by Nicolas Perez | Dec 11, 2019 | Budget Execution

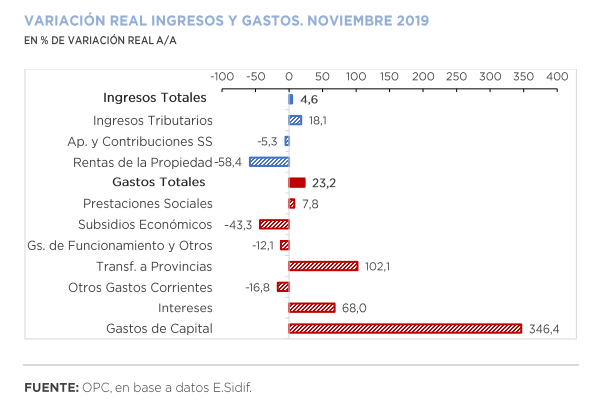

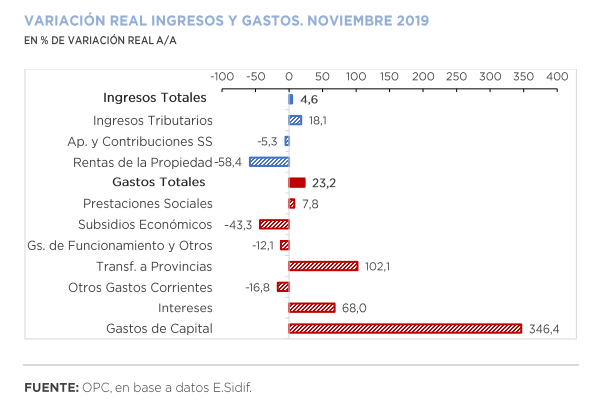

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Dec 6, 2019 | Tax Revenue

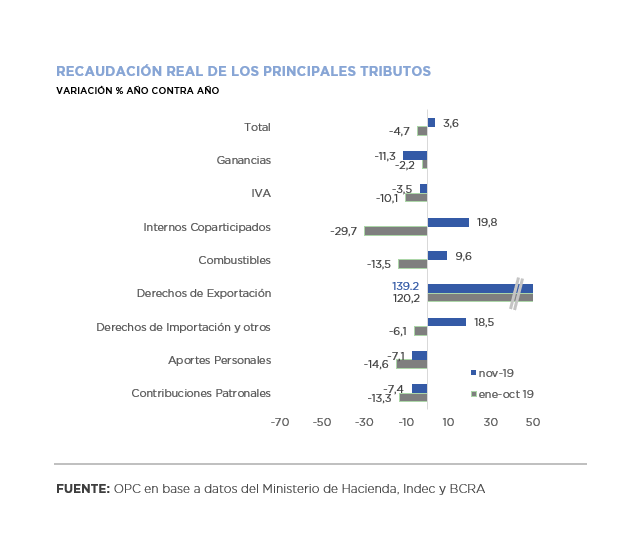

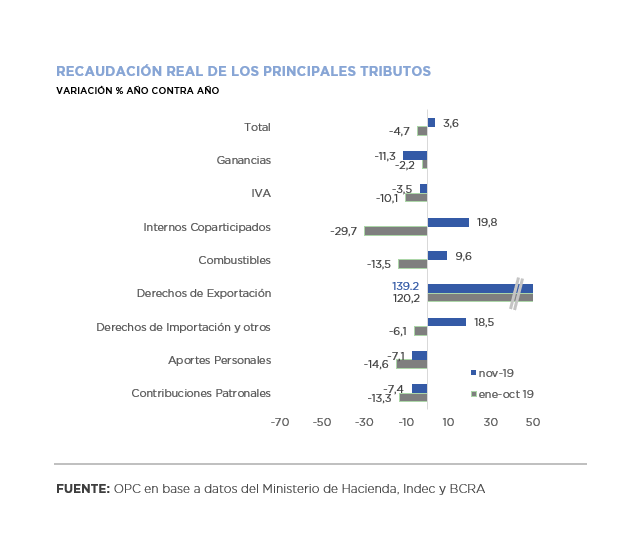

November tax revenue totaled AR$474.87 billion, which implied a nominal growth of 58.2% year-on-year (YoY) and a real growth of 3.6%, the best performance since May 2018.

