by Nicolas Perez | Nov 23, 2018 | Cost Estimates

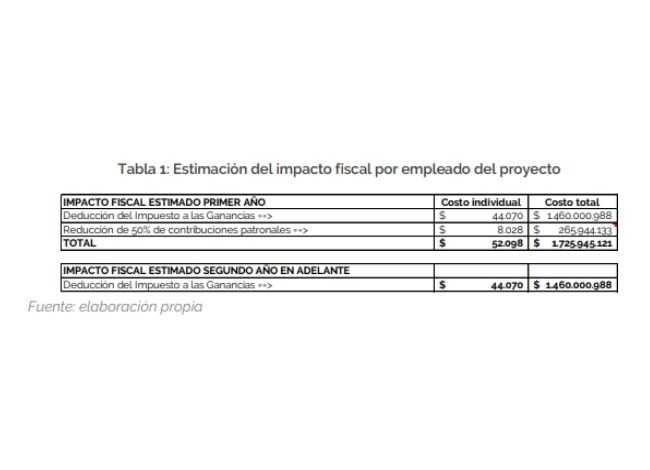

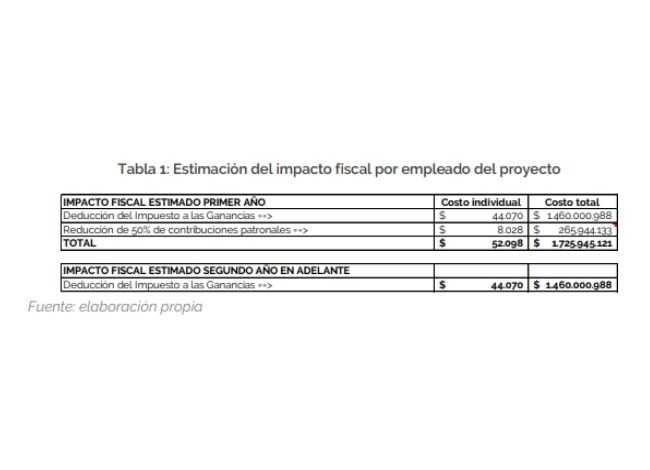

Tax benefits for employers, included in the Bill on a Federal Regime for Socio-labor insertion for People with Disabilities, would cause an estimated negative fiscal impact of AR$1.72 billion in the first year and AR$1.46 billion in the following years.

The benefit of paying half of the employer’s contributions will be in force only for the first year. Throughout the employment relationship, the employer will be able to deduct the entire amount of the wages subject to the Income Tax regime.

