The fiscal impact of the legislative proposal is approximately ARS1.106 billion per year. The Bill proposes to create...

The fiscal impact of the legislative proposal is approximately ARS1.106 billion per year. The Bill proposes to create...

The Bill under analysis proposes to include the department of Malargüe in the Province of Mendoza to the region known...

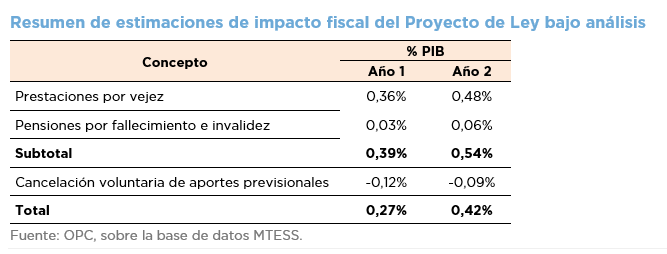

Bill 0029-S-2022 proposes a differential pension system for workers who work or have worked as forest or rural fire...

The purpose of Bill S-972/2021 is, among others, to promote the sustainable development of the production of hand...

Bill S-1860/2022 aims at reducing indigence, guaranteeing access to adequate food for people who are in a situation of...

The purpose of this report is to analyze and estimate the fiscal impact of the Bill called "Plan de Pago de Deuda...

The Bill under analysis proposes the creation of the Program for the Promotion of Productive Investments and Services...

Bill S-1682/22 proposes amendments to the Simplified Regime for Small Taxpayers (monotributo). On the one hand, it...

Bill S-710/2021 - Freight expense tax credit for small and medium-sized companies of the fruit and vegetable chain....

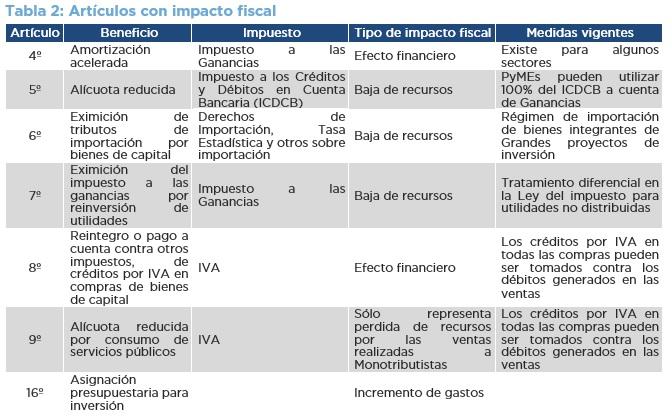

This report analyzes Bill CD 3/2022 on Incentive to the Argentine Construction and Production Investment and evaluates...

The Bill that creates the "Transitory reimbursement regime for the acquisition of vehicles that provide taxicab...

This report analyzes the text approved by the Chamber of Deputies on Tax Relief for Small Taxpayers and Self-Employed,...