by Nicolas Perez | Jun 25, 2019 | Budget Law

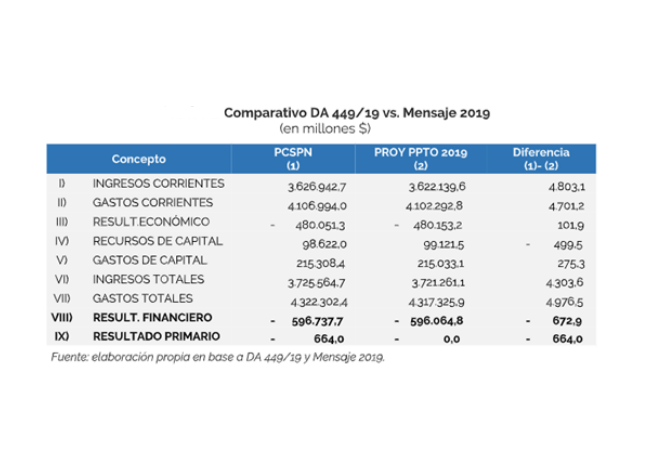

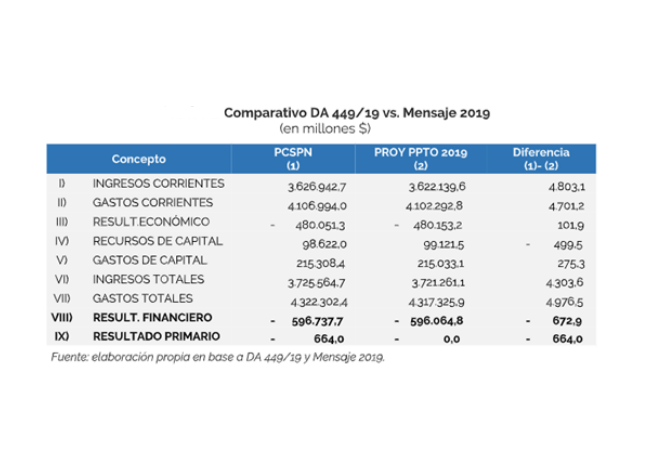

Administrative Decision No. 449/19 approved the Consolidated Budget of the National Public Sector for Fiscal Year 2019, in compliance with the provisions of Article 55 of Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector, as amended. Said article provides that the National Budget Office must prepare the consolidated budget annually and submit it to the National Executive Branch before March 31 of the year in which it is in effect. Once approved, it is submitted to the National Congress.

The Consolidated Budget of the National Public Sector represents the integration of the economic transactions carried out by the different agencies of the National Public Sector, which provides information on the total public expenditure and revenue and the effect on the rest of the economic system.