This increase was basically explained by higher revenues from Export Duties that jumped 139.2% compared to the same month of the previous year. Given the possibility of an increase in this tax, the agro-export sector accelerated the pace of settlements.

The performance of the Value Added Tax (VAT) also improved, despite the current reduction in the rate on some commodities.

On the other hand, Social Security contributions fell by 7% in real terms, although in November there was a slight improvement in the wage bill, which had been falling in relation to inflation during the year.

In the year-on-year comparison, the main factor explaining the increase in nominal revenues was VAT, which contributed 26.2% of the additional resources.

The largest increase was recorded in Wealth Tax, mainly due to regulatory amendments. The exchange rate hike also had an impact, which affected the values of assets located abroad, as well as the taxable base on foreign trade.

In the eleven months of the year, there has been an accumulated real decrease in tax resources of 4.0% YoY.

by Nicolas Perez | Dec 5, 2019 | Employment and Social Security

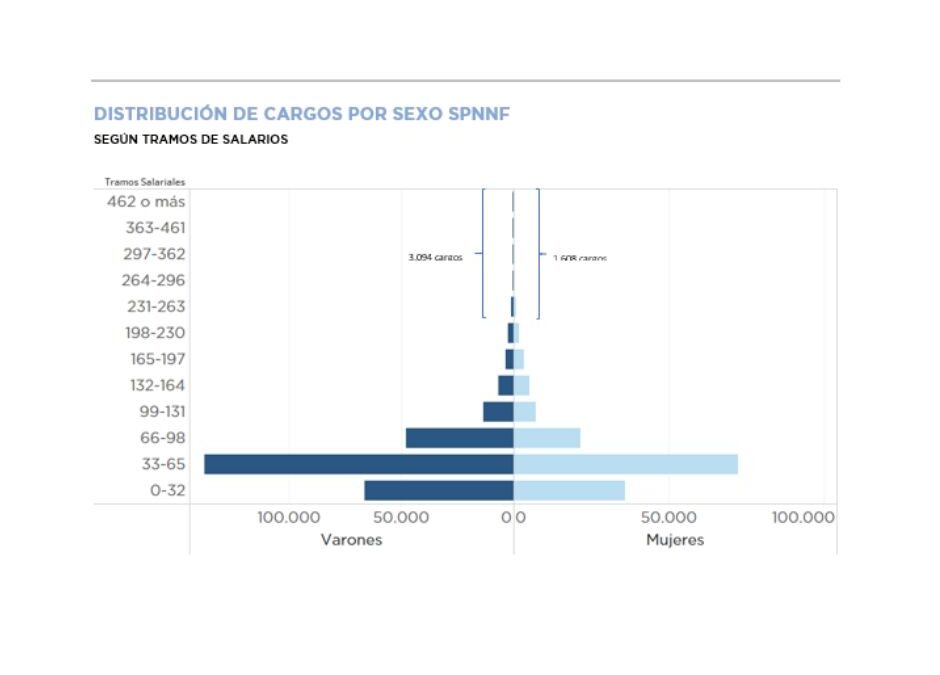

The OPC analysis consists of a description as of April 30, 2019 of government employment in the jurisdictions and entities that make up the National Public Administration (APN), government-owned companies and other entities of the National Non-Financial Public Sector (SPNNF), excluding universities.

This is a universe of 449,797 positions, of which 385,189 belong to APN, 34,239 to Other Entities (non-business but financially autonomous public organizations) and 30,319 to the thirteen government-owned companies for which information is available. Eighty-nine percent are employed by the National Executive Branch. In addition, there are about twenty legal regimes and more than 120 specific scales with different levels of employment.

