by Nicolas Perez | Dec 30, 2019 | Budget Amendments

The Budget Law passed by the National Congress is amended during the year in accordance with the delegation of powers arising from the regulations in force. Within this framework, it is important to analyze such amendments to provide updated data on the budgetary dynamics throughout the fiscal year.

To this end, these periodic reports focus on the analysis of budgetary amendments made by Administrative Decisions of the Chief of Cabinet of Ministers (JGM) or by Necessity and Urgency Decrees (DNU).

by Nicolas Perez | Dec 26, 2019 | Public Debt

- Countries that have a substantial number of guarantees extended are exposed to the risk of a fiscal shock, to the extent that they do not have sufficient budgetary resources to face a massive call on guarantees.

- The exposure that the National Treasury faces in relation to guarantees provided (contractually guaranteed amount) totaled at the end of 2018 nearly USD20 billion (5.1% of GDP).

- At the end of September 2019, the residual balance of indirect debt (disbursements less accumulated amortizations) was USD9.72 billion (3.1% of gross public debt).

- The residual balance of indirect debt increased in 2017 and 2018 mainly due to the issuance of guarantee bills placed to the Trust Fund for the Development of Renewable Energies (FODER).

- The lack of consistency in publicly available information on indirect debt makes it difficult to analyze its historical evolution.

by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

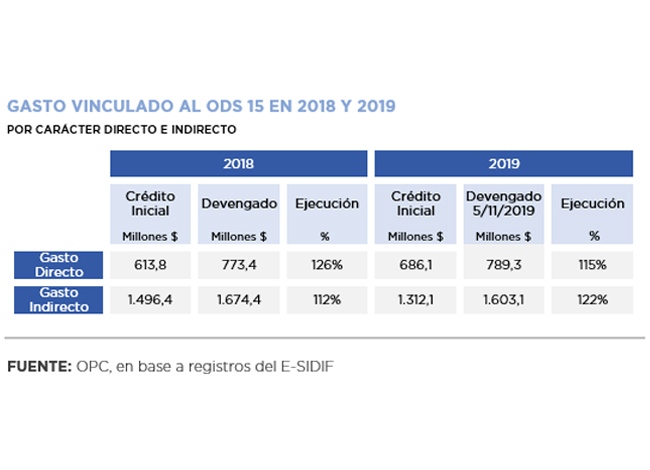

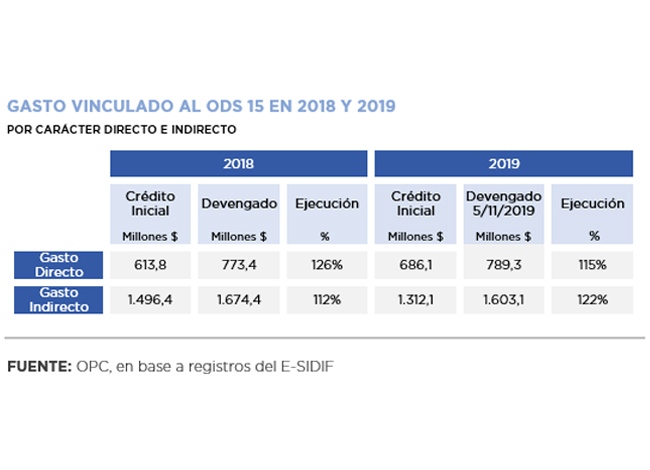

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 19, 2019 | Budget Law

The Budget Bill submitted to Congress in September 2019 estimates a public investment amount for the national government at AR$232.21 billion, with an estimated nominal increase of 19.6% year-on-year with respect to the 2019 closing projection made by the Ministry of Finance.

Public investment of the entire National Public Sector (NPS) -including government-owned companies, trust funds and other entities- would amount to AR$318.02 billion, according to the Message 2020, which is equivalent to 4.9% of the total expenditure of the NPS. This implies a drop of 10.9% year-on-year in relation to what was projected for this year.

The largest increase is in capital transfers made by the national government to other entities or jurisdictions to carry out works or purchase goods, which increased 32.4%. Real direct investment (works projects and equipment acquisition) only increased by 6.1% YoY.

The geographical breakdown of these transfers shows a concentration in the Pampas Region, basically in the Province of Buenos Aires (18%) and in the Autonomous City of Buenos Aires (10.3%), jurisdictions in which half of the real direct investment is concentrated.

