by Nicolas Perez | Apr 11, 2019 | Tax Revenue

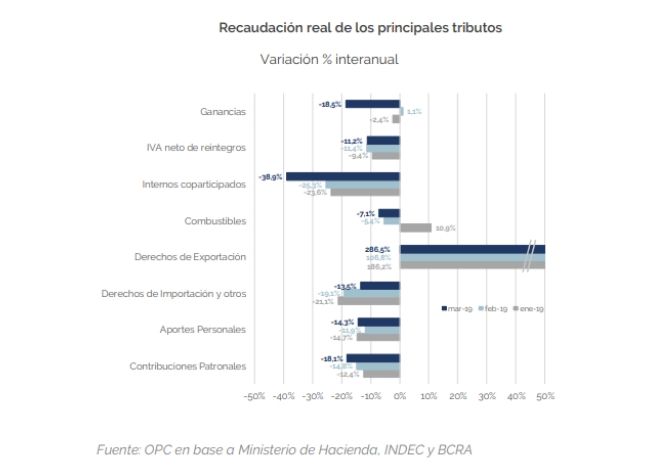

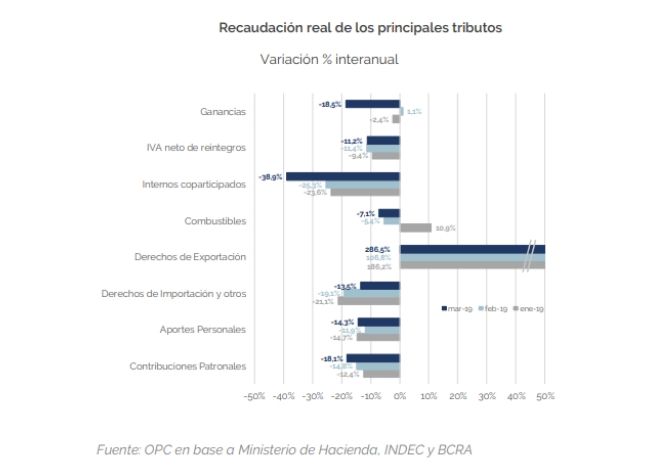

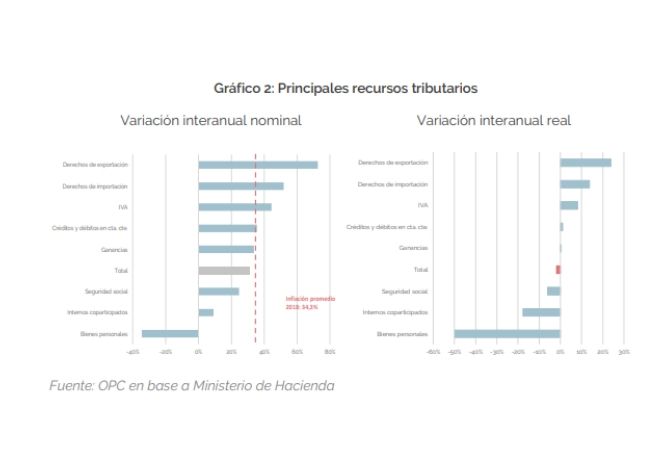

In the third month of the year, national public sector revenues grew by 37.3% in nominal terms compared to the same period of the previous year but fell by 10.5% in real terms. Similar behavior was observed in the first quarter of the year.

This performance also entails a decline compared to previous months and reaffirms that government revenues are strongly linked to the level of economic activity, as shown by the VAT DGI, which fell 7.3%.

Income Tax contracted by 18.5%, partly due to the deferral of some maturities. The significant growth in Export Duties allowed mitigating the fall in the most important taxes of the national tax structure (VAT, Income Tax and Social Security Contributions).