by Nicolas Perez | Jun 13, 2019 | Public Debt Operations

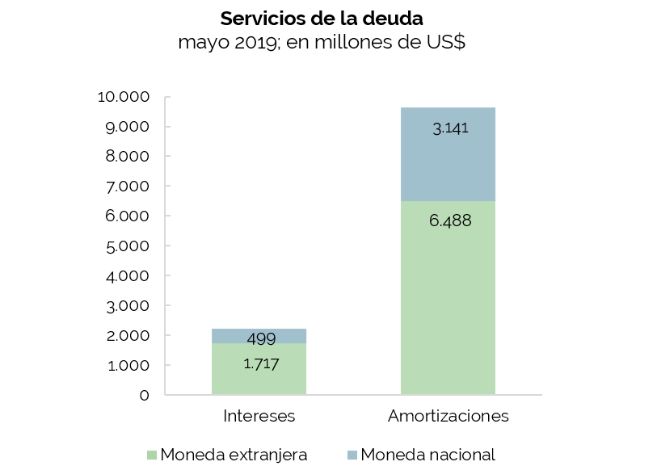

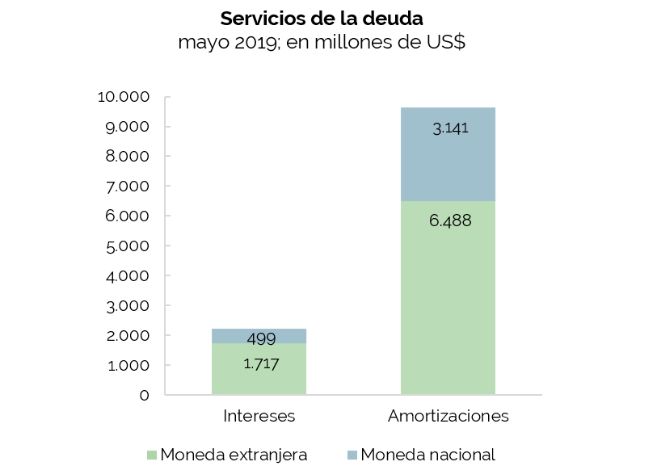

- During May, placements of government securities and loan disbursements totaled USD6.5 billion, mainly through the issuance of treasury bills and bonds.

- As a result of five public auctions, the equivalent of USD5.48 billion in treasury bills and USD131 million in bonds were placed during the month.

- A voluntary swap of BONAR DUAL for new dollar-linked bills (LELINK) for USD964 million was carried out on May 23.

- Debt service for the month totaled the equivalent of USD11.85 billion, of which USD9.63 billion were principal repayments and USD2.21 billion were interest payments.

- At the end of the month, the fifth payment of principal and interest on the loans derived from the 2014 Renegotiation Agreement with the Paris Club was paid. The payment was for USD1.55 billion of principal and USD325 million of interest.

- Main maturities scheduled for the month of June are DISCOUNT bonds, different BONARs in dollars, BONAR Badlar and BOTAPO.

by Nicolas Perez | Jun 10, 2019 | Budget Execution

In May, the national government recorded a primary surplus of AR$23.99 billion but a financial deficit of AR$22.38 billion, within a framework of an acceleration in the fall of revenues in real terms. Expenditures, also in contraction, had the seventh month of decline measured against inflation.

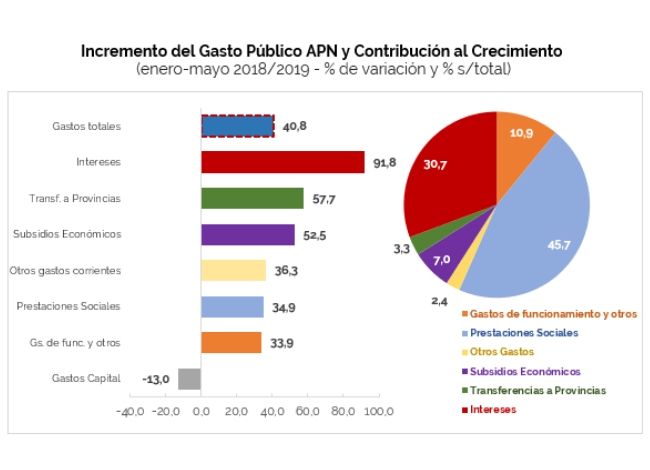

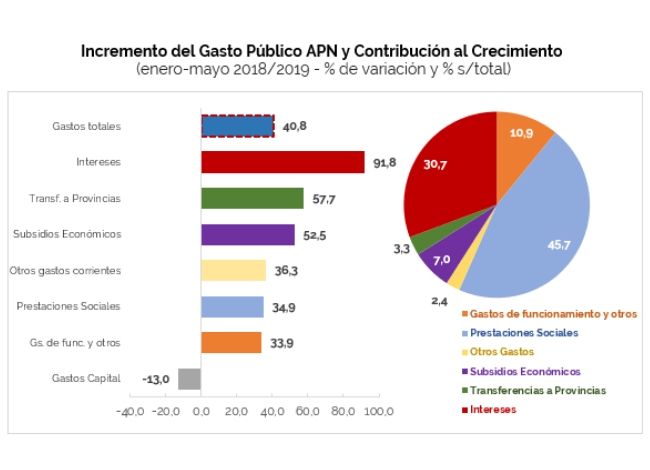

In the term January-May, expenditures increased 40.8% year-on-year. Interest on debt, transfers to provinces and economic subsidies recorded the largest expansions in the period with 91.8%, 57.7% and 52.5% YoY, respectively. Social benefits (34.9% YoY), operating expenses (33.9% YoY) and capital expenditures (-13.0% YoY) were below the increase in total expenditure.