by Nicolas Perez | Nov 6, 2018 | Public Debt

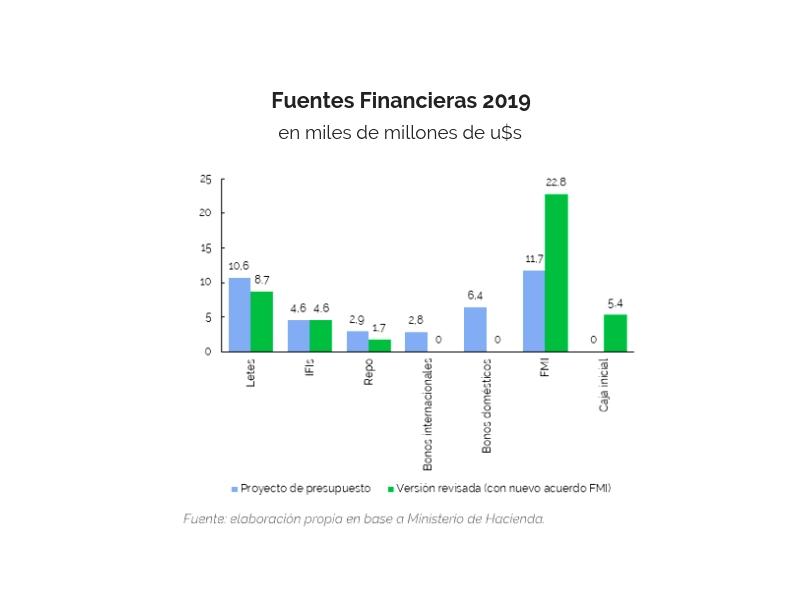

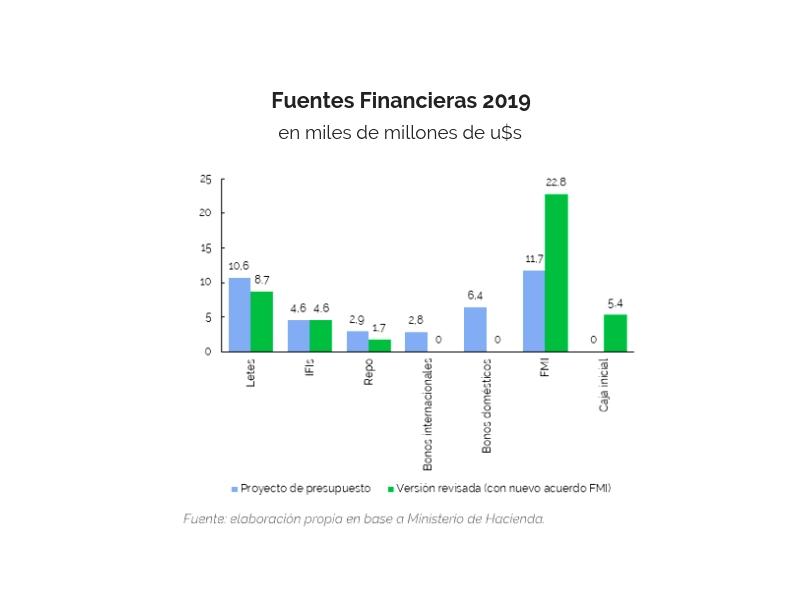

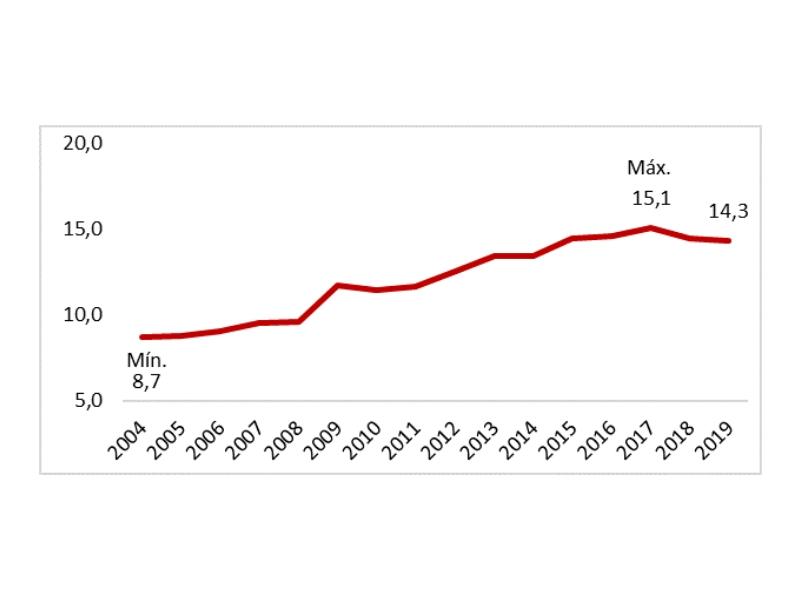

The renegotiation of the stand-by arrangement with the International Monetary Fund (IMF) resulted in a reformulation of the 2019 Financial Program with respect to the version included in the Budget Bill.

With the new arrangement, the IMF will increase its disbursements by USD7.6 billion this year and USD11.1 billion next year. The IMF assistance will cover 54% of next year’s financial needs, a figure that will drop to 14.7% in 2020.

