by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

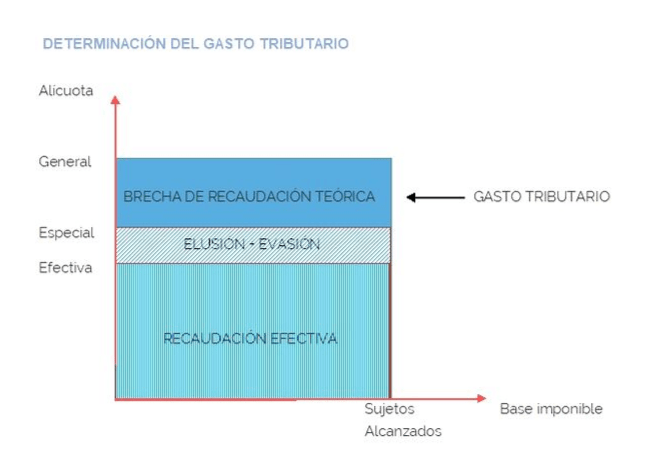

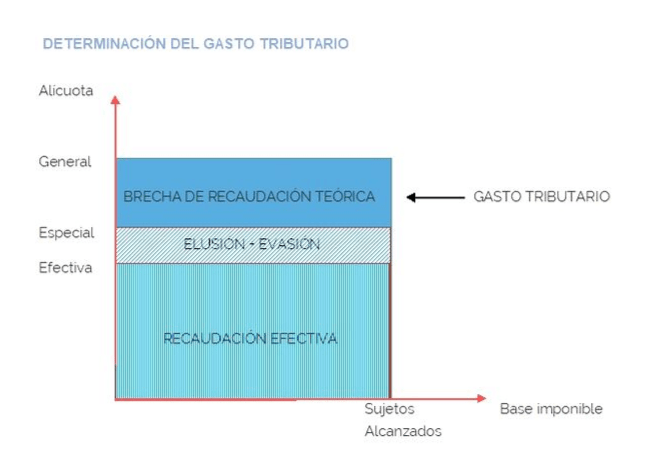

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.

by Nicolas Perez | Oct 2, 2019 | Gender

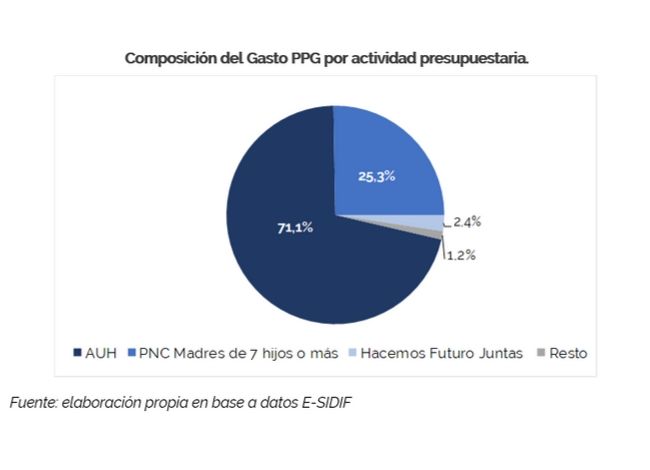

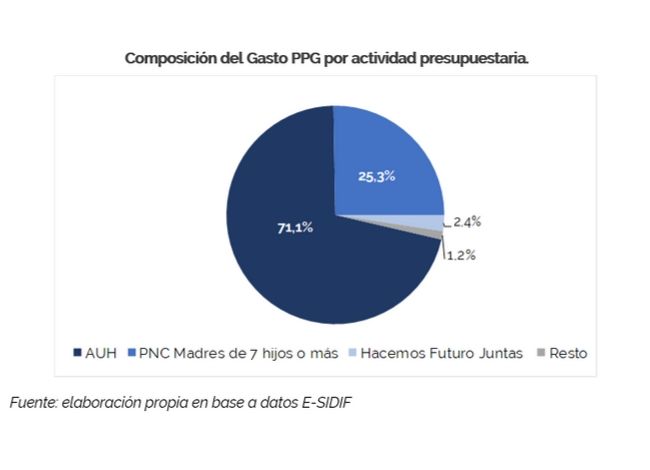

Progress in the preparation of a Gender Responsive Budget (GRB) in the country is focused on labeling budgetary activities with an impact on the gender gap from their design, without considering others that may also have that impact, although they have not been conceived for that purpose.