Social benefits account for 45.7% of the increase in total expenditure, while interest payments account for 30.7%. Both explain 76.4% of the increase in expenditure in the period under analysis.

- National government revenues (40.5% YoY) again grew above expenditures (36.9% YoY), although the differential is reduced to 3.6 percentage points (p.p.) (5.2 p.p. in April).

- Personnel expenditure recorded a real fall of 14.6% YoY, in line with the retraction experienced in the salaries of several sectors (SINEP).

- After the first five months of the year, the financial balance is in deficit by AR$180.51 billion, reflecting a real reduction of 17.0% compared to the same period of the previous year.

- So far this year, the expenditure components that grew the most were Debt Interest (91.8% YoY), Transfers to Provinces (57.7% YoY) and Economic Subsidies (52.5% YoY). At the other extreme, capital expenditure contracted 13.0% YoY in nominal terms.

- The 76.3% of national government expenditure is rigid.

- At the end of May, the execution level of total expenditure reached 35.4% with respect to the current appropriation, higher than the level observed during the same period of the previous year, which reached 32.3%.

by Nicolas Perez | Jun 7, 2019 | Tax Revenue

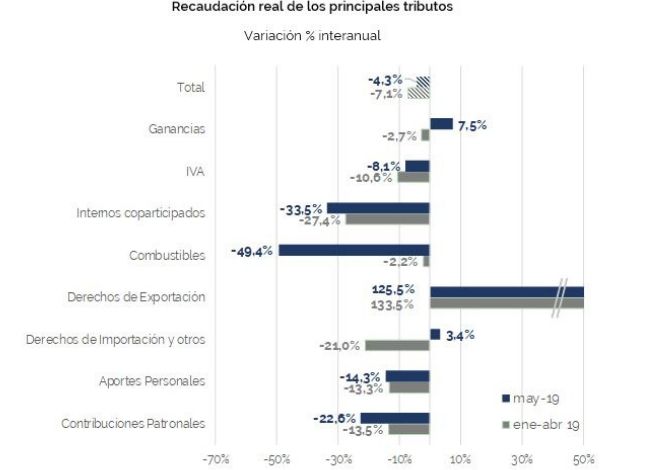

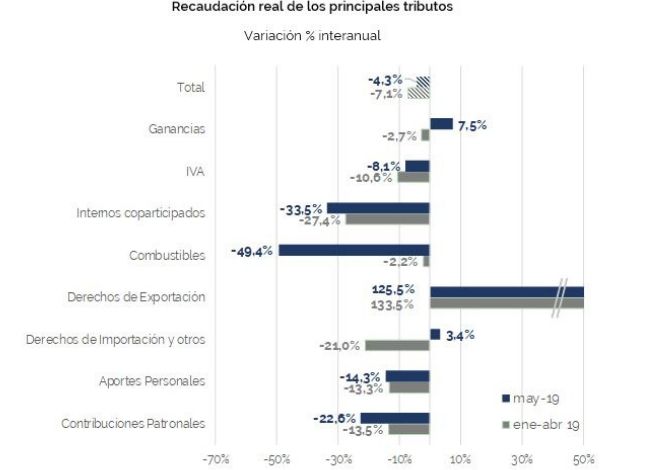

In May, tax revenue grew 50.4% in nominal terms with respect to the same month of the previous year but declined 4.3% in real terms during the same period. This decline deepens to 6.5% when considering the first five months of the year.

Overall tax revenue has been declining in real terms for eleven consecutive months, although it began to reduce the rate of decline.

