by Nicolas Perez | May 16, 2019 | Other Publications

In 2015, Argentina adhered to the 2030 Agenda for Sustainable Development of the United Nations (UN), which identifies 17 central goals expressed in 169 targets agreed by member states.

Of these, Argentina adopted 89 with priority in food security, health, education, economic growth, and infrastructure development.

The national government is one of the key actors in the achievement of these goals and the budget, organized through programs, is a fundamental tool for the implementation of domestic policies that honor the commitments made with the UN.

The Argentine Congressional Budget Office (OPC) makes a preliminary methodological proposal to assess the achievement of the SDGs through the budgetary implementation of policies, which involves identifying the expenditures effectively related to these purposes.

by Nicolas Perez | May 15, 2019 | Public Debt Operations

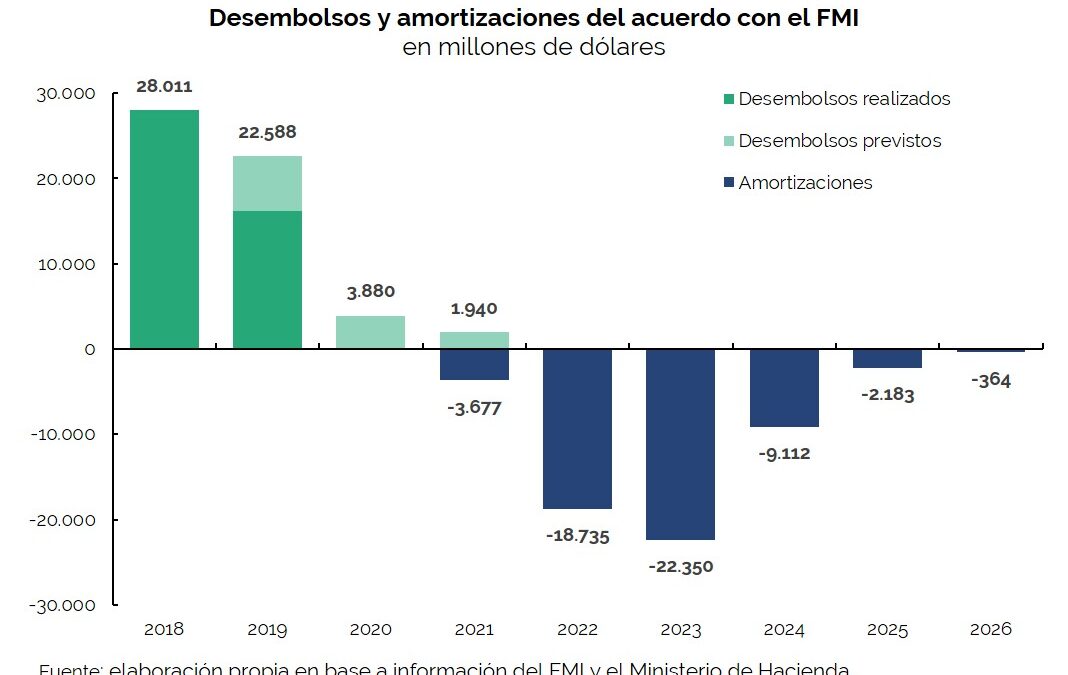

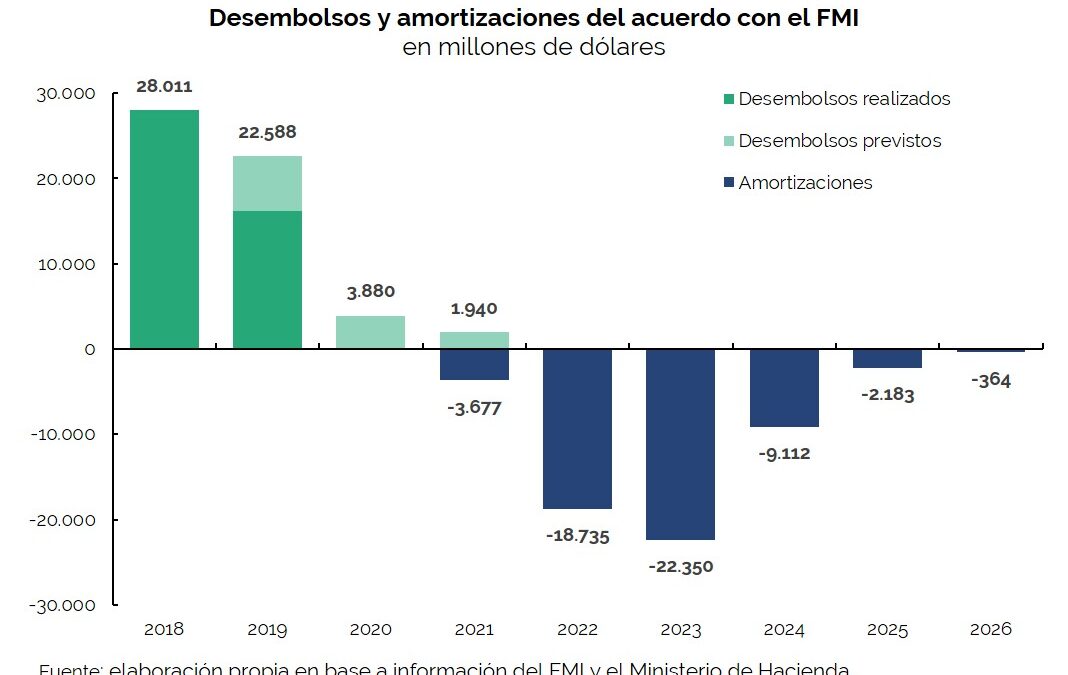

Placements of securities and loan disbursements for USD18.52 billion were recorded during the month of April, of which 58% (USD10.83 billion) consisted of the fourth disbursement from the International Monetary Fund (IMF) within the framework of the Stand-By Arrangement (SBA). Debt service payments during the period totaled USD11.46 billion, of which 82% (USD9.38 billion) were principal payments.