This report analyzes the implementation of activities with a gender perspective from January to August 2019: twenty-six budgetary actions that represent 3.7% of the public expenditure budgeted for the current fiscal year.

Expenditure is focused on initiatives that seek to strengthen the economic autonomy of women through direct monetary transfers and that privilege the mother status of the recipients. In fact, the Universal Child Allowance for Social Protection (AUH) represents more than 70% of GRB expenditure.

These activities show a lower level of implementation than total expenditure (56.5% compared to 62.9%) and great disparity among them.

The Gender Awareness, Visibility and Training dimension shows the highest level of execution (64.9%) as opposed to the Gender Violence and Sexual and Reproductive Health dimensions, whose accrued expenditure represented less than 10% for the first and little more than a third of the allocated appropriation for the second.

by Nicolas Perez | Sep 23, 2019 | Sustainable Development Goals

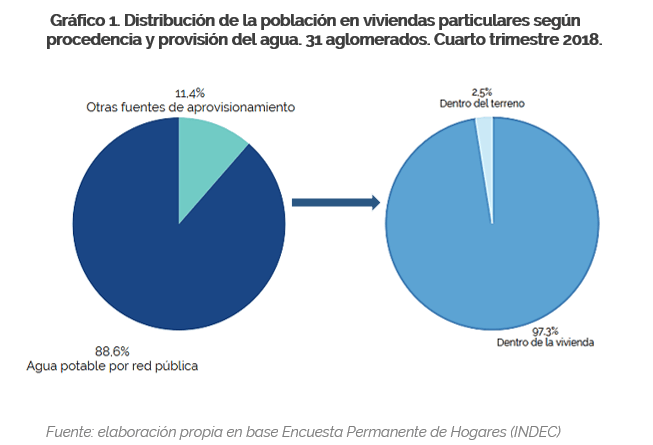

This is the first in a series of reports to be prepared by the Argentine Congressional Budget Office (OPC) to analyze Argentina’s progress in achieving the United Nations Sustainable Development Goals from a budgetary perspective. As there is no international consensus on the SDG budget evaluation methodology, the OPC used its own tool.

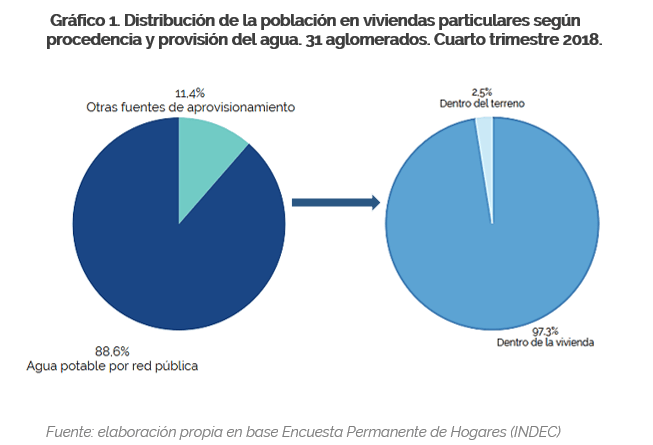

The focus is on SDG 6, Clean Water and Sanitation, and SDG 7, Affordable and Clean Energy. In accordance with the provisions of the current year’s Budget Law, the actions to be carried out by Argentina related to the SDG 6 will require AR$25.48 billion, while those related to energy issues have an initial appropriation of AR$212.01 billion.

By 2023, Argentina has committed to universal access to drinking water service through the public network, which would imply, according to INDEC population projections, the addition of 9.5 million people. As for the sewage network, the commitment to universalization was set for the year 2030, bringing the number of citizens to be included up to that year to 26.4 million.

