The results of the restructuring of foreign legislation bonds were announced on October 31, by

means of which 99.01% of the outstanding USD66.18 billion of all bonds involved were

swapped. The level of acceptance of the proposal among creditors was sufficient for the

implementation of the Collective Action clauses in most of the eligible bond series, except for

the Par bonds in euros and dollars issued in 2010. New bonds in dollars were issued for

USD63.2 billion and bonds in euros for EUR4.18 billion.

Subsequently, on September 4, the results of the early acceptance for the swap of government

securities in dollars issued under Argentine legislation were announced. In this stage, 98.9% of

the outstanding USD41.71 billion of eligible securities were swapped. New bonds in dollars for

USD41.72 billion and new inflation-adjustable bonds (BONCER) for AR$57.68 billion were

issued.

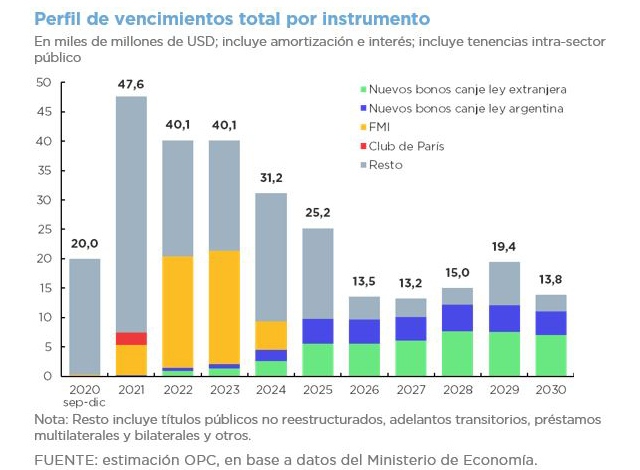

As a result of both swaps (securities under foreign and Argentine legislation), the debt maturity

burden (including debt within the public sector) was reduced by USD55.5 billion for the term

2020-2024.

In August, security placements and loan disbursements were recorded for the equivalent of

USD4.68 billion, of which AR$237.9 billion (USD3.25 billion) were auctions of marketable

securities in pesos. On the other hand, the equivalent of USD2.65 billion of principal was

cancelled, mainly due to maturities of Treasury bills in pesos. Likewise, interest payments for

the equivalent of USD656 million were cancelled, of which 54% were in foreign currency.

Debt service maturities are estimated for the equivalent of USD3.44 billion in September,

amounting to USD20 billion until the end of the year (approximately USD10.43 million if holdings within the public sector are excluded).