by Nicolas Perez | Nov 1, 2018 | Budget Law

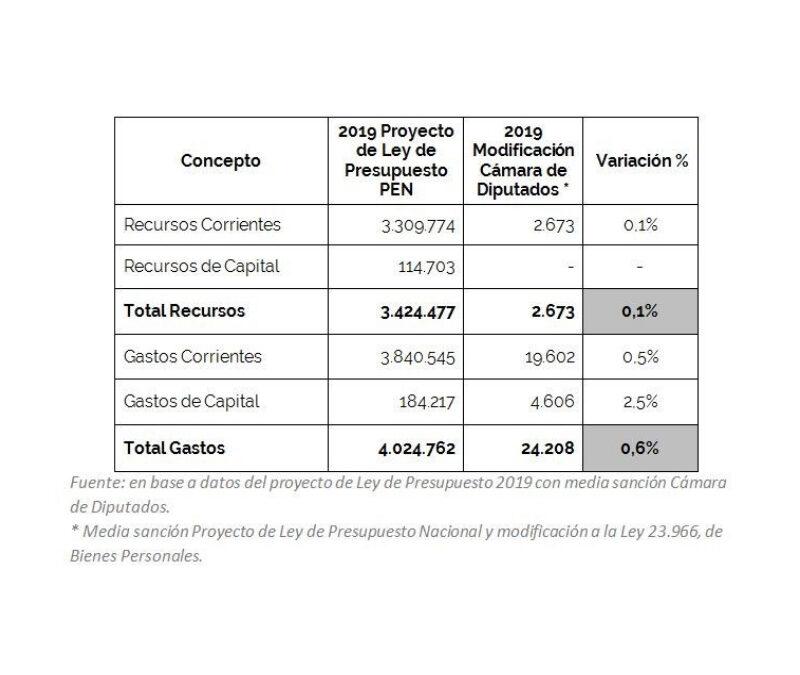

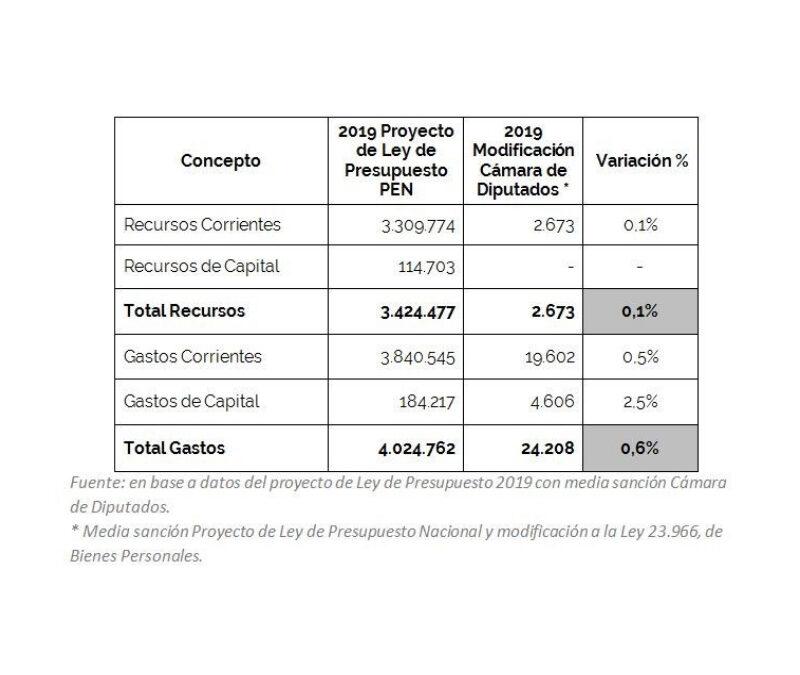

By virtue of the amendments introduced by the Chamber of Deputies in the 2019 Budget Bill, resources are increased by AR$2.67 billion and expenditures by AR$24.2 billion, which creates a financing gap of AR$21.53 billion.

Under current legislation, this requires a reduction of expenditures by the same amount or to seek additional financing, which would alter the primary and financial balances.

The preliminary approval implies an increase of 0.1% in resources and an increase of 0.6% in total expenditures.

by Nicolas Perez | Oct 17, 2018 | Budget Law

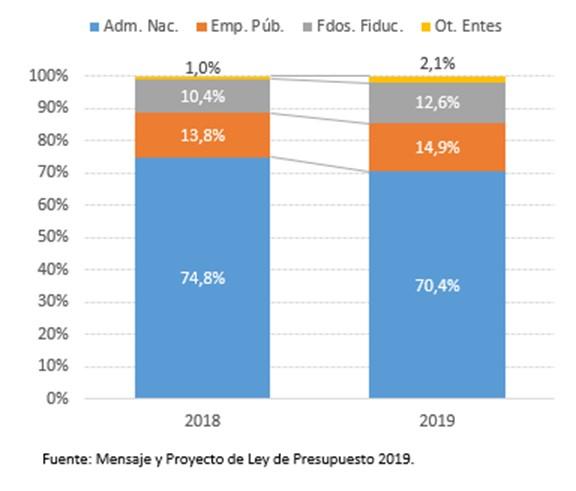

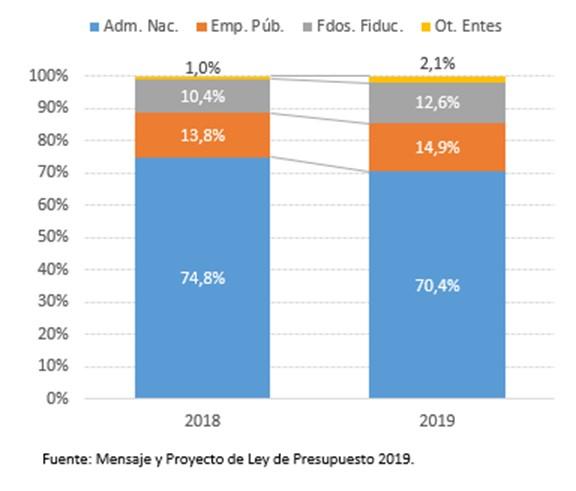

This report analyzes budgetary allocations included in the 2019 Budget Bill for Public Investment, including Real Direct Investment (RDI) and Capital Transfers (CT) within this concept.