Argentina adopted three targets linked to SDG 7. That of “universalizing access to affordable, reliable and modern energy services” implies meager increases in coverage, since according to the latest available data 98.8% of households had access to electricity and 97.2% to clean fuels for cooking; that of “significantly increasing the proportion of renewable energy” implies using 10.9% of green sources to supply total consumption this year; the most challenging is to increase energy efficiency (total energy vs. GDP), changing the trend shown in recent years.

by Nicolas Perez | Sep 12, 2019 | Public Debt Operations

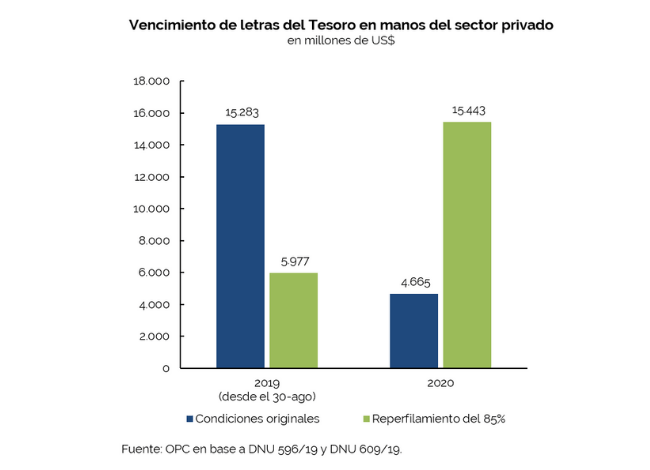

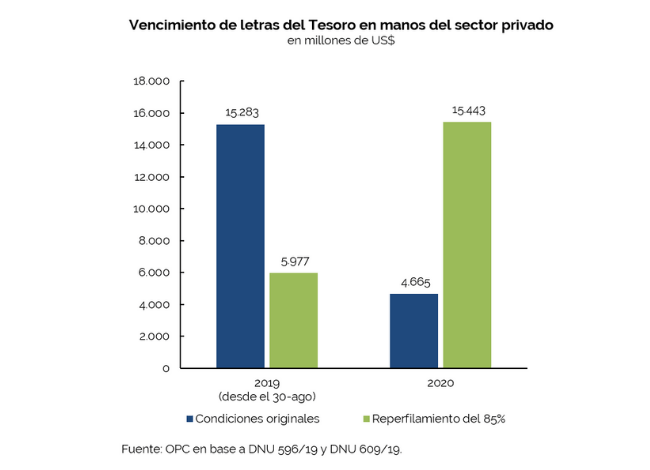

- With the financial markets facing an episode of extreme volatility, the Executive Branch announced in August a rescheduling of the maturities of Treasury bills held by institutional holders.

- The rescheduling reversed the maturity burden: under the original terms, 77% of the payments were to be made this year. But under the new schedule, 72% will be cancelled in 2020. Estimated maturities for 2019 are reduced by USD9.3 billion, but because of the extension of maturities, an additional USD1.47 billion of interest will accrue with respect to the original payment schedule.

- Placements of securities and loan disbursements for the equivalent of USD1.8 billion were recorded in August, mainly with transactions within the public sector.

- Principal and interest cancellations for USD17.06 billion were made during the month, of which 96% were for repayments of principal. The major amortizations for the month were the cancellation of bonds issued as collateral for repo transactions.

by Nicolas Perez | Sep 11, 2019 | Cost Estimates

Currently, national public policies on food and nutrition are implemented through the Food Policies and National Social Protection Plan programs, both of the Ministry of Health and Social Development, as well as through the Pro Bienestar program of the National Institute of Social Services for Pensioners and Retirees.

