Although the final fiscal impact of the proposed regime to promote investments in hydrocarbons will depend on the decisions made by the companies, on the macroeconomic evolution and on what happens in the domestic market, it is estimated that it could produce a positive balance of ARS21.384 billion per year for the Treasury, basically because of the increased revenue from the Tax on Fuels, which will no longer be a fixed amount.

- Based on the assumption that fuel prices will increase 59% next year, an increased revenue of ARS9.964 billion per year is expected, to which ARS6.345 billion would be added because of export retentions.

- On the other hand, the new regime could result in a loss of revenue for other concepts: ARS12.664 billion because of the exemption from Income Tax for the transfer of oil and gas areas and ARS3.1 billion for a new calculation of recording losses, a benefit which only involves YPF.

- Half of the investments projected for 2022 would qualify for the import duty rebate, the fiscal cost of which is estimated at ARS2.2 billion.

- Because of the type and volume of crude oil they process, PAE and YPF will have an additional benefit to access the regime’s incentives, particularly for exports.

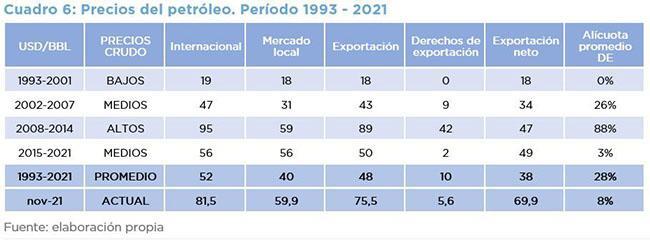

- With a maximum rate of 8% for Export Duties, the Treasury could lose ARS2.6 billion per year for each rate point in the next two decades.

- The change in the Fixed Amount Fuel Tax per volume of carbon dioxide emissions will boost future increases in the price of crude oil at the pump, will affect competition and hinder control.

- Furthermore, since they are more expensive, the less polluting gasoline and diesel will pay a higher Carbon Dioxide Tax than the more polluting products, completely distorting the purpose of the tax.

- The initiative intends to make the Gas Plan, established by Necessity and Urgency decree until 2024, a law.