by Nicolas Perez | Mar 13, 2019 | Budget Execution

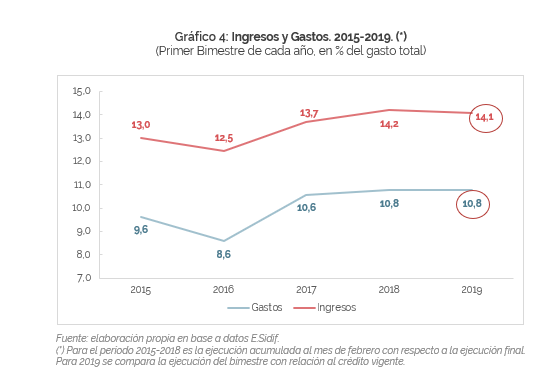

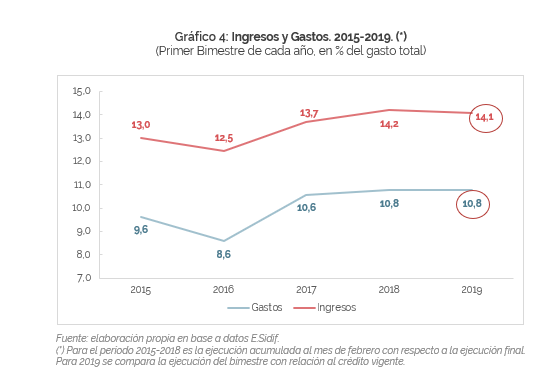

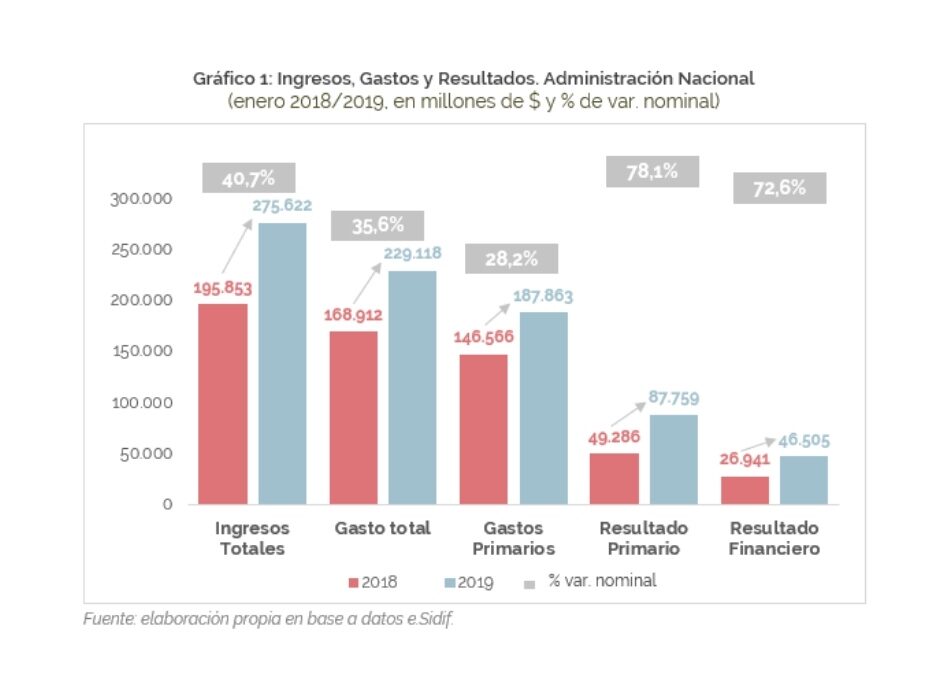

In February, the national government had a primary surplus of AR$14.74 billion, as revenues increased nominally by 43.6%, while expenditures increased by 22.8%, 19 points lower. The financial balance was also positive by AR$1.43 billion, which also implies an improvement in relation to the deficit recorded a year ago.

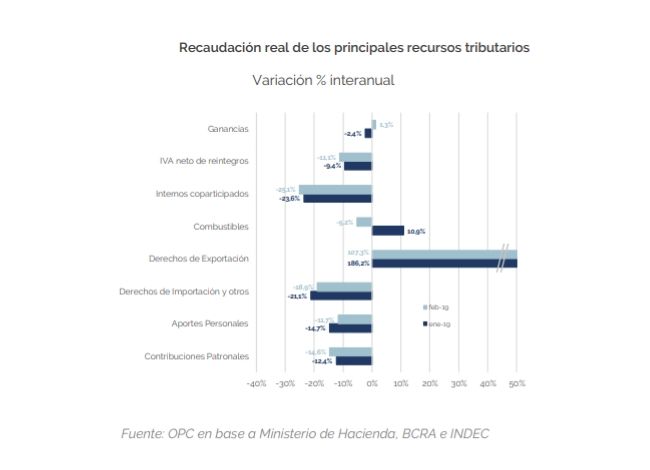

During the second month of the year, tax resources increased nominally by 39.5% year-on-year (-7.5% YoY real), largely driven by export duties, which increased by 374.7% YoY, because of both amendments to legislation and changes in the exchange rate.

However, in real terms, the total resources of the national government lost against inflation, recording a drop of -7.5%. Although the drop was lower than in the previous two months, Social Security contributions fell -10.9% year-on-year.