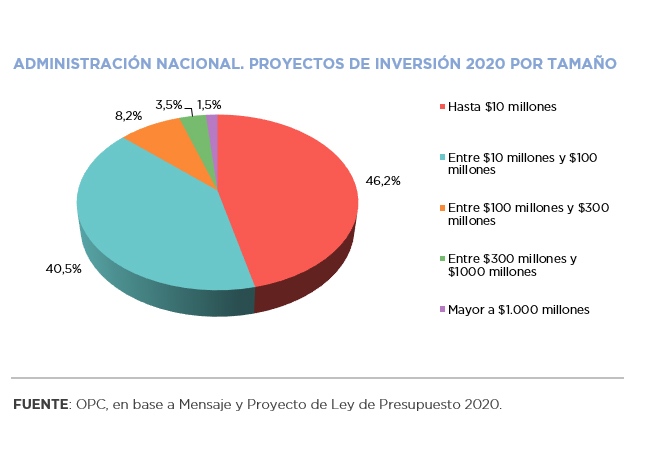

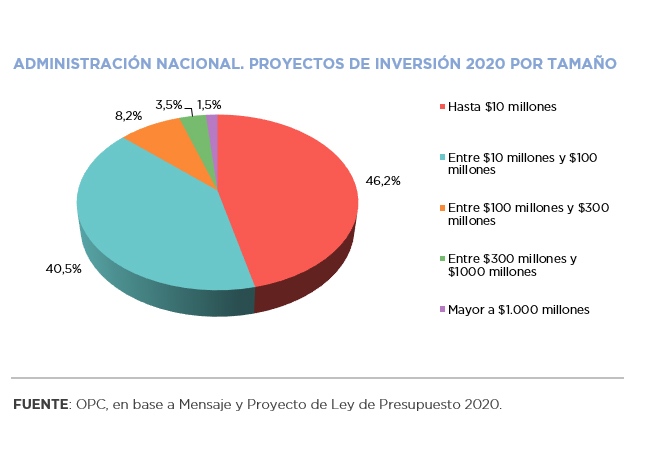

The Bill provides for the execution of 995 projects to be carried out by the national government for an average amount of AR$80 million each. The total amount shows a decline since 2011: from 0.68% of GDP in 2011 to 0.25% in 2020.

The largest amounts are allocated to railway works, such as the improvement of the Belgrano Cargas Railway, which involves several jurisdictions and would demand AR$5 billion, and to the laying of highways, including Route 19 connecting San Francisco with Córdoba or Route 8 connecting Pilar with Pergamino.

In the rest of the Public Sector, the main direct investments would be carried out by government-owned companies: Nucleoeléctrica Argentina S.A. (36.9% of the total), and Integración Energética Argentina S.A. – Ex- ENARSA (30.3%).

by Nicolas Perez | Dec 12, 2019 | Tax Policy and Fiscal Federalism

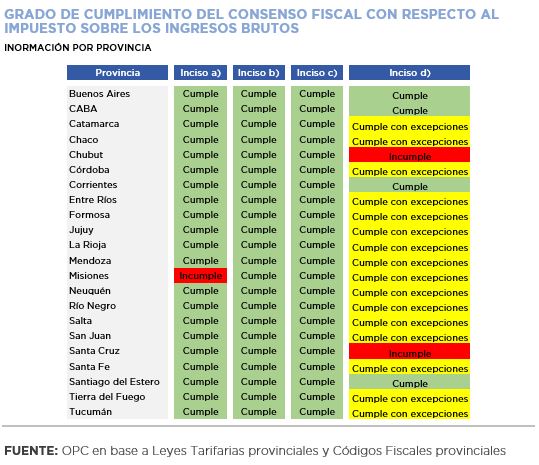

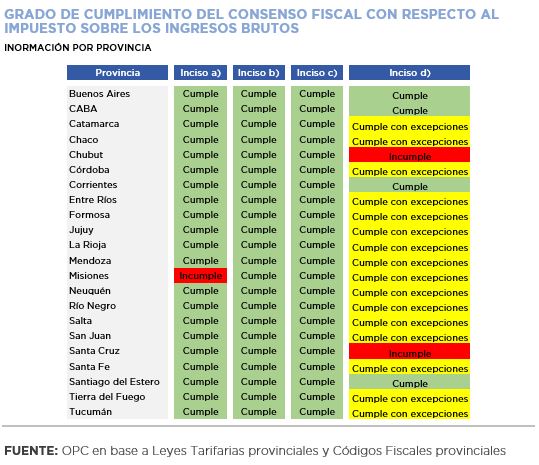

Although with variations by jurisdictions, progress was made in the amendments to the provincial taxes included in the 2017 Fiscal Consensus.

There is a high level of compliance with the commitments assumed to lighten the burden of Gross Income Tax and to homogenize it.

All provinces involved made progress in excluding exports from the scope of this tax which, however, in some jurisdictions a higher rate was applied to certain commercial activities.

There was also a high level of compliance with the commitments related to the Stamp Tax, which eliminates differentiated treatments, prevents the raising of rates for certain activities and foresees a reduction schedule, which was finally suspended.

Tax revenue in the committed provinces did not have a significantly different dynamic. Gross Income tax rose 10 percentage points above the nominal growth recorded in the jurisdictions that did not adhere, but Stamps and Property Taxes, on the other hand, grew less.

by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

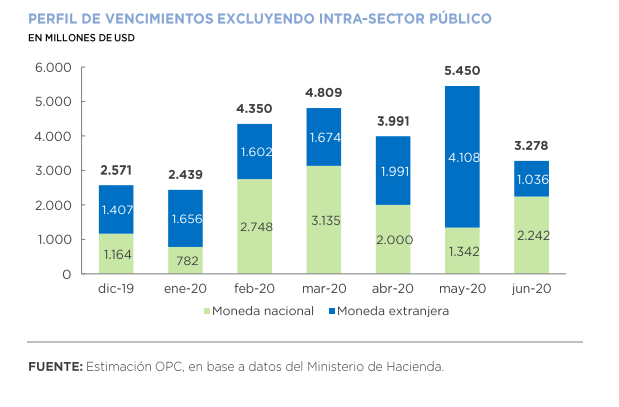

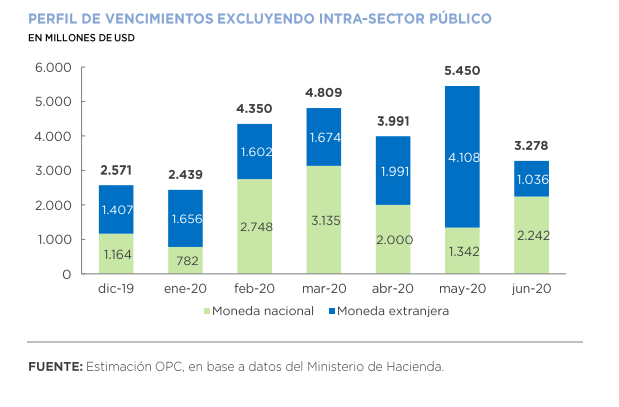

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.