In this context, Income Tax exceeded the collection expectations for the month with an increase of 7.5% year-on-year in real terms. Together with taxes on foreign trade, it is one of the taxes whose growth exceeded inflation.

VAT contracted by 8.1% in May, although this record implies a deceleration of the falls of the last seven months.

The decline in Social Security resources deepened because of the deterioration of the labor market and the changes in the employer contributions system. However, in the fifth month of the year, Social Security resources might have found its lowest level, and in the following months the trend may consolidate.

by Nicolas Perez | Jun 3, 2019 | Gender, Other Publications

Gender-responsive budgeting aims at contributing to social equity by providing information that helps policymakers to consider the impact of these decisions on different groups of people.

This report describes the main methods for including this perspective in the budget cycle, both in terms of spending and resources, with an analysis of what has taken place in Australia, Austria, Bolivia, Brazil, Canada, South Korea, Ecuador, El Salvador, France, Japan, and Mexico.

Argentina has been working on the development of a methodology to analyze the budget from a gender perspective since last year, and the 2019 Budget Law has already targeted 23 activities in different programs related to this issue.

Public policies can help to dismantle dynamics that produce patterns of inequality and there has been progress in the world to understand the impact that budgets have on gender. However, there is still room for improvement in terms of accountability of political officials and in terms of amending policies.

by Nicolas Perez | May 17, 2019 | Cost Estimates

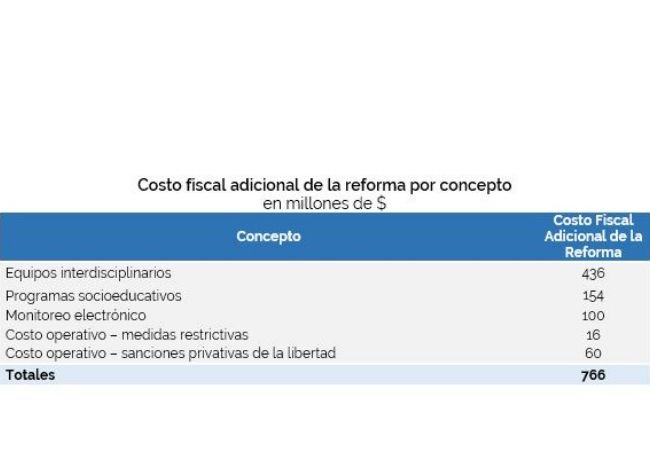

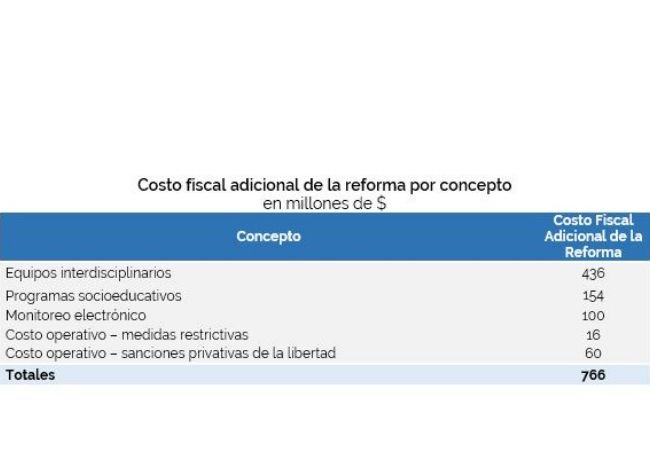

The estimated annual fiscal cost of the Bill to reform the Juvenile Criminal Regime and create the Juvenile Criminal Responsibility System amounts to AR$766 million.

In accordance with the provisions of the Bill, the implementation of the system will be progressive, so that the estimated cost would not fall entirely on the first year of its entry into force.

Likewise, this additional cost would not be fully financed by the National Budget. Although it is not explicitly stated in the Bill, part of the cost should be financed with resources from provincial Budgets, based on the powers of the jurisdictions.