Progress Status of the 2017 Fiscal Consensus – 2019 update

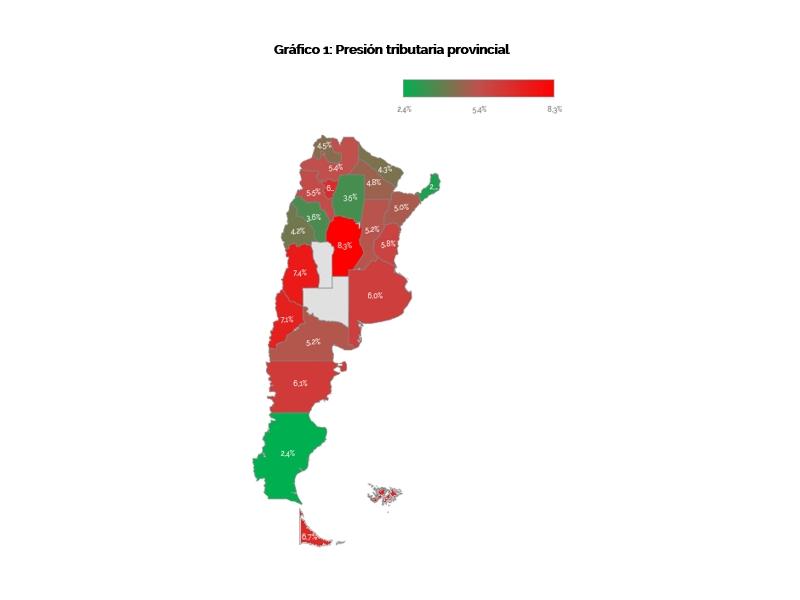

Although with variations by jurisdictions, progress was made in the amendments to the provincial taxes included in the 2017 Fiscal Consensus.

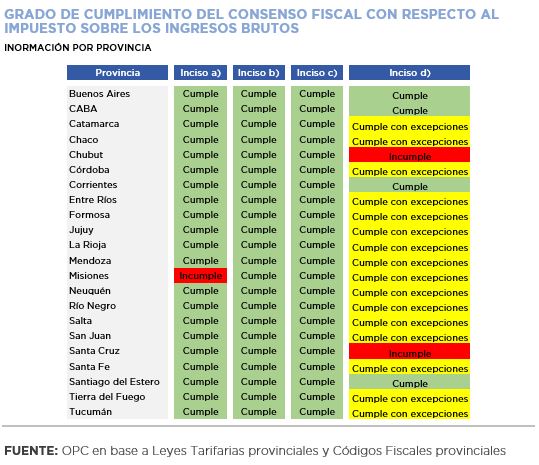

There is a high level of compliance with the commitments assumed to lighten the burden of Gross Income Tax and to homogenize it.

All provinces involved made progress in excluding exports from the scope of this tax which, however, in some jurisdictions a higher rate was applied to certain commercial activities.

There was also a high level of compliance with the commitments related to the Stamp Tax, which eliminates differentiated treatments, prevents the raising of rates for certain activities and foresees a reduction schedule, which was finally suspended.

Tax revenue in the committed provinces did not have a significantly different dynamic. Gross Income tax rose 10 percentage points above the nominal growth recorded in the jurisdictions that did not adhere, but Stamps and Property Taxes, on the other hand, grew less.