In a context of high volatility, a higher yield was validated in LETES placements, whose refinancing ratio fell to 64% from 87% in April.

During the month, new bonds in dollars for USD1.5 billion were placed to cancel a debt remaining from natural gas production stimulus plans, and securities for USD369 million to satisfy a ICSID arbitration award in favor of the former concessionaire of Aguas Argentinas. On April 22, the first securities issued under the agreement with “holdout” creditors for USD2.75 billion matured.

On May 31, the fifth payment of principal and interest of the loans renegotiated with the Paris Club is due: if the minimum principal established in the agreement is paid, such payment will amount to USD 1.87 billion.

by Nicolas Perez | May 10, 2019 | Budget Execution

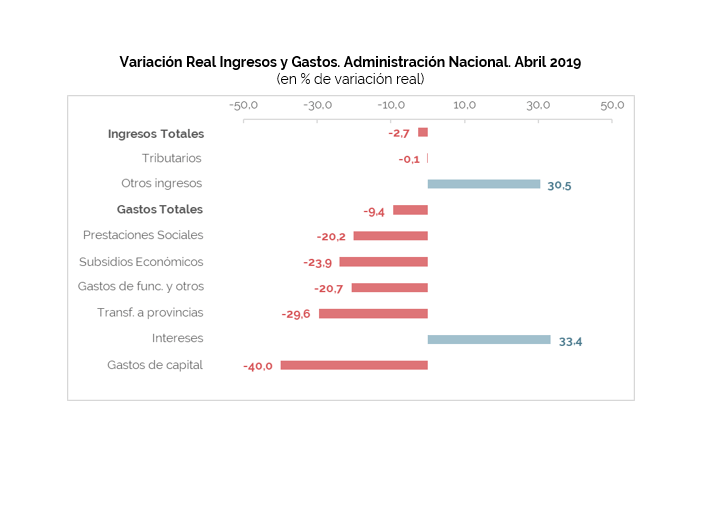

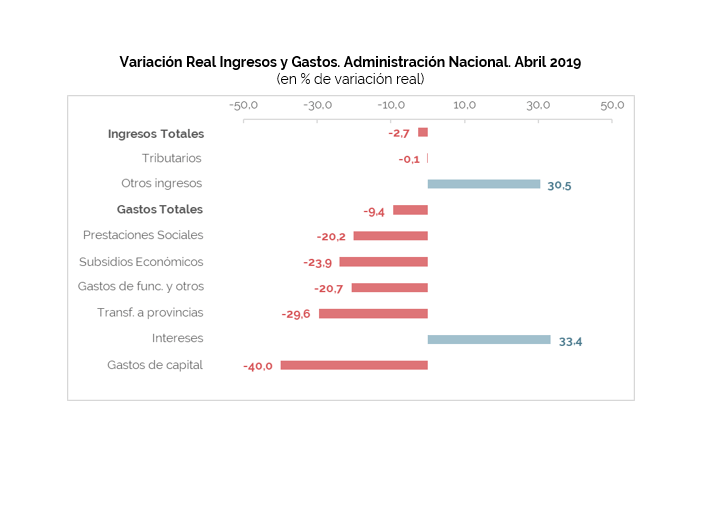

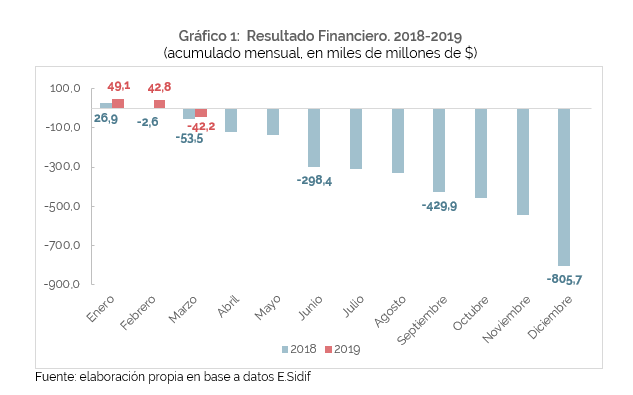

In April, the nominal increase in national government total revenues was higher than that of expenditures, which helped to generate a primary surplus of AR$36.83 billion and to reduce the financial deficit, which totaled AR$76.36 billion.