From a historical viewpoint, while between 2010 and 2015 a sustained growth of employment was identified (with an increase of more than 20% in that term); between 2016 and 2018 the overall trend has been downward, exhibiting a decrease of close to 8% in the National Executive Branch.

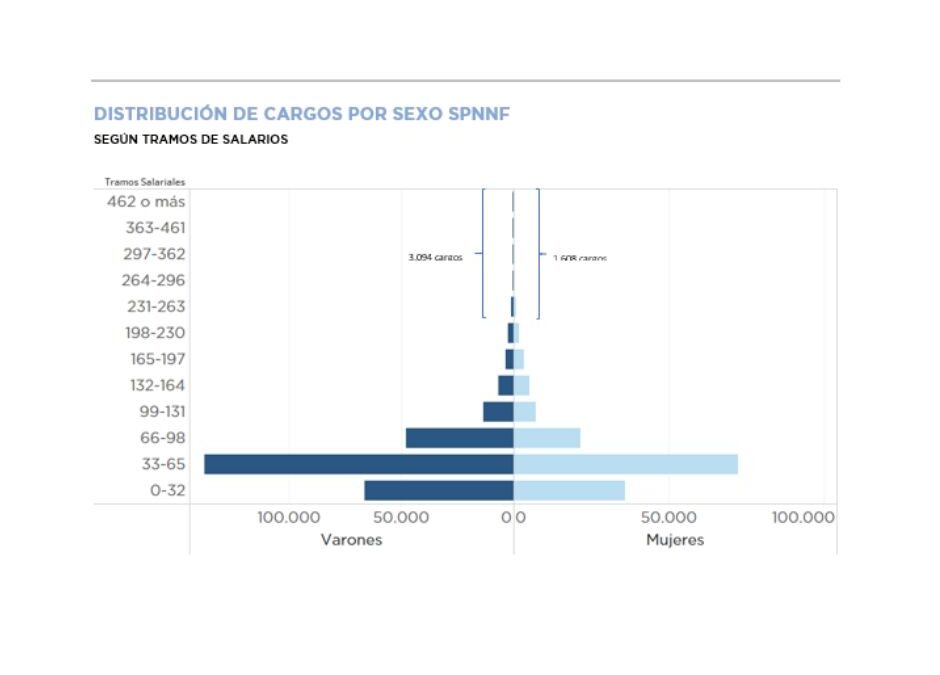

Eighty percent comprise the permanent staff, 26% have a university degree -predominantly positioned in decentralized agencies- and the employment is concentrated in two age groups: 20-34 years old and 35-49 years old, both being over 75% of the total.

The average gross general salary in this universe is AR$60,748, but most of the employment is below this level (64.2%). In fact, the median of the distribution is AR$48,463. Average salaries are higher in companies and decentralized organizations and contrary to the general level, the Foreign Service of the Nation, the Judiciary and Collective Labor Agreements have a high percentage of their staff with average salaries above AR$66,000.

There is an inverse effect between the level of employment and the average salary. Those regimes with a higher level of employment have average salaries below the general average and those with lower relative employment have salaries above the general average.

An analysis by sex shows that 35.0% of total employment are women and 65.0% are men, a proportion affected by the high relative weight of the armed and security forces. The average salary of women is lower than that of men at all levels of education and, in line with this bias, there is greater representation of men in the higher income segments.

