The fiscal impact of the proposed tax amendments included in the Bill on Palliative and Relevant Tax Measures was...

The fiscal impact of the proposed tax amendments included in the Bill on Palliative and Relevant Tax Measures was...

The change proposed by the National Executive Branch implies adjusting the pension benefits by the current formula in...

The analysis refers to a set of sections that create a new regime for the regularization of assets, modifies the...

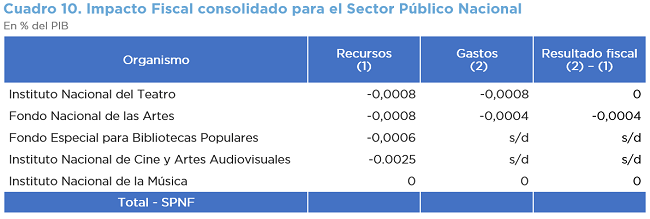

This report analyzes budget amendments planned in agencies related to culture. The report includes the following...

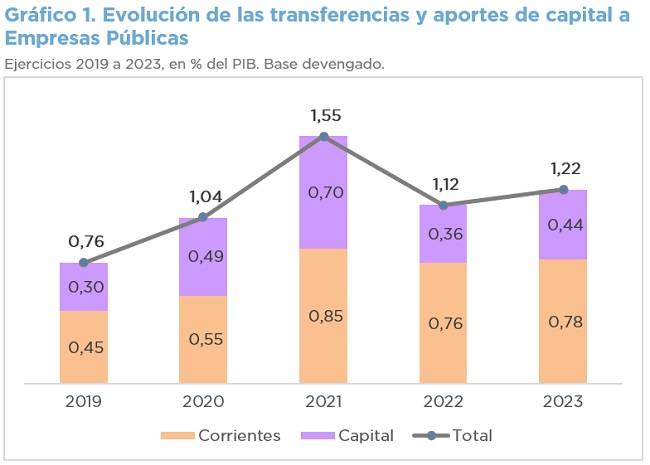

Sections 8 and 11 of the Bill establish that state-owned enterprises are subject to privatization and authorize the...

The Bill provides for the total cancellation of the intra-public sector debt through the transfer to the Treasury of...

This report presents the analysis of a first group of the tax measures contained in the Bill "Bases and Starting Point...

With the purpose of promoting registered employment, these sections offer incentives to the employers that join the...

Section 106 of the Bill suspends the mobility of quarterly adjustments for pension benefits and family allowances,...

The majority committee report implies the creation of the National Dance Institute (INDa) as an autarkic entity within...

The Bill proposes an additional reimbursement for exports from ports and customs located south of the 40th parallel,...

Bill 018-PE-2023 provides for the creation, as from January 1, 2024, of the "Buy without VAT" Program. This program...