The most dynamic expenditure item continues to be the payment of interest on the debt, while the most dynamic revenue item is export duties: total revenue grew last year almost as much as inflation but, excluding withholdings, this increase is reduced by 17.5 percentage points.

Both total revenues and total expenditures fell by 2.7% and 9.4%, respectively.

-

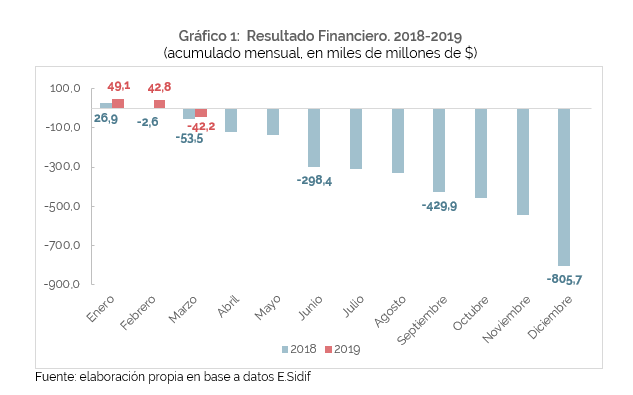

The cumulative financial balance for the first four months of the year recorded a deficit of AR$138.75 billion. In real terms, this implies an improvement of 24.2% YoY compared to the same period of the previous year (-AR$119.65 billion).

-

Tax revenues increased 56.5% YoY in the month, in line with inflation (-0.1% YoY in real terms).

-

Current expenditures increased by 44.7% YoY, while capital expenditures contracted by 6.0% YoY.

-

Interest on debt was the component with the highest growth (108.9% YoY), accounting for 60% of the increase in current expenditure.

-

As of April 30, the initial budget appropriation increased by AR$56.93 billion, AR$34.57 billion through Necessity and Urgency Decrees – DNU (61%) and AR$22.35 billion through Administrative Decisions – DA (39%).

-

The execution of total expenditure was 27.4% in the four-month period.

by Nicolas Perez | Apr 25, 2019 | Cost Estimates

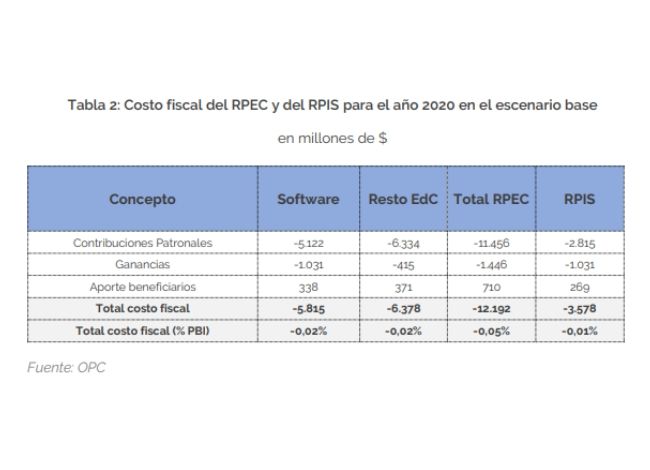

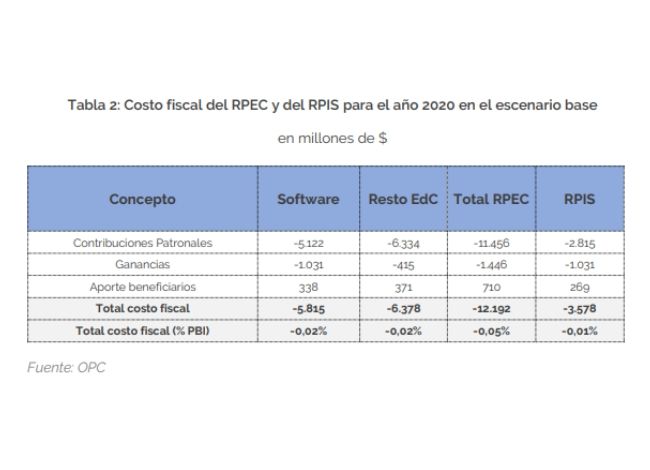

Tax benefits for the economic activities included in what the bill defines as Knowledge Economy, would result in a fiscal cost of AR$12.19 billion during 2020. This represents approximately 0.05% of the projected GDP for the year.