Total expenditure amounted to AR$223.97 billion in February, an increase of 20.1% year-on-year. Current expenditures grew 22.8%, while capital expenditures contracted 17.8%.

Property Income was eight times higher than in the same month of the previous year and totaled AR$45.83 billion in the first two months of the year.

The 46% increase in allocations as of March 1 will imply a higher expenditure of AR$16.08 billion, equivalent to 0.1% of GDP in 2019.

by Nicolas Perez | Mar 12, 2019 | Tax Revenue

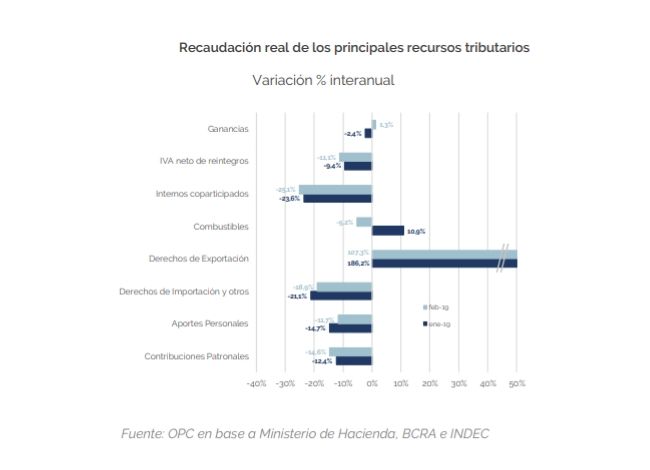

February tax revenue totaled AR$330.89 billion, which implied a nominal year-on-year increase of 40.4% and of 39.6% with respect to the first two months of last year.

In real terms, it declined 6.9% against February 2018, although the fall in inflation-adjusted tax resources was softened as of December.

Income Tax had a real recovery of 1.3%, and together with Wealth Tax and Export Duties, were the ones with the highest year-on-year increase.

Value Added Tax recorded a year-on-year decline of 11.5%, basically due to the fall in imports and the reduction of some taxes on foreign purchases and the lower level of activity.

by Nicolas Perez | Feb 14, 2019 | Budget Execution

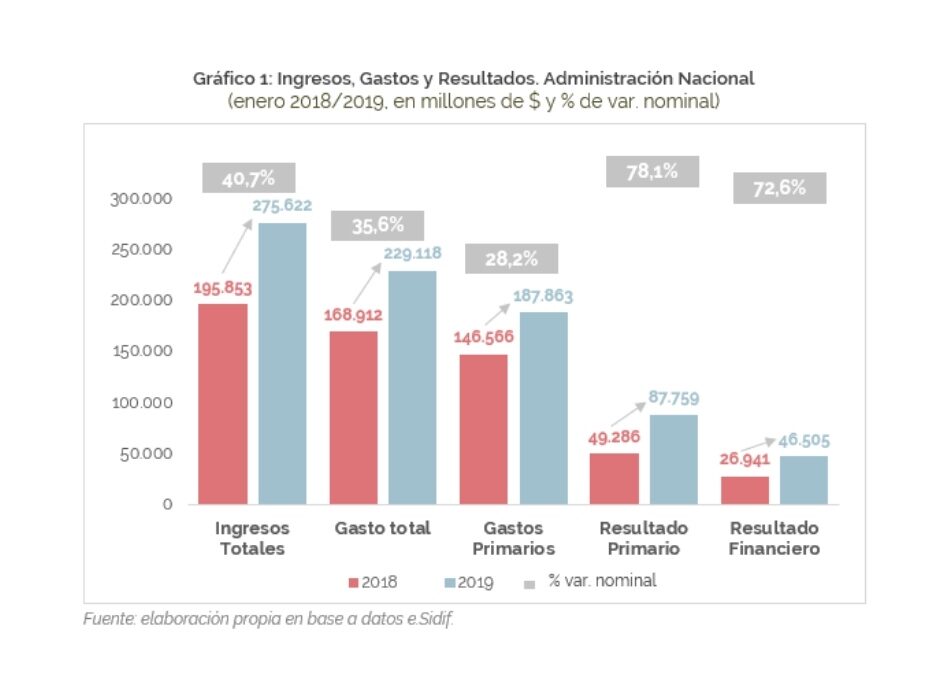

During January, the national government had a financial surplus of AR$87.76 billion, 19.7% higher in real terms than in 2018. Compared to inflation, both total revenues and total expenditures decreased during the month.

Revenues showed a drop -in real terms- in all items, except for property income and capital revenues.

Expenditures showed some exceptions to this pattern. Debt interest payments increased 84.6% YoY (+24.1% in real terms) and economic subsidies grew by 143% (+63.9% YoY in real terms).