by Nicolas Perez | Nov 28, 2019 | Budget Law

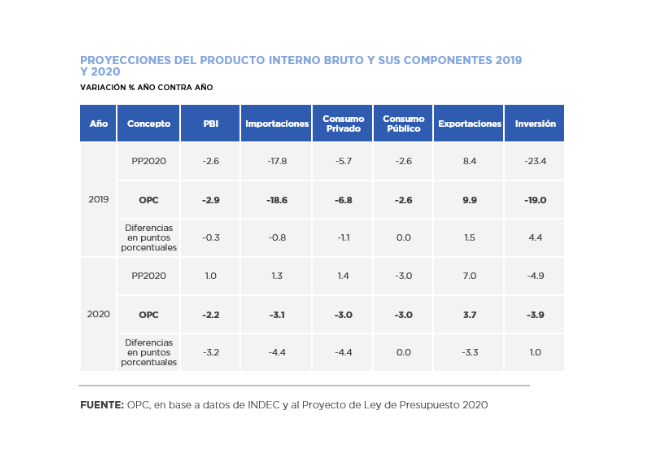

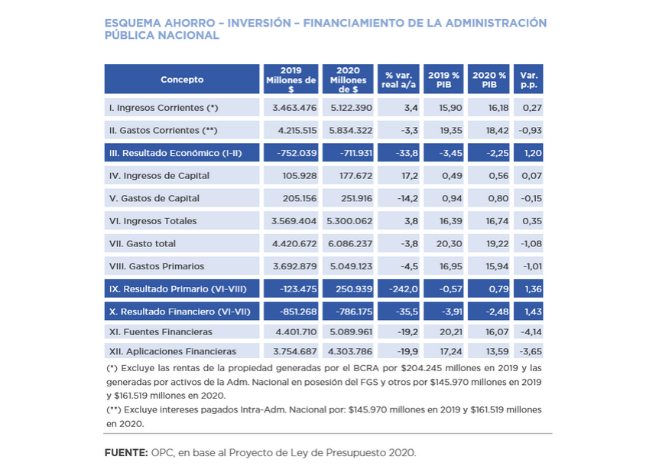

The Argentine Congressional Budget Office (OPC) made its own projections for next fiscal year on the assumption that there will be no changes in the current policy.

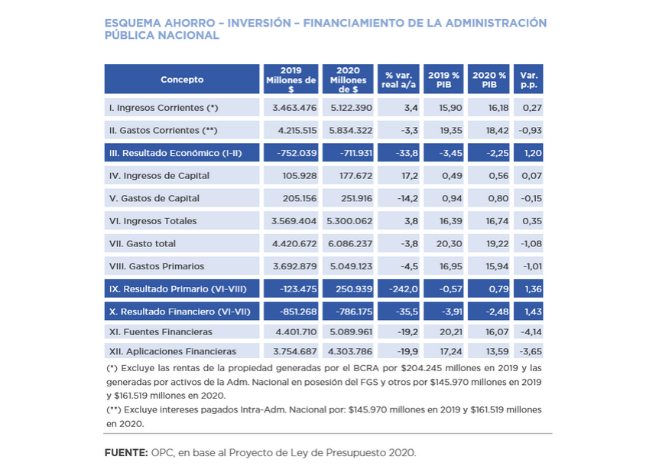

The OPC estimates for 2020 a primary deficit of AR$154.91 billion (-0.5% of GDP), which contrasts with the surplus of AR$250.93 billion (+0.8% of GDP) projected by the 2020 Budget Bill. The financial deficit will reach AR$1.36 trillion (-4.3% of GDP), higher than that projected in the Budget Bill of AR$786.17 billion (-2.5% of GDP).

These discrepancies are the result of different macroeconomic assumptions, with an impact on the effective level of resources and their allocation between national and provincial jurisdictions.