Among the tax exemptions proposed are the early implementation of the non-taxable minimum applicable to the payment of Employer Contributions, the granting of a tax credit certificate equivalent to 1.6 times the amount of such contributions applicable to the payment of other national taxes, the reduction of the Income Tax rate and the non-applicability of withholdings or collections of Value Added Tax. The duration of this promotion regime is established as from 01/01/2020 until 12/31/2029.

by Nicolas Perez | Apr 12, 2019 | Public Debt Operations

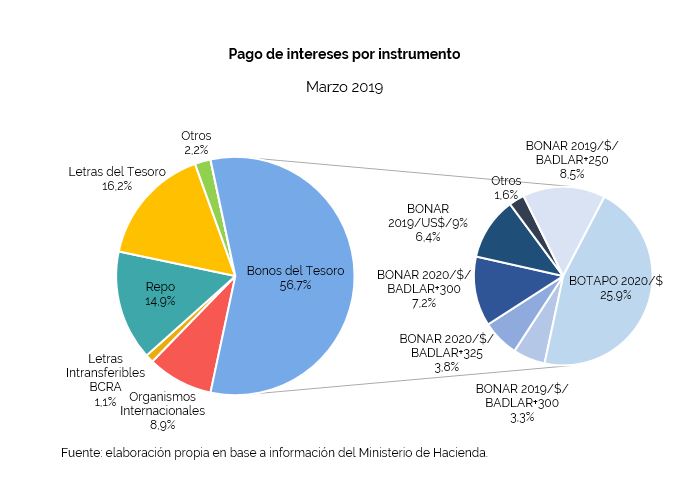

In March, there were placements of securities and loan disbursements for AR$5.4 billion, of which 92% consisted of placements of government securities. The rollover ratio resulting from the auctions held during the first quarter of 2019 was higher than projected in the Financial Program.

On the other hand, debt services for a total of USD8.92 billion were paid during the month, of which 85% (USD7.59 billion) were principal payments. The main amortizations of the month were the cancellation of the BONAR in dollars 2019 for USD1.9 billion, which was held by the Sustainability Guarantee Fund (FGS), and the maturities of LETES for USD1.67 billion and LECAP for AR$45.89 billion (USD1.06 billion).

Payments of loans with multilateral and bilateral credit organizations totaled USD273 million which, considering disbursements, implies a net cancellation of USD126 million.

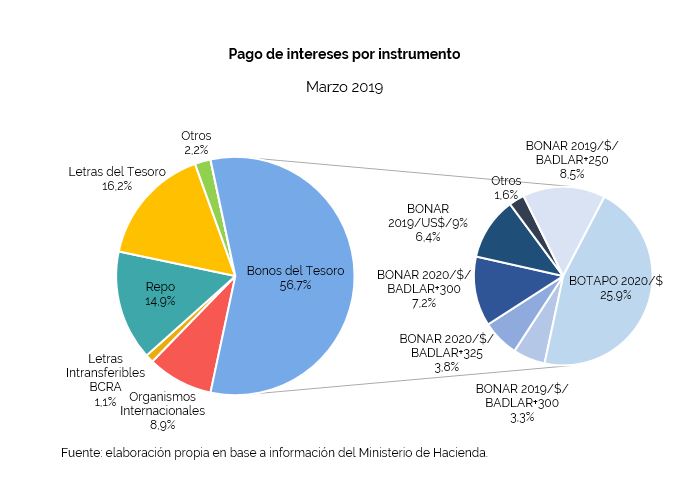

Interest payments totaled USD1.32 billion, of which 68% were made in domestic currency.

by Nicolas Perez | Apr 11, 2019 | Budget Execution

In a context of economic downturn, in March the national government had a better performance compared to the same month of the previous year, but liquefied the surplus recorded in the first two months of the year.

-

The National Government recorded in the first quarter a financial deficit of AR$42.19 billion, which implies a real drop of 47.9% compared to the same period of 2018.

-

Total revenues increased 39.4% YoY, and expenditures increased 34.0% YoY.

-

Export duties increased by 477.0.% YoY, becoming the most dynamic source of resources in the period.

-

Interest payments on public debt rose 65.1% YoY and economic subsidies doubled (107% YoY).

-

Capital expenditure remains at the same levels as a year ago, which means a fall in real terms of 33.7% YoY.

-

As of March 31, the initial budget appropriation was increased by AR$40.32 billion, AR$34.57 billion by Necessity and Urgency Decrees – DNU (86%) and AR$5.73 billion by Administrative Decisions – DA (14%).

-

The level of total expenditure implementation in the quarter was 19.1%.