Total accrued expenditures accounted for 5.5% of the total item, current expenditures for 5.6% and capital expenditures for 3.0%.

by Nicolas Perez | Feb 7, 2019 | Tax Revenue

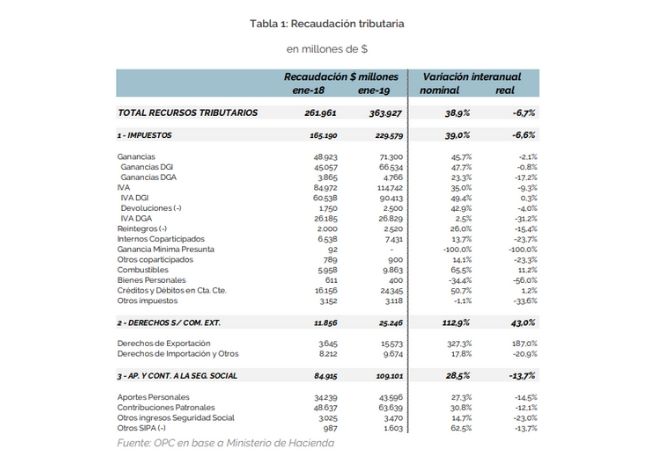

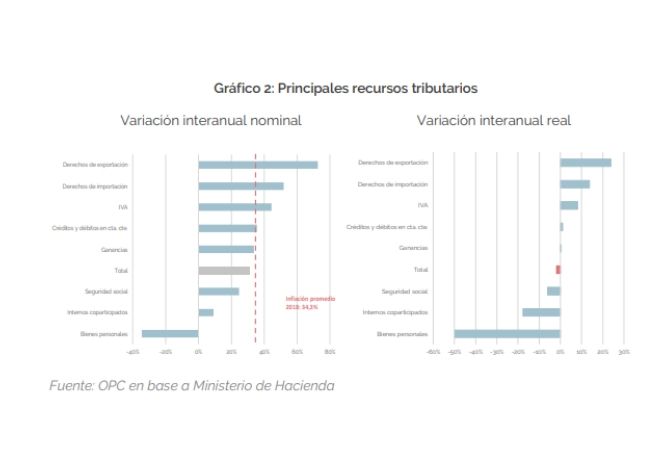

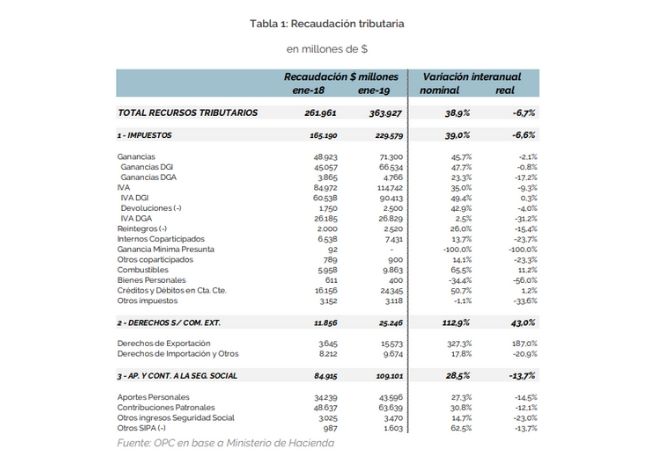

This report analyzes tax revenues for the first month of the year and outlines the scenario for the whole of 2019.

National tax revenue in January 2019 totaled AR$363.92 billion, showing a year-on-year increase of 38.9% in nominal terms, which implied a drop of 6.7% in real terms.

As for the projection for the year, after the submission of the 2019 Budget, three regulatory amendments were introduced with a significant impact on the national tax revenue for 2019.

These amendments have an almost neutral net impact on the projected revenue: a reduction of AR$3.83 billion, which is equivalent to 0.1% of the total projected amount.

by Nicolas Perez | Jan 31, 2019 | Tax Revenue

National tax revenue totaled $3.82 trillion in 2018, an increase in nominal terms of 31.2% with respect to 2017.

In terms of inflation-adjusted revenue, there was a drop of 1.8% year-on-year, the third consecutive year showing this trend.

Measured in terms of Gross Domestic Product, revenue was 24.1% of GDP, 0.3 percentage points below that recorded in 2017, continuing the trend started in 2016.

As for the allocation of tax revenue, the national government and the social security system received less resources for the equivalent of 0.3% of GDP each, which contrasts with the increase of 0.4% of GDP that was allocated to the provinces.