During January, the National Government recorded a financial surplus 77.2% higher than that obtained in the same month of the previous year. This was the result of a greater decrease in expenditures, mainly related to social benefits, than the drop in tax revenues.

- The primary surplus, which does not include interest payments, was 105.2% higher than a year earlier.

- Total revenues contracted by 1.3% in the year-on-year comparison, driven by the fall in Social Security contributions

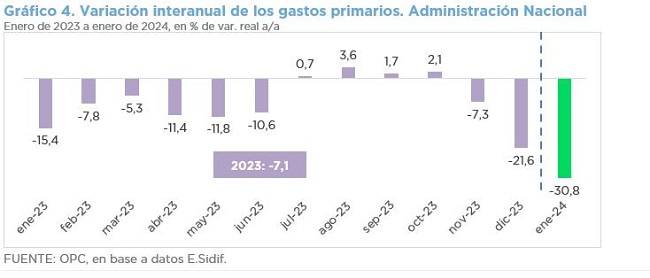

(-26.5% YoY) and Income Tax (-40.3% YoY), partially offset by increases in the PAIS Tax (411.6% YoY) and in Export Duties (88.5% YoY). Partly due to the improvement in the exchange rate, partly due to regulatory changes. - Total National Government expenditures recorded a real fall of 11.9% YoY in the first month of the year, and the cut in primary expenditures reached 30.8% YoY.

- Pensions (-32.5% YoY), social programs (-59.6% YoY) and personnel expenses (-18.0% YoY) were the items that most contributed to the reduction in expenditures. The absence of records for some programs had an impact on the item social programs.

- However, debt interest grew 139.1% YoY, basically due to the payment of coupons on bonds issued after the restructuring.

- Transportation subsidies increased 144.9% YoY, mainly due to subsidies to urban rail services.

- In contrast to January 2023, no expenditure was recorded for energy subsidies.