ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – YEAR 2023

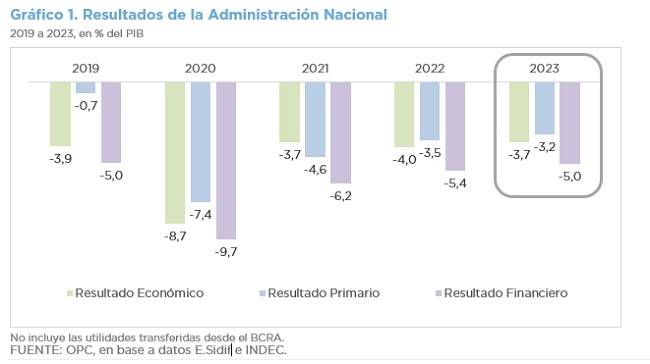

During 2023, the National Government reduced its primary deficit by 0.3 p.p. of GDP and its financial deficit by 0.4 p.p. with respect to 2022. Such dynamics was the result of a contraction of primary expenditures (-7.0%) greater than that of resources (-5.9%).

- Total resources fell by 5.9% due to lower revenues from Export Duties (-57.0% YoY) and Income Tax (-21.5% YoY), partially offset by higher revenues from PAIS Tax (+118.0% YoY) and VAT (+8.2% YoY).

- Tax revenues reached 9.4% of GDP, 1.0 p.p. below 2022.

- Non-tax revenues amounted to ARS308.651 billion from the awarding of 5G licenses, which boosted the increase (+61.2% YoY).

- The largest declines in primary expenditures were recorded in Pensions (-6.1% YoY), Family allowances (-31.1% YoY), Energy subsidies (-26.5% YoY) and Capital expenditures (-12.9% YoY).

- The purchasing power of pensions and family allowances was reduced by an average of 16.3% YoY, due to the application of the benefit adjustments under the “mobility formula”.

- There was a lower financial assistance to CAMMESA (-34.8% YoY) and to ENARSA (-2.3% YoY), within the framework of the tariff segmentation policy implemented during 2023 and a lower value of natural gas imports, due to lower quantities and prices.

- On the other hand, personnel expenses (+8.5% YoY), current transfers to provinces (+8.1% YoY) and transfers to universities (+6.2% YoY) increased.

- Current appropriations increased by 39.3% during the year: transfers to provinces and social programs had increases above this annual average. Seventeen amendments were made, including two by means of Necessity and Urgency Decrees (DNU), which accounted for 83.1% of the increase in expenditure.