The national government public investment budget provided for next year -real direct investment and capital transfers- amounts to AR$171.57 billion, with a drop estimated at 9.7% with respect to 2018.

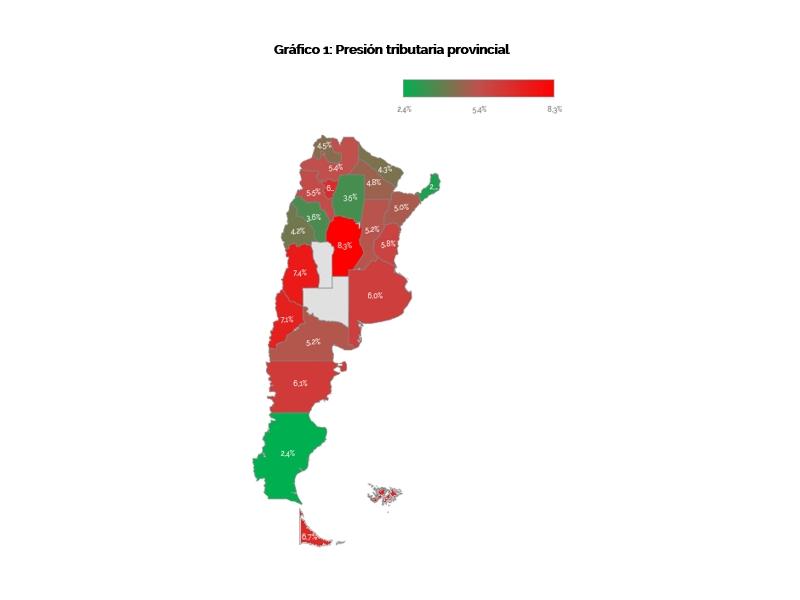

by Nicolas Perez | Oct 16, 2018 | Tax Policy and Fiscal Federalism

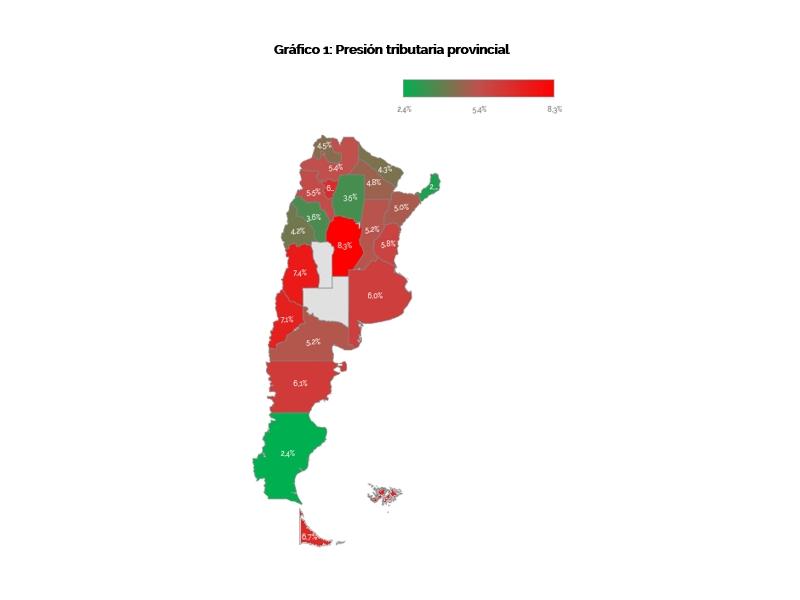

The Executive Branches of the Nation, of twenty-two provinces and of the Autonomous City of Buenos Aires (CABA) signed on November 16, 2017 a new agreement on tax matters, called the Federal Fiscal Consensus which, as stated by the National Executive Branch in its message to the National Congress, aims “to achieve a more integrated, equitable and supportive economy.” A detailed study of the degree of compliance with the obligations that such agreement imposed on all jurisdictions reveals that significant progress was made in tax matters. However, the situation is very heterogeneous when analyzing the behavior in each sector and in each province.

by Nicolas Perez | Oct 10, 2018 | Budget Law

This report analyzes the public social spending included in the 2019 National Budget Bill, from a financial and physical perspective.

For this purpose, public social spending is defined as the set of expenditures made by the National Government classified in purpose 3 as Social Services, which include expenditures related to the provision of health services, social promotion and assistance, social security, education and culture, science and technology, labor, housing and urban planning, drinking water and sewage and other urban services.