The primary result of the National Government during fiscal year 2022 was negative by ARS2,915.619 billion, equivalent to 3.5% of GDP. Excluding the remission of profits of the Central Bank received in 2021, the primary deficit implied an improvement of 1 percentage point compared to that year.

Total revenues fell 12.7% year-on-year in real terms, and primary expenditures declined 7.4% YoY.

- Interest on debt increased by 18.0% YoY, moderating the 5.6% YoY decline in total expenditure.

- Due to differences between the mobility adjustment formulas and inflation, family allowances fell 2.4% YoY and general regime pensions fell 2.5% YoY.

- Capital expenditures contracted 37.6% YoY, reflecting decreases in all items and recipients.

- The financial deficit was 5.4% of GDP, lower than in the previous year.

- A total of 96.3% of the budget increases were allocated through a Necessity and Urgency Decree (DNU).

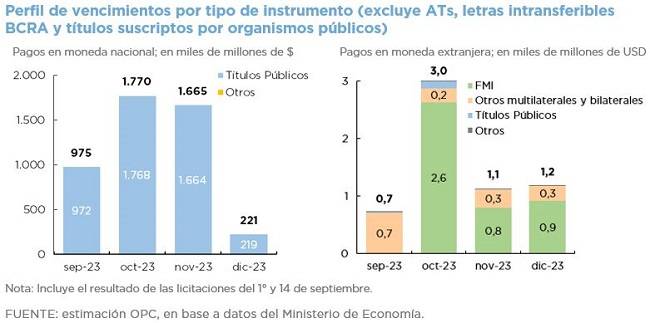

- The stock of public debt payable in foreign currency totaled USD264.032 billion, showing an increase of USD10.023 billion during 2022.

- Debt in pesos increased by the equivalent of 4.8% of GDP, reaching 28.1% of GDP.

- During the year, the deficit of the National Non-Financial Public Sector, which includes state-owned enterprises, trust funds and other national entities, increased to 5.0% of GDP.