approved on February 5. The securities covered total US$66.5 billion, about 21% of the total debt stock.

Payments of USD2.28 billion between amortizations (USD1.51 billion) and interest (USD769 million) are expected for February.

The debt service maturity schedule between February and December 2020 amounts to USD66.76 billion. Excluding maturities within the public sector, estimated services are reduced to USD34.46 billion.

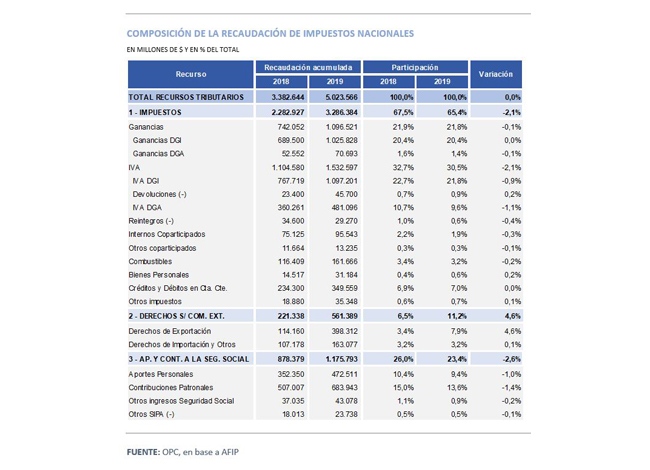

by Nicolas Perez | Feb 10, 2020 | Tax Revenue

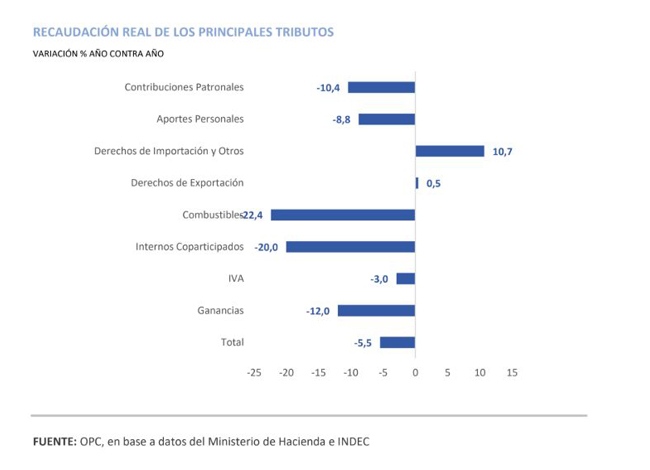

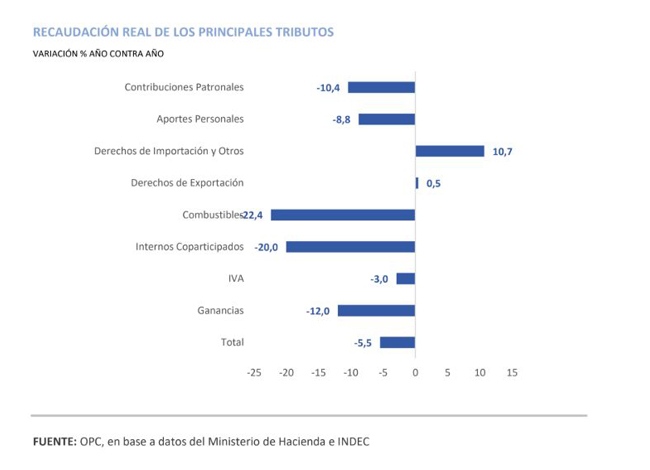

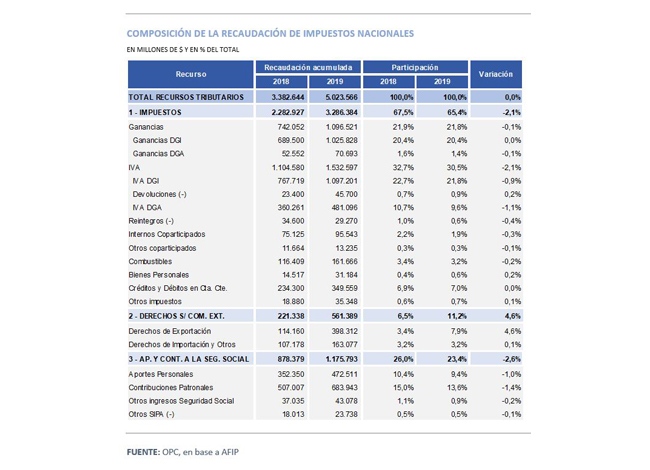

Tax revenue reached AR$527.28 billion in January, thus recording a nominal increase of 44.9% year on year (YoY) but a drop in real terms of 5.5%, the sharpest since September last year.

A major novelty was the implementation of the PAIS Tax, which contributed AR$3.18 billion, equivalent to 1.9% of the year-on-year growth of the total tax revenue. According to AFIP (Federal Administration of Public Revenue), this amount reflected transactions carried out between December 23, 2019 and the third week of January. At the official exchange rate in effect at the time, the new tax would have levied transactions for a total of approximately USD177 million.

There was also a decline in Export Duties, which in the last year were the main tax revenue. This occurred because many exporters advanced their transactions at the end of last year, anticipating that there would be regulatory reforms.

Despite the jump in the exchange rate throughout 2019, the fact that in most cases the duty rate was a fixed amount caused a significant loss in real terms.

During the first month of the year, most of the main taxes suffered a real drop. Fuel Taxes fell by 22.4% YoY, Income Tax fell by 12% YoY, VAT revenues fell by 3% YoY and Social Security Resources fell by 9.7%. This is the most contractive item and shows twenty-two months of decline.

VAT DGI has been down for twelve months, basically due to the poor behavior of consumption since 2018.

Because of regulatory changes implemented in 2018 and the rise in the exchange rate -which increased the value of assets located abroad-, Wealth Tax increased 41.7% YoY.

by Nicolas Perez | Jan 23, 2020 | Tax Revenue

Driven by the increase in Export Duties, tax revenue in December totaled AR$492.36 billion, which implied a nominal growth of 53.9% and a real growth of 0.8% year on year.

Tax revenue growth in the last month of the year was due to the higher sales reported by the soybean sector, which, fearing the imposition of quotas for sales abroad, rushed transactions: withholding taxation rose 161.7%, repeating a phenomenon that had been recorded since October.

Social Security resources, which due to the loss of wages against inflation were the main contractionary factor throughout the year, declined in real terms by 3.9% in December and 13.1% during 2019.

Towards the end of the year, a recovery of the wage bill began to be seen, which, however, lost 8 percentage points throughout the year.

In annual terms, tax revenue fell 3.6% in real terms, with the exceptions of Export Duties and Wealth Tax.

National tax revenues once again increased their burden on international trade and goods and services, to the detriment of income and property taxes, a situation that will be reinforced during 2020 after the approval of the Solidarity Law last December.