GENERAL DESCRIPTION OF THE CONTENTS OF THE 2024 NATIONAL GOVERNMENT BUDGET BILL

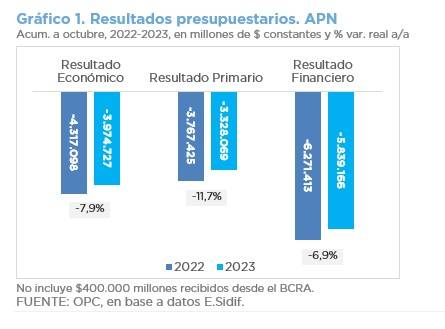

The National Government Budget Bill for fiscal year 2024 estimates revenues equivalent to 14.4% of GDP (1.0 p.p. less than the current 2023 budget), primary expenditures with a share of 15.8% of GDP (-4.2 p.p. vs. current 2023) and interest on debt in the order of 1.7% of GDP (equivalent to 2023).

The projected dynamics for revenues and expenditures result in a primary deficit equivalent to 1.5% of GDP (4.7% of GDP in the current 2023 budget) and a financial deficit of 3.2% of GDP (6.5% in 2023).

The projected reduction in primary expenditures results from social benefits (-1.6 p.p. of GDP), economic subsidies (-0.8 p.p.), personnel expenses (-0.6 p.p.), transfers to provinces (-0.4 p.p.) and capital expenditures (-0.4 p.p.).

Likewise, real drops are projected in budget allocations for cross-cutting policies with respect to 2023: -21.9% for the gender equality policy, -22.2% for children and adolescents, -35.4% for the care of persons with disabilities and -29.8% for the sustainable environment and climate change policy.

The gross financing needs of the National Government for 2024 total 16.6% of GDP, including the financial deficit (3.2% of GDP), debt repayments (12.6% of GDP) and net financial investment (0.9% of GDP). They are expected to be covered by gross placements of government securities (14.9% of GDP, including intra public sector), gross granting of Temporary Advances from the Central Bank (0.9% of GDP) and disbursements from international organizations (0.9% of GDP).

This report analyzes the macroeconomic projections on which the 2024 Budget is based, and the tax revenue projections for 2023 and 2024 derived from such projections, presenting an exercise of distribution of tax resources between the National Public Sector and the provinces. In addition, the results arising from adjusting the projected tax revenue for 2024 based on the changes in the macroeconomic scenario and in the regulations in force that occurred after the submission of the 2024 Budget Bill are also presented.