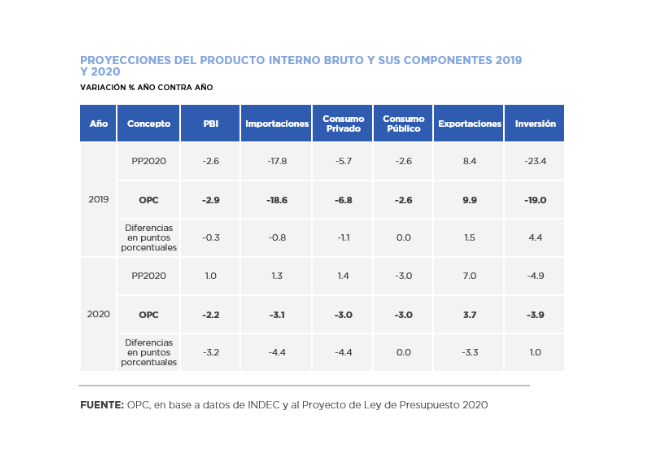

- The OPC forecasts a 2.9% drop in the Gross Domestic Product for 2019 and a 2.2% decline for next year, which contrasts with the 1% increase included in the Bill under parliamentary analysis.

- The nominal exchange rate and inflation rate for 2019 are projected to be higher than those included in the Executive Branch’s proposal. The annual average dollar rate is expected to be AR$69.3 and the Consumer Price Index 46.4%.

- Total tax resources are expected to fall in real terms in both 2019 and 2020, although at different rates. While for this year a reduction of 4.2% YoY is projected, in 2020 the estimated contraction would accelerate to 5.8% YoY.

- The decline in terms of GDP of Social Security Contributions due to the increase in the non-taxable income for employer contributions, which implies fewer resources for the national government, stands out.

- The loss of momentum of Export Duties (main factor for the growth of tax revenue during 2019), and the regulatory amendments to Income Tax and Employer’s Contributions explain part of the setback.

- The first half of the year will account for 73% of total debt payments and gross financing needs for next year are estimated at the equivalent of 17.8% of GDP.

- The adjustment based on the mobility formula would be 51.30% throughout 2020 and would be applied to pensions, family allowances, AUH (Universal Child Allowance), non-contributory pensions and other social benefits.

- The projection of personnel expenditures considers applying the salary policy implemented during 2019.

- The amount projected for electricity subsidies is based on the policy defined in the Budget Bill under which users assume 63% of the wholesale cost of electricity generation, and as for natural gas, import volumes and prices are similar to those of 2019.

by Nicolas Perez | Nov 26, 2019 | Budget Law

The projected Public Social Spending (PSS) for 2020 amounts to AR$3.9 trillion, which implies a contraction of 0.6% year-on-year in real terms with respect to what was estimated for 2019. But that itself implies an increase of 5.9 percentage points (p.p.) with respect to the average of the years 2015-2018 and 0.9 p.p. with respect to that projected for 2019.

PSS accounts for 12.3% of GDP estimated by the Budget Bill, 0.3 p.p. less than projected for 2019 and 1.5 p.p. less than recorded in 2018. The PSS projected for 2020 is equivalent to 62.5% of total spending and 77.4% of primary spending, levels almost equivalent to those projected for 2019.

Social Security represents 80% of GPS and its growing significance is because 90% of it is subject to the mobility index. This item marks the historic high since 1993. According to official macroeconomic assumptions, pensions will recover 1.7% in real terms, against a drop in the rest of benefits.

All social spending functions will register negative real indicators by 2020, except for Social Security, which will increase 0.5% YoY. The functions that fall the most are Housing and Urban Development, and Drinking Water and Sewerage, with real variations of 21.3% YoY and 16.0% YoY, respectively.

by Nicolas Perez | Nov 19, 2019 | Budget Law

The purpose of this report is to provide a comprehensive description of the basic content of the National Government Budget Bill for 2020, submitted by the National Executive Power in mid-September.

The existing economic and financial volatility, the pending implementation of the agreement with the IMF and the need for a public debt rescheduling process, have determined important adjustments in the macroeconomic projections made. In addition, the outcome of the election process that led to a change of political authorities as of December 10 and, therefore, a very likely change of priorities in the allocation of public resources, are issues that relativize the analysis made in this report. However, it is essential to carry it out, since it will be very useful to understand the constraints in the national budget caused by previously adopted regulations, as well as to provide elements of judgment in the process of discussion and legislative approval.