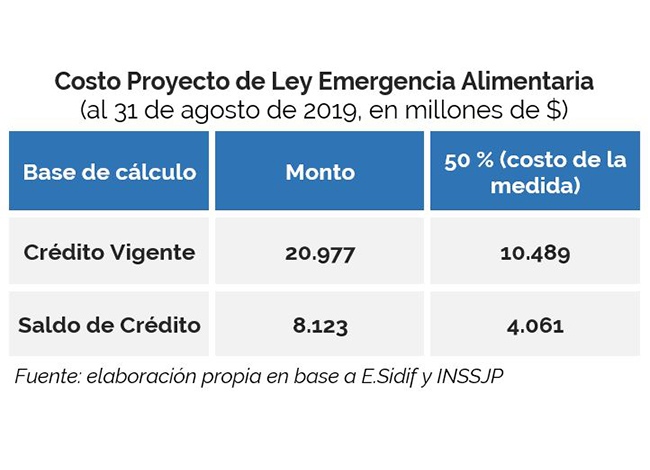

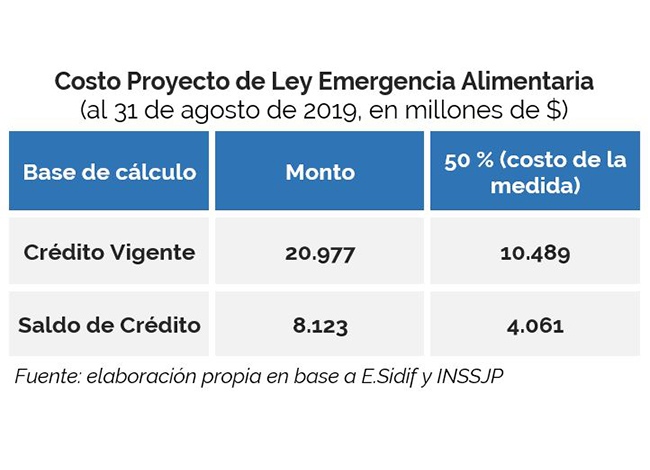

Two possible scenarios for the estimation of a fiscal cost arise from the Bill:

- if the increase is estimated based on the appropriations in force for the identified programs as of August 31, the cost would amount to AR$10.5 billion.

- If the increase is estimated based on the appropriations not executed in the identified programs as of August 31, the cost would amount to $4.06 billion.

by Nicolas Perez | Sep 10, 2019 | Budget Execution

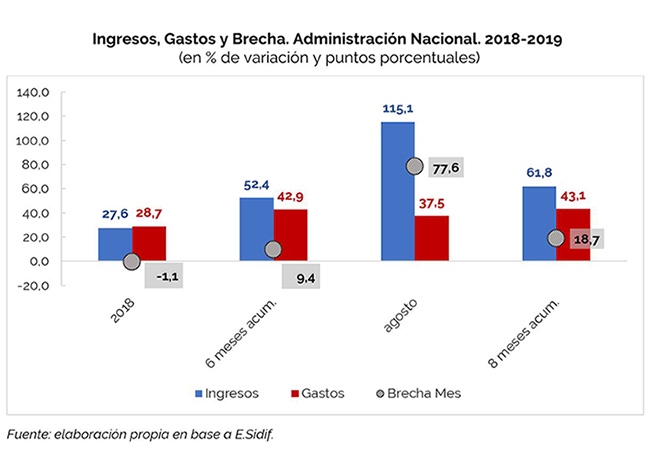

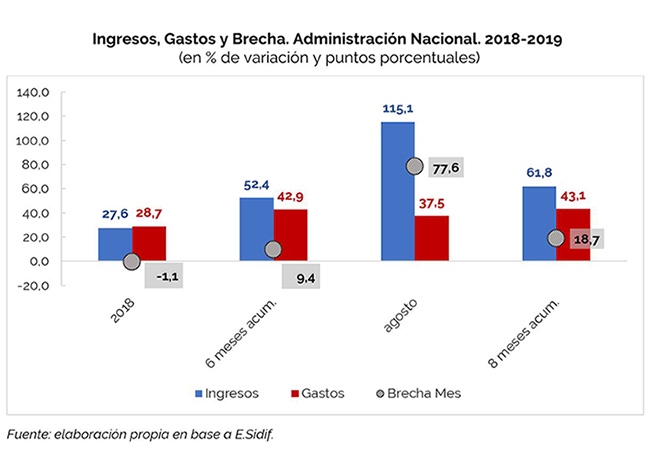

The national government recorded primary and financial surpluses of AR$119.8 billion and AR$110.01 billion in August, which implies a substantial improvement over the fiscal outcome obtained in the same period of the previous year. Although largely due to the inflow of extraordinary funds from Central Bank profits, total resources recorded the highest rate of expansion so far this year (115.1%), while expenditures fell in real terms for the tenth consecutive month.

- Property income totaled AR$136.9 billion and accounted for 52.8% of the increase in resources.

- Expenditure increased 37.5% year-on-year (YoY), with economic subsidies (106.1% YoY) and capital expenditures (61.7% YoY) being the components with the highest increase.

- In the first eight months of the year, the cumulative financial balance was negative by AR$216.6 billion, recording, however, an improvement of 60.6% YoY in real terms.

- Budget execution level of total expenditures as of August 31 was 64.2% (64.6% as of the same date of the previous year), with the items economic subsidies and current transfers to the provinces standing out as the ones with the highest execution, with 70.5% and 71.3%, respectively.

- As a result of the economic measures adopted on August 14, an increase in expenditure of AR$39.89 billion is expected for the remainder of the year.