Bill S-2286/2020 states that the economic context resulting from the pandemic has led to a growth of micro and small enterprises in Argentina, many of them highly dependent on the internet.

In this framework, the Bill proposes a tax relief for the imports of digital services for entrepreneurs consisting in the exemption of PAIS tax and VAT for imported digital services, provided that such imports are made by entrepreneurs or Venture Capital Institutions in accordance with Law No. 27,349 of Support to Venture Capital.

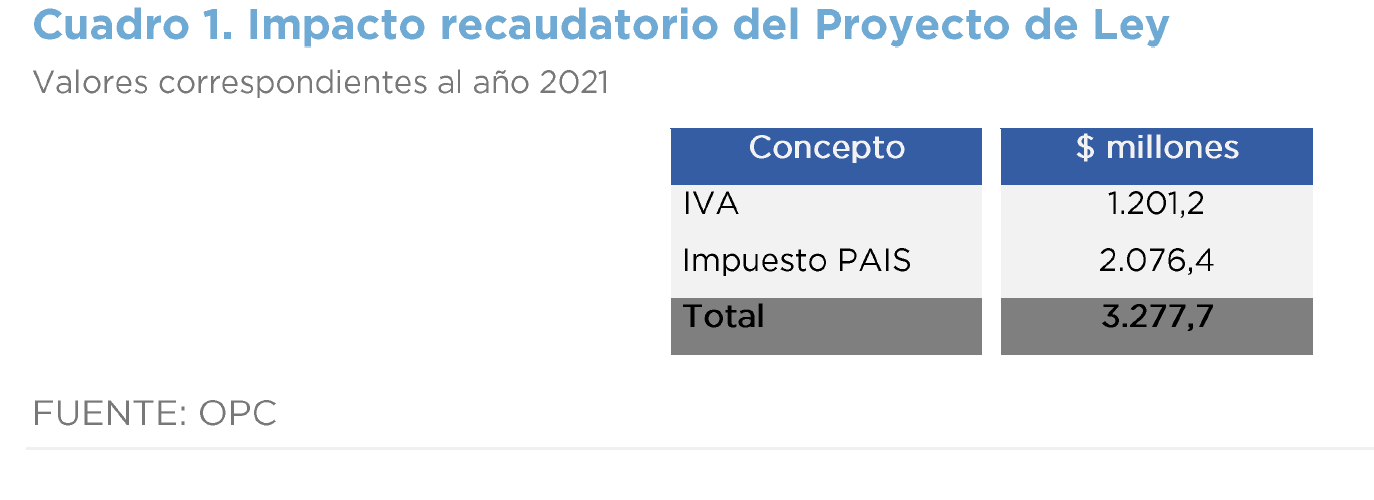

It is estimated that the fiscal impact would imply a drop in tax revenues of AR$3.28 billion for the year 2021.